Market Shrugs Off Large Oil Build

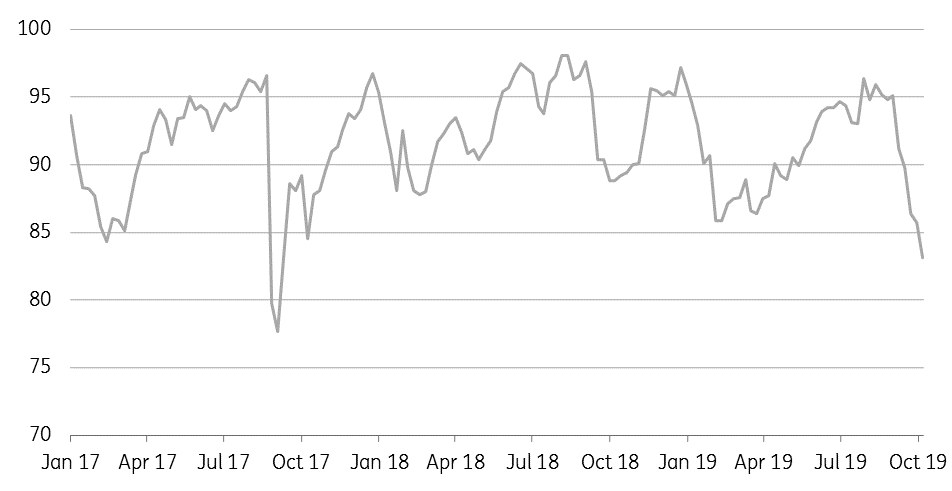

US refinery utilisation rate (%)

Source: EIA, ING Research

Energy

EIA weekly report: The EIA released its weekly oil report yesterday, which was more aligned with the big build that the API reported the previous day. The EIA reported that commercial US crude oil inventories increased by 9.28MMbbls over the last week- the largest weekly build seen since April. This was significantly higher than the 3MMbbls the market was expecting. Despite this large build, the market settled higher yesterday, with draws across all refined products.

The key driver behind the large crude draw was seasonal refinery turnarounds, with refinery run rates falling by 2.6 percentage points over the week to average 83.1%, which is the lowest levels we have seen since September 2017. As a result of this decline, we saw gasoline stocks falling by 2.56MMbbls, while distillate fuel oil inventories declined by 3.82MMbbls. Distillate fuel oil stocks in the US are now below the 5-year low, and with middle distillate demand set to only increase in the coming months, with IMO 2020 regulation, we continue to hold a constructive view towards middle distillate cracks.

ICE Brent spread strength: The ICE Brent Dec/Jan spread has seen quite the recovery this week, with the spread trading from an intraday low of just US$0.07/bbl on Tuesday, to a backwardation of over US$0.40/bbl yesterday. We see a couple of reasons behind the recovery. Firstly, the Buzzard oilfield was shut once again on the 16th October; the 150Mbbls/d field is the largest contributor to the Forties crude stream. Secondly, the tanker freight market has continued to weaken this week (following a strong rally earlier in the month), and this is likely to have eased some earlier concerns that the strong freight market would weigh on prompt crude demand from refineries.

Metals

Palladium strength: Palladium prices made a fresh high of US$1,769/oz earlier this week, leaving the market 5% higher so far this month, and up 40% YTD, with continued fears of large supply deficits. Increasing environmental scrutiny of vehicle emissions in China and Europe has clearly been constructive for palladium demand. Meanwhile, supply has been unable to keep up with this strong demand growth. One of the major supply sources over the past few years has been ETF holdings, which have declined significantly- they have fallen from around 3mOz back in 2015 to just 600kOz currently.

China steel output: Latest data from the National Bureau of Statistics shows that Chinese steel output declined by 5.1% MoM to 82.77mt in September, which is the lowest monthly production number seen since March. Steel margins in China have come under pressure in recent months, which has not helped, while environmental cuts over September would have likely weighed on production further. Despite this, output this year is set to reach record levels, with cumulative production for the first nine months of the year standing at almost 748mt, up 8.4% YoY.

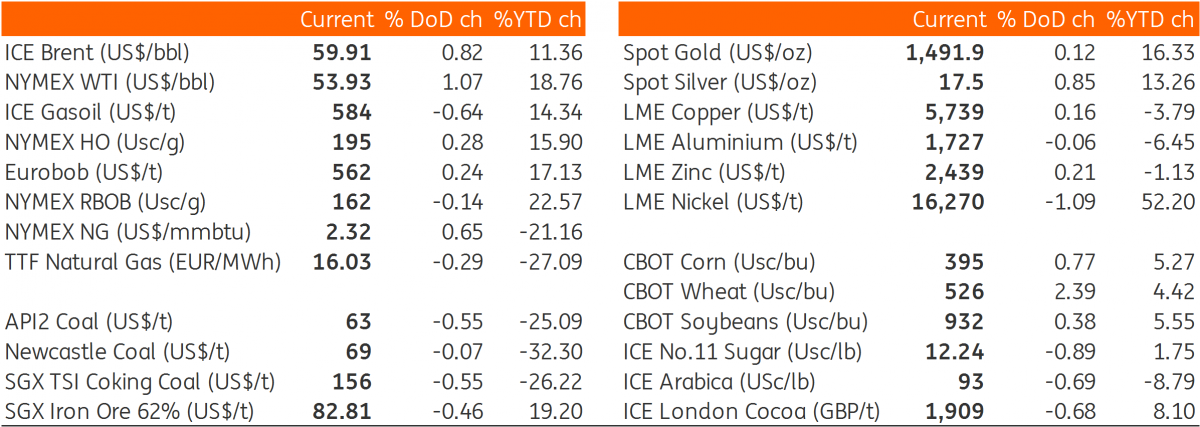

Daily price update

(Click on image to enlarge)

Source: Bloomberg, ING Research

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more