Market Update For November 14, 2016

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Market Update

A memorable and wild week is behind us. In my last report it was just an intuitive premonition that a big surprise might be upon us while the "facts" clearly spoke a different language. Now a change in this world has become tangible. Whether it is for the good or the worse will have to be seen.

The most important insight to remember is that "nothing gets eaten as hot as it is cooked". Mr Trump definitely deserves a fair chance. Fair him in his deeds, and not in his words.

To understand the ugly election campaign take a look at this video from 2011. I think this is the exact moment Donald decided to show the world how wrong they are….

Now that the dust is starting to settle we can see financial markets that went berserk last week. While initially gold has been skyrocketing towards 1,335 USD, Trump´s win certainly was a disaster for the precious metals sector and accelerated the ongoing correction since early July.

Yet Gold´s trading volume last Wednesday was the highest in CME gold history. Somebody dumped a lot of paper gold into the market while at the same time Indians panicked into gold as their government suddenly and without a warning demonetized the 500 and 1,000 rupee notes in an effort to crack down on corruption. The banned rupee notes made up more than 80 percent of the currency in circulation, leaving millions without cash and threatening to bring much of the cash-driven economy to a halt. One can only wonder why the Indian government had to pick the week of US elections to demonetize the high value notes after planning this in secrecy over the past 10 months. They certainly have been putting ordinary people into difficulties.

On top of all this one of the smartest investors Stan Druckenmiller told the press that he had sold all of his gold on election night. This guy has an outstanding track record but he definitely wasn´t right all the time. Should Trump indeed manage to turn around the economy and all the other problems there is no need to hold gold over the next couple of years but we shall not praise the day before the evening. I think its more likely that we will get a crack up boom, helicopter money and finally hyperinflation. The only way Trump might be successful is by drastically raising interest rates while at the same time flooding the markets with massive QE. But he will have to persuade a lot of incapable central banksters and politicians to implement such unconventional measures....

