Inflation And Energy Prices

It’s belaboring the obvious that gasoline (and energy prices) had a big impact on headline inflation [BLS release]. M/m inflation was at Bloomberg consensus of 1.2%, while core was below, at 0.3% vs. consensus 0.5%. However, it’s useful to see how over time exactly how much headline and core diverged.

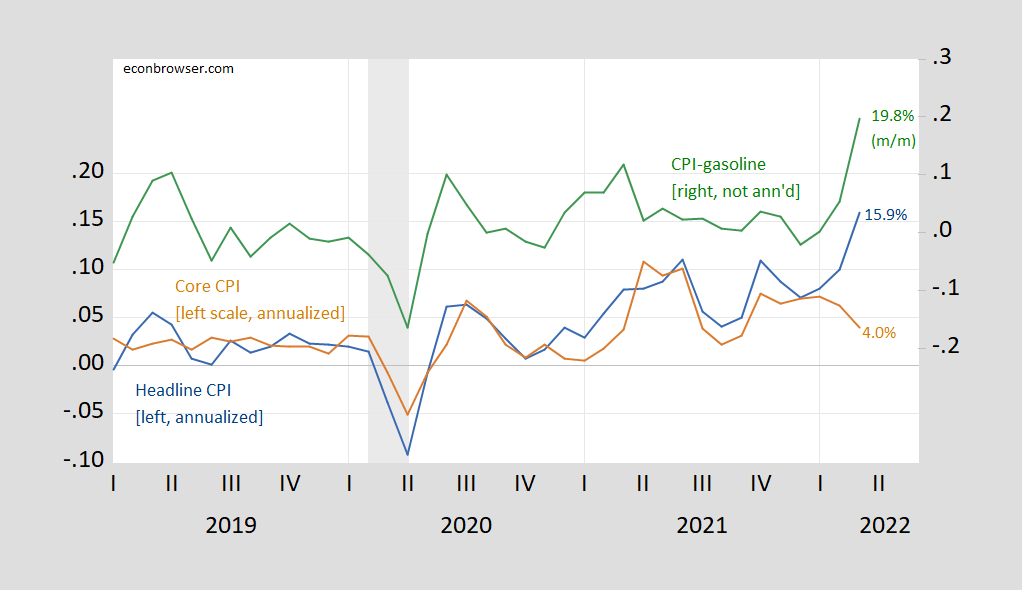

Figure 1: Month-on-month annualized CPI inflation (blue, left scale), Core CPI inflation (brown, left scale), and CPI gasoline component inflation, not annualized (green, right scale). NBER defined recession dates peak-to-trough shaded gray. Source: BLS, NBER, and author’s calculations.

Core inflation fell, while gasoline prices rose nearly 20% (m/m not annualized).

