Letting The Fed Be Your Friend

Screen capture via Twitter.

Letting The Fed Be Your Friend

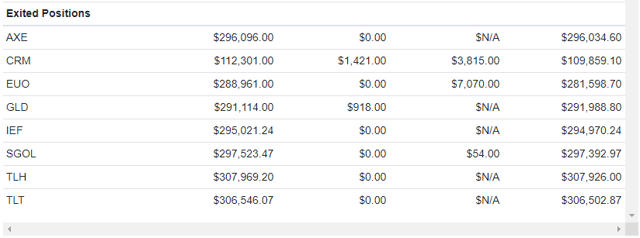

As Holger Zschäpitz noted in the tweet pictured nearby, global liquidity hit an all time high last week. The Fed opening the monetary spigot in the wake of the COVID Crash has weakened the dollar while fueling spikes in precious metals. As the renowned market technician Tim Knight put it, the spike in precious metals was an "F.U." to the Fed.

Image via Twitter.

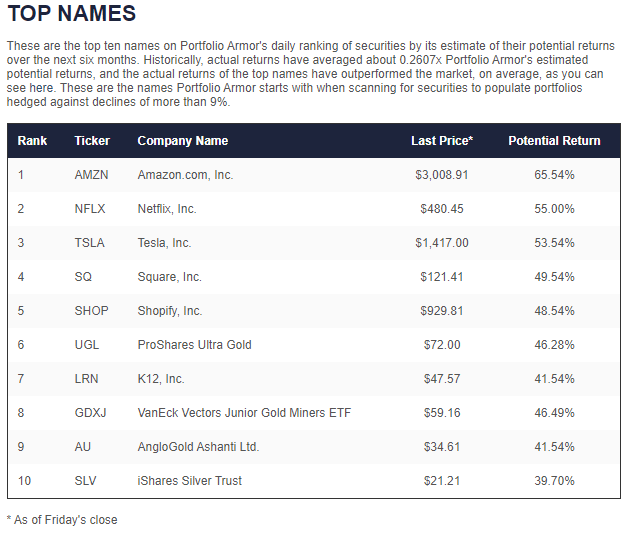

Another way to think of it is as tailwind for you if you're long precious metals. If you're looking for precious metals names to consider now, we had four of them make Portfolio Armor's top names on Friday. Before we get to those, a quick note about how we select those top names, and their track record so far.

Picking Our Top Names

Our system selects its top names by analyzing past returns as well as forward-looking options market sentiment on every security with options traded on it in the U.S., every trading day. That's a universe of about 4,500 securities currently. The names that make it to our top ten tend to outperform the market over the next six months. You can see final 6-month performance of all of our previous top names cohorts here.

Our Top Precious Metals Names

Four precious metals names made it into Portfolio Armor's top ten names on Friday: the ProShares Ultra Gold ETF (UGL), the VanEck Vectors Junior Gold Miners ETF (GDXJ), the gold miner AngloGold Ashanti (AU), and the iShares Silver Trust ETF (SLV).

Below is the full ten; readers of our previous post ("Amazon And Tesla: Insanity Defense") may recall that Amazon and Tesla were top ten names on Thursday as well.

(Click on image to enlarge)

The top-ranked precious metals name there, UGL, was also the least expensive of them to hedge. Below are a couple of ways of hedging it in case we end up being wrong about it.

In Case We're Wrong About UGL

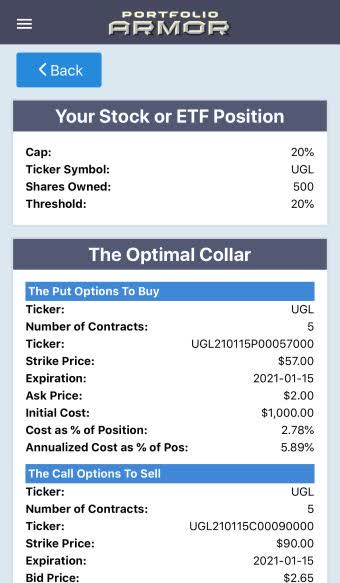

Let's say you own 500 shares of UGL and can tolerate a 20% drop over the next several months, but not one larger than that. Here are two ways you can hold it will strictly limiting your risk.

Uncapped Upside

As of Friday's close, these were the optimal puts to hedge 500 shares of UGL against a >20% drop by mid-January.

(Click on image to enlarge)

The cost here was $1,600, or 4.44% of position value (calculated conservatively, using the ask price of the puts; in practice, you can often buy and sell options at some price between the bid and ask).

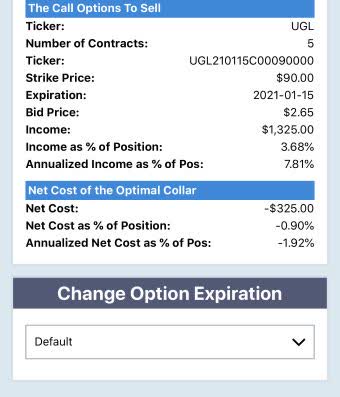

Capped Upside, Negative Cost

If you were willing to cap your possible upside at 20% by mid-January, this was the optimal collar to protect against a >20% decline over the same time frame.

(Click on image to enlarge)

Here, the net cost was negative, meaning you would have collected a net credit of $325 when opening this hedge, assuming you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

Another Advantage Of Precious Metals Names

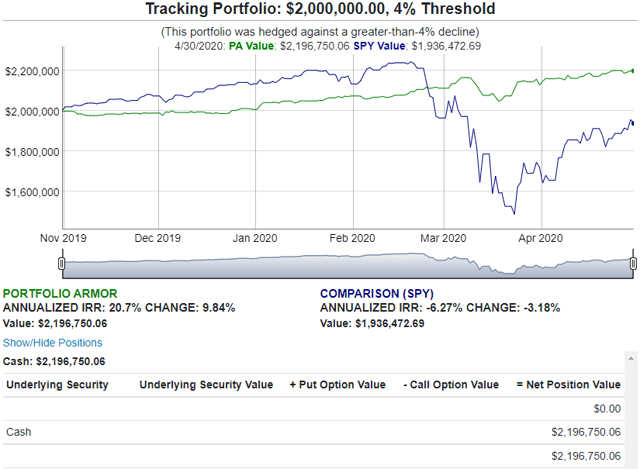

One advantage of precious metals names, in addition to benefiting from loose monetary policy, is that they can benefit from a flight to safety as well. We saw examples of that with our hedged portfolios that finished their 6-month runs last spring, such as the one below created on October 31st of 2019, which included the SPDR Gold Trust (GLD) and the Aberdeen Standard Gold Shares (SGOL).

(Click on image to enlarge)