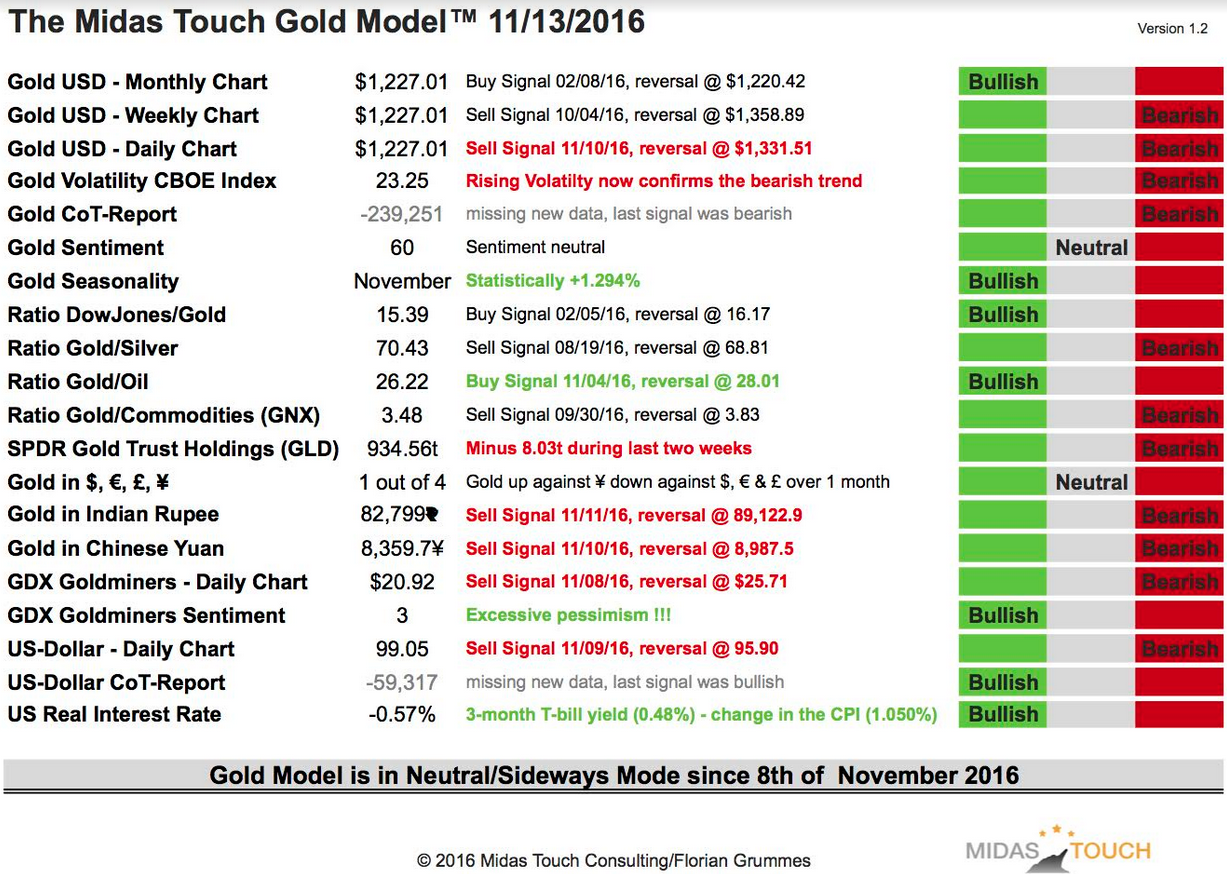

Compared to last week we have four bullish changes:

Gold Seasonality

Ratio Gold/Oil (good for the miners!)

GDX Goldminers Sentiment

US Real Interest Rate

Seven signals turned bearish:

Gold USD - Daily Chart

Gold Volatility CBOE Index

SPDR Gold Trust Holdings

Gold in Indian Rupee

Gold in Chinese Yuan

GDX Goldminers - Daily Chart

US-Dollar Daily Chart

Here are the model´s latest conclusions:

Bullish: 24th of June 2016

Neutral: 22nd of August 2016

Bullish: 6th of September 2016

Neutral: 15th of September 2016

Bullish: 28th of October 2016

Neutral: 8th of November 2016

The model gave a short-term buy signal on the 28th of October when Gold broke through 1,275 USD. The buy signal was canceled seven trading days later just before the election as Gold felt back below 1,290 USD.

So far the model has been bullish most of the year. Especially the first signal, the monthly chart, has been positive. But now there are just a couple of dollars missing to flip this signal to a bearish reading which would change the big picture! The probability for "just a bear-market rally" has certainly been rising in the last couple of days and weeks.

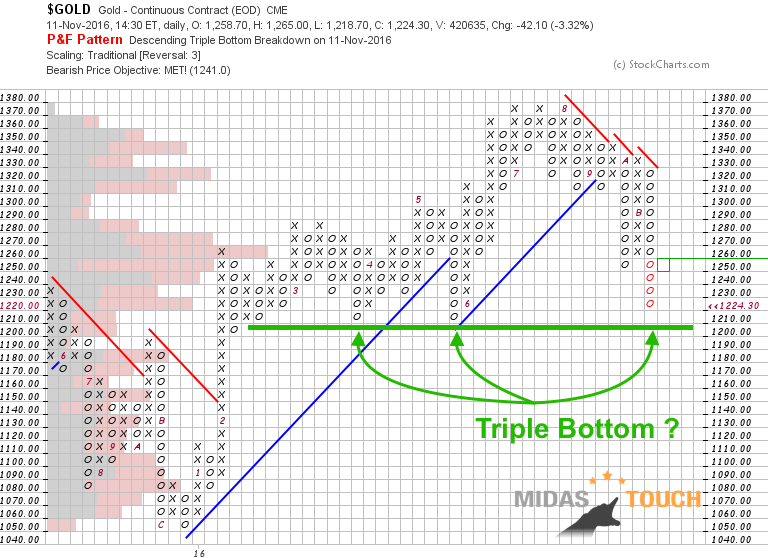

Gold P&F-Chart: Potential triple bottom around $1,200

The classic point & figure chart for gold shows a potential triple bottom around 1,200 USD. To confirm this gold needs to create reversal with a move back above 1,255 USD.

