June Supply/Demand Updates - Record Slow 2019 Plantings Was Focus, But Lower Corn Yield Firms CBOT

Market Analysis

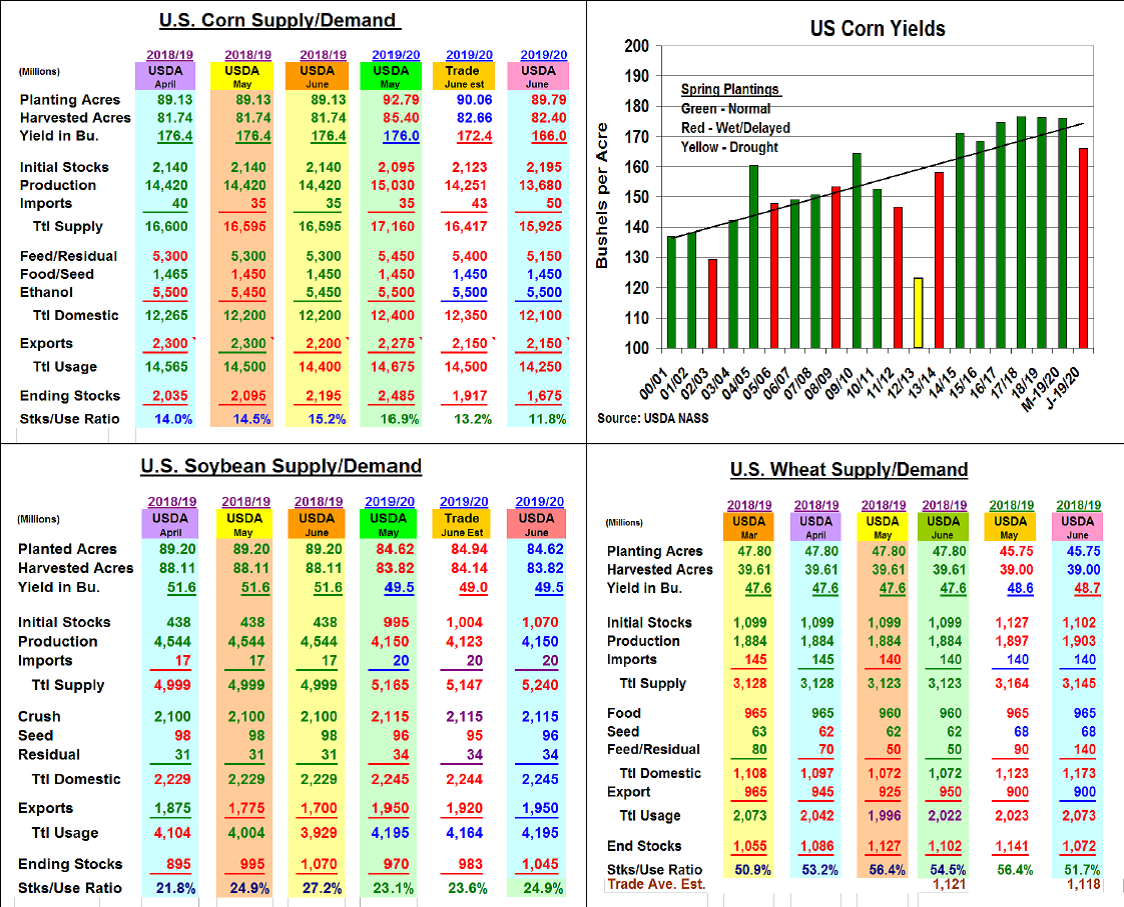

The USDA’s June report had some curves for the markets. The World Board’s sharp drop in 2019’s corn yield surprised the trade and firmed prices across the Board with the trade’s focus on plantings because on 2019’s cold/wet Midwest weather delaying the pace to a record slow level, No change in the US soybean seedings despite a modest decline in corn plantings was also a positive with frequent talk about producers switching to beans if they couldn’t get their corn planted. This month’s 6 million bu. higher US wheat output didn’t startle this market, but the jump in the USDA’s feed demand tightened US supplies modestly.

This month’s combination of a 3 million acre cut in the US corn plantings and 10 bu. cut in the USDA’s yield forecast to 166 bu. dropped the US corn forecast by 1.35 billion bu. (13.68 billion) and was 571 million lower than trade expectations. However, reduction in both old & new-crop exports and new-crop feed demand lessened the impact on corn’s 2019/20 stocks to 1.675 billion bu. An 810 million drop from last month. Given the known agronomic impact of late plantings (only 2008 had a higher yield vs. recent levels) on corn’s yield, the USDA decision to make this adjustment vs. a larger planting reduction seems like the best approach with a new planting update in 17 days.

Sluggish bean shipments recently prompted the USDA to reduced old crop’s export by 75 million bu. This increase in beginning stocks were carried over to higher 2020 ending stocks by a similar amount since no 2019/20 demand levels were changed. The weather next 14 days will be a major factor in 2019’s bean plantings.

Higher hard red yields in KS & OK (+1 bu) helped over-come smaller soft red & white wheat output for a limited change in supply. Wheat’s late surge in old-crop exports and the USDA’s 50 million bu. jump in feed demand because of the 2019’s likely sharp drop in corn supplies tightened wheat’s stocks.

(Click on image to enlarge)

What’s Ahead

This month’s USDA update provided some insights on 2019 US crop prospects. However, the upcoming late planting and growing season for the spring row crops have many unknowns and exact sizes of US corn, soybean and spring wheat crops are yet to be determined. Hold 2019/20 corn and KC wheat sales at 25-30% vs. $4.40-$4.55 & $4.75-$4.95 ranges. Have 15-25% of SX supplies sold in $9.00-$9.20 range.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more