Is Gold About To Get Whacked?

Gold has spent the past couple of weeks steamrolling technical barriers and reviving the spirits of long-suffering gold bugs.

But markets don’t move in a straight line. Bull runs (if that’s what this is) have stomach-churning corrections along the way – usually just as everyone concludes that the good times will roll on forever.

321gold’s Bob Moriarty, a consistent voice of reason in the precious metals space, explained this to his readers yesterday:

Gold bulls are coming out of hibernation with even billionaires talking about how much they like gold. That tends to happen just before a correction. The gold bulls get frothy around the mouth; speculators pour money into gold contracts just in time to get whacked once more so they can whine about how gold and silver are manipulated and no one saw it coming.

I’ve written a number of times about the importance of understanding bullish sentiment. I find the DSI of Jake Bernstein the single most valuable indicator I use. On both Thursday and Friday last, the DSI for gold hit 94. That doesn’t suggest a major high marking a top for the next 200 years but it does say caution would be merited. Too many people turned bullish all of a sudden.

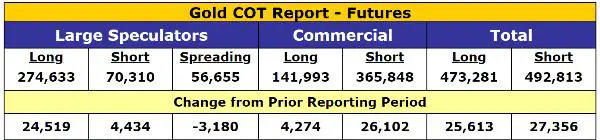

The COTs agree. Gold sentiment is excessive.

Speaking of the COTs (which show the structure of the gold futures market), they are indeed excessive. The past few weeks have seen an epic buildup of speculator longs and commercial shorts:

(Click on image to enlarge)

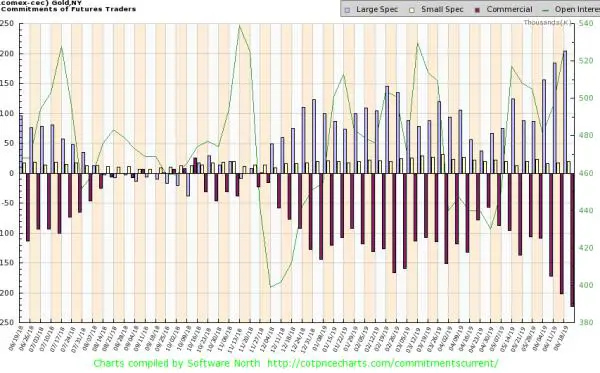

Here’s the same data in graphical form, with the speculators in gray and the commercials in red:

(Click on image to enlarge)

Since the speculators are usually wrong at big turning points and the commercials are usually right, the paper market set-up is extremely bearish. As Moriarty says, this doesn’t mean an end to the bull market, but it might mean a several-week-long pause.

As for how to play this kind of squiggle, that’s easy. Keep doing what you should have been doing all along, which is dollar-cost-averaging into gold and silver bullion and well-chosen mining stocks. The fundamentals that will eventually drive precious metals and other real assets higher will continue their long march towards an era-ending financial crisis. And gold will track this evolution — with the occasional correction.