On the other hand should gold break through 1,200 USD we will very likely see another bloodbath and prices crashing towards 1,100 USD.

Conclusion: As long as the likely bounce from around 1,210 USD is not bringing gold back above 1,255 USD the outlook remains ugly!

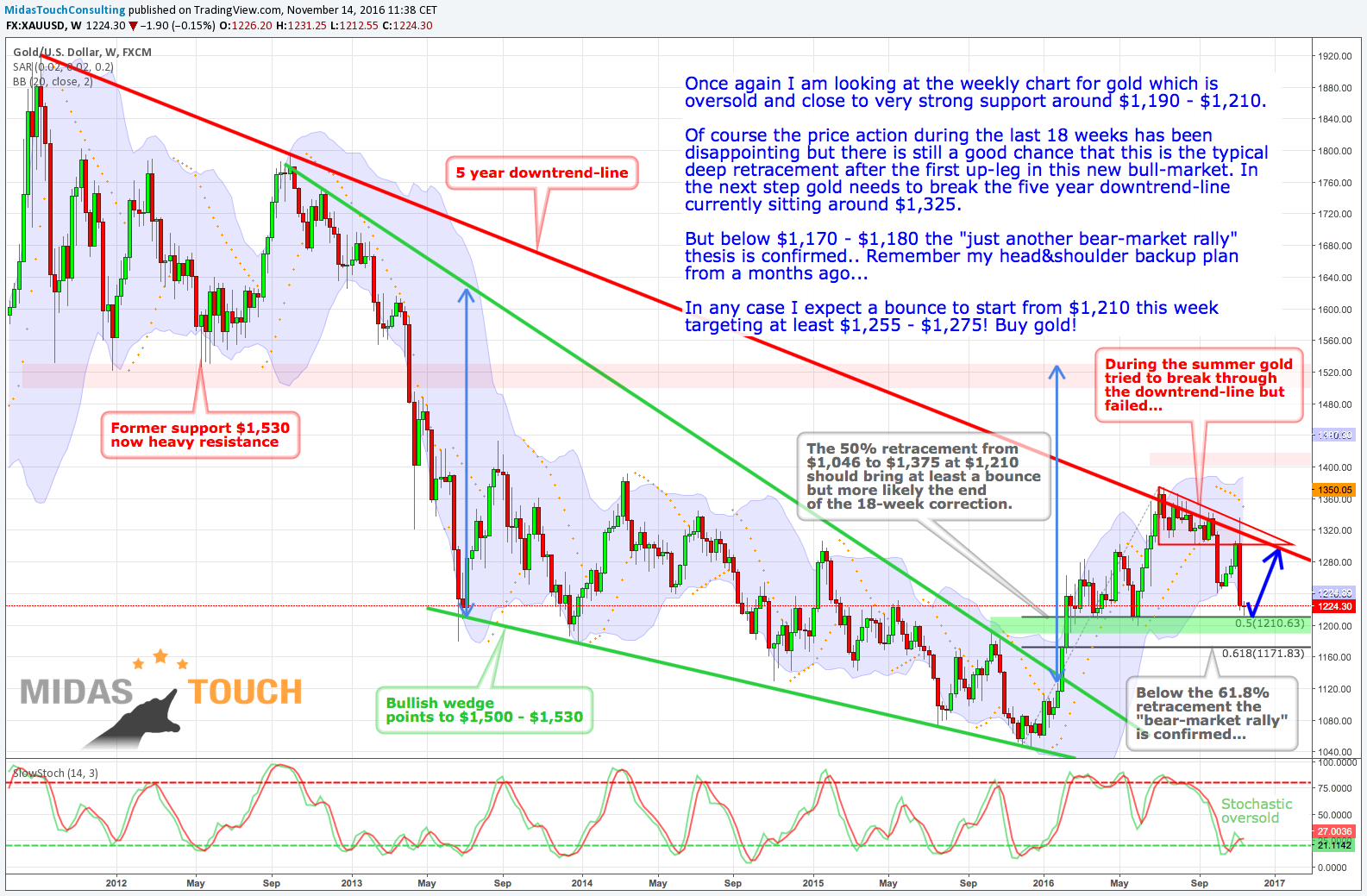

Gold weekly chart - A bounce towards 1,255 USD is next

Once again I am looking at the weekly chart as gold has experienced a mini-crash after the US-elections. If we assume that the ongoing correction since early July takes on the form of an ABC-pattern we should be very close to the lows and the turnaround. Surprisingly gold still has not yet even reached the 50%-retracement of the rally from 1,045 USD to 1,375 USD but I am sure you will agree that it feels like.

