Inflation, Weighting And Valuations All Positive For Energy Names

“Davidson” submits:

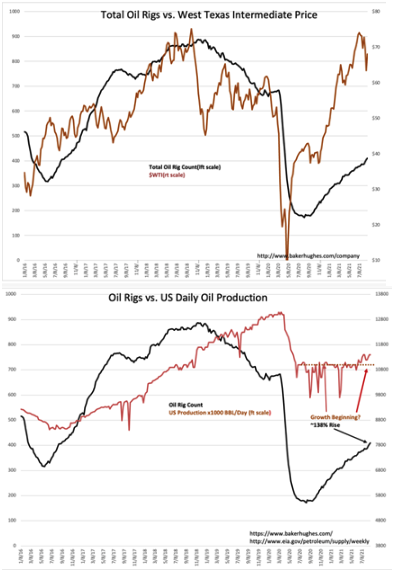

The Baker Hughes Rig Count is higher by 5 oil rigs with the gas rig count unchanged. This represents 138% rise from the August 2020 low. US Crude Production remains 11.4mil BBL/Day. Even a lag in production vs the rig count in the 6wk range, there continues to be little rise in US Crude Production since June 2020 which indicates an activity level geared more towards replacing the natural decline in well output than increasing output above the 11mil BBL/Day range. Crude Imports have risen from pre-COVID 1.6mil BBL/Day to 3-4mil BBL/Day as the US recovery progressed.

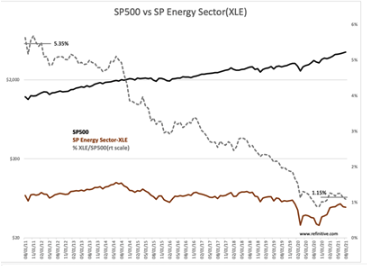

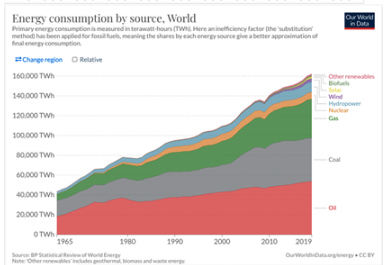

Few seem interested in E&P as an investment option at this time even with an unmistakable rise in consumption with global economic expansion. The chart of SP500 vs XLE shows just how far the historical energy sector has fallen out of portfolios. An ~80% relative decline since 2011. How much energy prices recover is the question. A recovery in demand is nots. The underlying fundamentals of fossil fuel as vital to global economic recovery can be inferred from the chart of Energy consumption by Source: World. https://ourworldindata.org/energy-mix?country=#energy-mix-what-sources-do-we-get-our-energy-from Alternatives to fossil fuels are not viable to make a substantial change the next several years. Energy demand, primarily in the form of fossil fuels, is too strong to permit investors to ignore IMO.

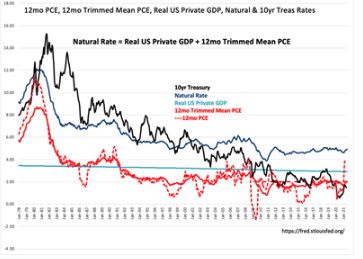

The 12mo Trimmed Mean PCE(Inflation) report was issued today at 2.02%. The 12mo PCE… chart now includes the raw data to show how the trimmed mean adjustment smooths the data. Inflation is likely to rise sharply despite the commentary by many who have viewed it as a consequence of restarting the economy from a recession and a short-lived rise in commodity prices. Past severe inflation periods have come from excessive government spending from M2 expansion much faster than the underlying economy can absorb. The Real Private GDP growth is 2.9% while M2 just expanded from Jan 2020’s $15,4Tril to Aug 2021 $20.6Tril with the potential of more to come if Congress passes the latest spending bills. A 30% expansion in M2 in this short period is likely to boost inflation significantly. With the economy continuing to expand and fossil fuel consumption globally returning to pre-COVID levels, it is difficult not to imagine oil prices rising with investors seeking an inflation hedge.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more