Looking at the big picture it becomes clear that gold has failed to break through the five year downtrend-line during the summer time. The "Trump-spike" last Wednesday quickly reached this heavy resistance again but in hindsight it was just a kiss and goodbye sort of nasty reversal! Gold needs to break through 1,325 USD to shift the odds to a new bull-market. Clearing this strong overhead resistance will finally open up the way towards 1,500 USD.

The good thing: Most of the weak hands that have bought since early February have certainly been killed. Now the weekly chart is oversold, close to strong support and sentiment numbers for GLD and GDX are showing very very extreme pessimism. That is the perfect setup for a nice bounce or even the start of the next upleg...

As gold is sliding down its lower Bollinger Band we could be in for another 1-4 days in search of the bottom. But 1,210 USD should hold and bring a recovery towards 1,255 USD in the first step. This coming bounce will tell us what´s really going on with gold. If gold recovers to and above 1,275 USD we can expect another (and this time successful) attack on the five year downtrend-line. But if gold already fails at 1,255 USD and move back towards 1,200 USD goldbugs with heavy holdings should make sure to start hedging their physical gold because the fourth attack on 1,200 USD will likely bring a success for the bears. In that case gold will move below 1,180 - 1,170 USD which would confirm the "just a bear market" thesis.

In any case I expect a bounce to start from 1,210 USD targeting at least 1,255 USD - 1,275 USD! Buy Gold!

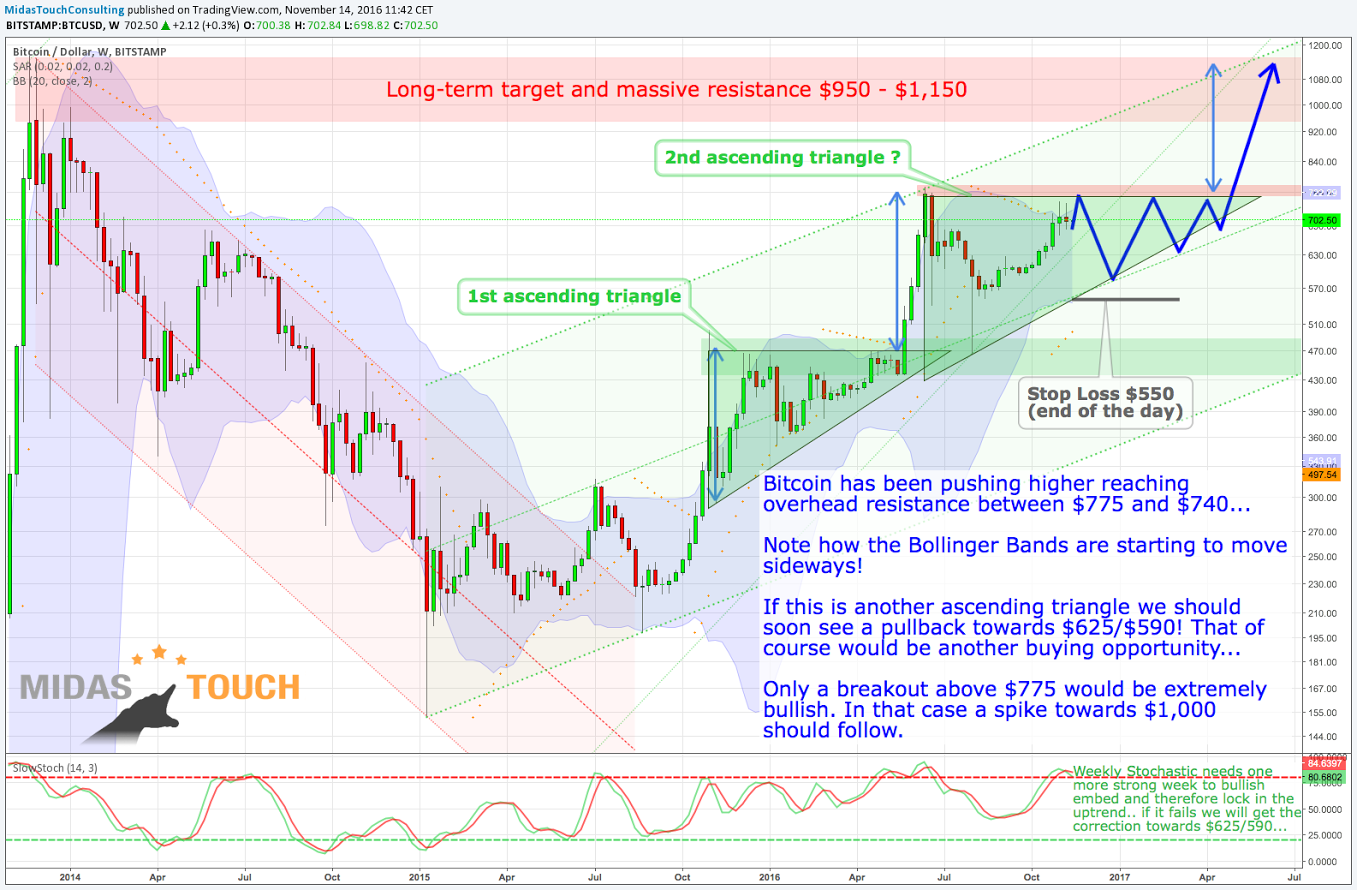

Bitcoin – Another ascending triangle?

As expected Bitcoin has been pushing higher over the last couple of weeks and has reached overhead resistance between 740 USD and 775 USD.

As the Bollinger Bands are starting to move sideways a consolidation and a pullback are more likely here. Considering the rather overbought situation on the weekly chart Bitcoin could run into another ascending triangle over the next couple of weeks and months. In that case we should soon see the beginning of a pullback that could bring Bitcoin down towards 625 USD - 590 USD. The very important rising EMA 200 is currently sitting at 593 USD and will likely hold. Prices around 600 USD are another buying opportunity of course.

Should the slow stochastic oscillator instead remain above 80 for another week the uptrend on the overbought weekly chart would then be locked-in (= bullish embedded) and a breakout above 775 USD would become possible. In that unlikely case a fast spike towards 1,000 USD should follow soon.

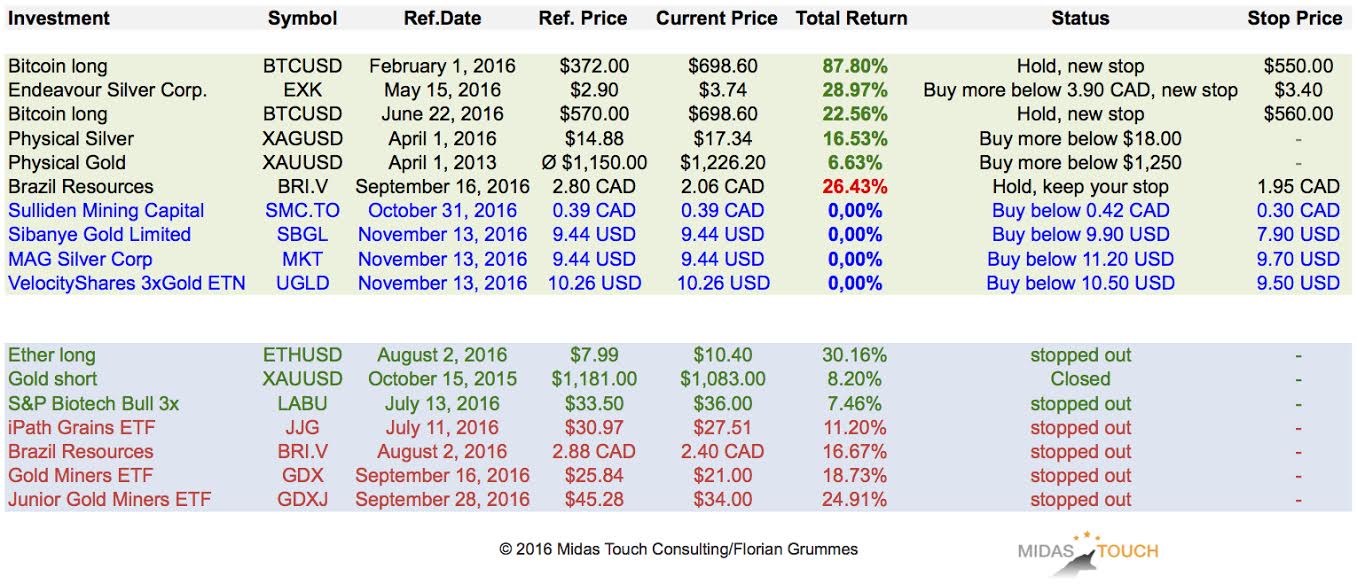

Midas Touch Consulting Portfolio & Watchlist:

After an ugly and extremely volatile week we got stopped out of our two mining ETFs. As well we got stopped out of Ether end of October already.

Considering the latest sentiment numbers as well as all the oversold charts it is now time to be a buyer and open up new positions in gold, silver and the mining stocks.

Bitcoin (BTCUSD):

Bitcoin has been moving higher and was able to push through the 700 USD level. As explained in my technical update already I would not be surprised to see Bitcoin starting a pullback soon. Now its important to make sure that we stay in this position and do not get stopped out during one of these sharp retracement moves because I continue to believe that overall Bitcoin is on the way to 1,000 USD and higher in 2017..

Endeavour Silver (EXK):

I met Bradford Cooke, the CEO of Endeavour Silver, recently in Munich at the "International Precious Metals Show". He updated me on some of the most recent achievements and I continue to like the company a lot. Due to the correction in the sector we gave back quite some of our profits but the stock is a buy again at the current levels and below 3.90 CAD. I think the worst is already behind us and Endeavour should regain its 200MA rather quickly.

Brazil Resources (BRIZF):

The CEO of Brazil Resources, Amir Adnani, continues to deliver a very positive news flow. As of November 8th Brazil Resources has increased the size of its private placement from 6 Mio. USD to 9 Mio. USD. The company intends to use the proceeds from the private placement to bolster its ongoing acquisition strategy.

Unfortunately the stock price is under pressure and is close to our stop again.

Sulliden Mining Capital (SMC.TO):

I met Paul Pint, president of Sulliden Mining Capital in Munich, and he confirmed my calculation on the NAV and the undervaluation. This stock has a lot of potential and limited downside. Sulliden remains a buy below 0.42 CAD.

Sibanye Gold Limited (SBGL):

Sibanye Gold is an independent, South African domiciled and focused mining group. Sibanye is the largest individual producer of gold from South Africa and is one of 10 largest gold producers globally. The stock was one of the top-perform in January & February this year and has recently given back more than 70% from its top in August! Buy this oversold senior gold stock which shows some positive divergences on the daily chart.

MAG Silver Corp. (MAG):

MAG Silver Corp. is focused on advancing and exploring high-grade district scale silver projects located within the Fresnillo Silver Trend in Mexico. I did have MAG Silver on my watchlist last November already but never gave a clear buy recommendation. Now the stock is down 55% from its August top and getting pretty oversold. I like the story, I like the management and I especially like their chief geologist Dr. Peter Megaw. The stock has an open gap to close at 11.07 USD and might therefore need to fall a bit lower still. Buy Mag Silver Corp. below 11.20 USD.

Velocity Shares 3xGold ETN (UGLD):

As explained in my gold update above I think we will see a bounce in gold soon. The support zone around $1,200 - $1,210 should hold and bring a recovery towards $1,275 in the coming weeks. Only experienced traders could buy this leveraged gold ETF below 10.50 USD to play the bounce. If you keep a stop at 9.50 USD you will risk 9.5% to find out if gold can come back on its feet.

If you would like to get regular updates on our gold model, gold and ...

more