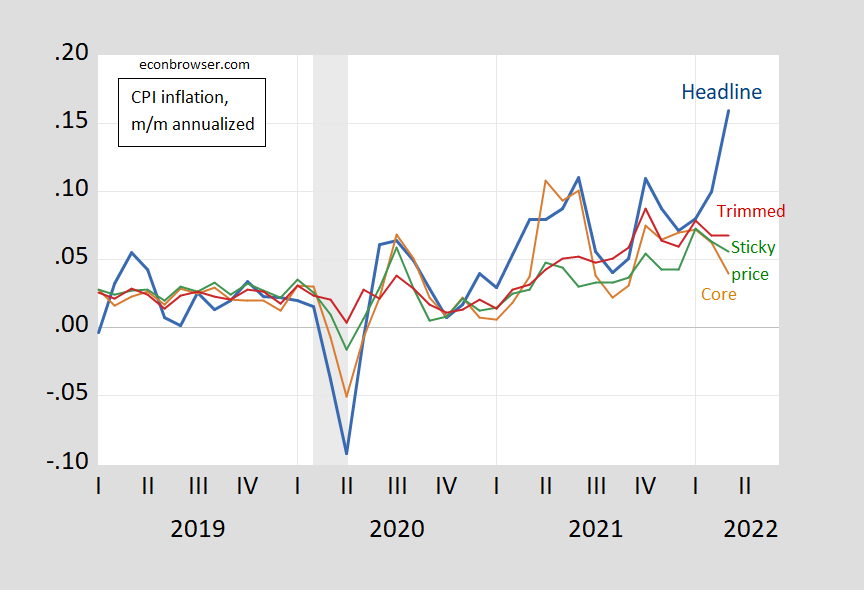

As shown in Figure 2, Trimmed CPI inflation fell, indicating the broadness of price inflation was reduced. Sticky price CPI inflation also fell, indicating that infrequently changed prices were also increased as a slower pace.

Figure 2: Month on month annualized CPI inflation (blue bold), core CPI inflation (orange), 16% trimmed CPI inflation (red), and sticky price CPI inflation (green).NBER defined recession dates peak-to-trough shaded gray. Source: BLS, NBER, Cleveland Fed, Atlanta Fed, and author’s calculations.

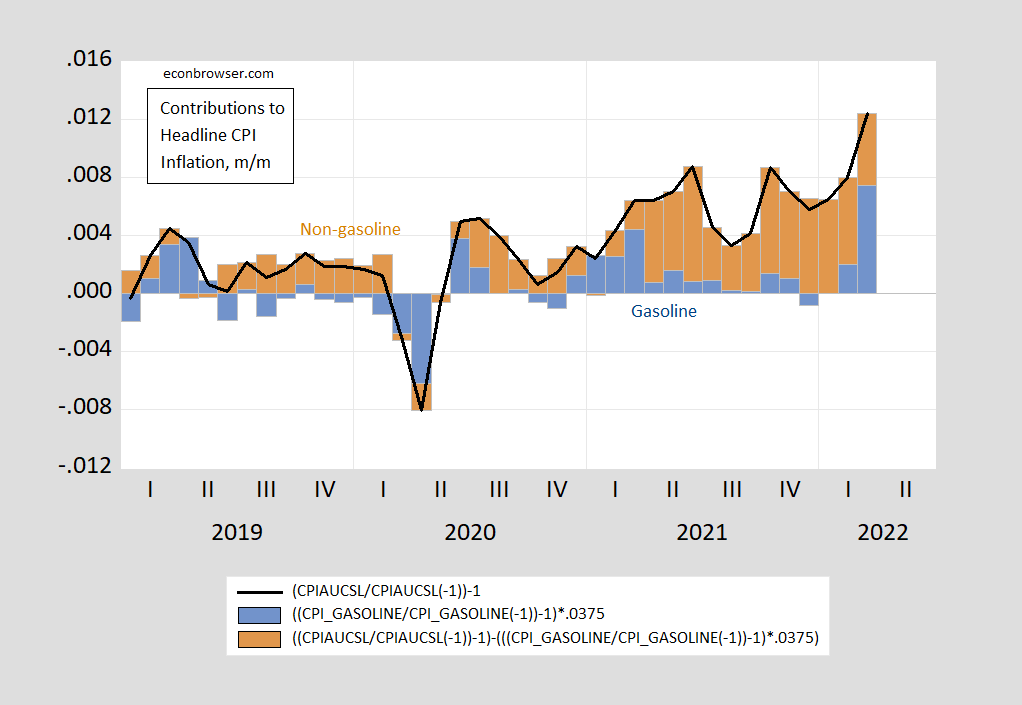

To isolate the contribution of gasoline prices to the CPI rise, I mechanically decompose the CPI into gasoline and non-gasoline components (using 3.75% weight for gasoline in the CPI).

Figure 3: Month-on-month headline CPI inflation (black line), gasoline contribution (blue bar), non-gasoline contribution (brown bar). Source: BLS and author’s calculations.

0.74 percentage points of the 1.24 percentage point month-on-month inflation rate was accounted for by gasoline alone.

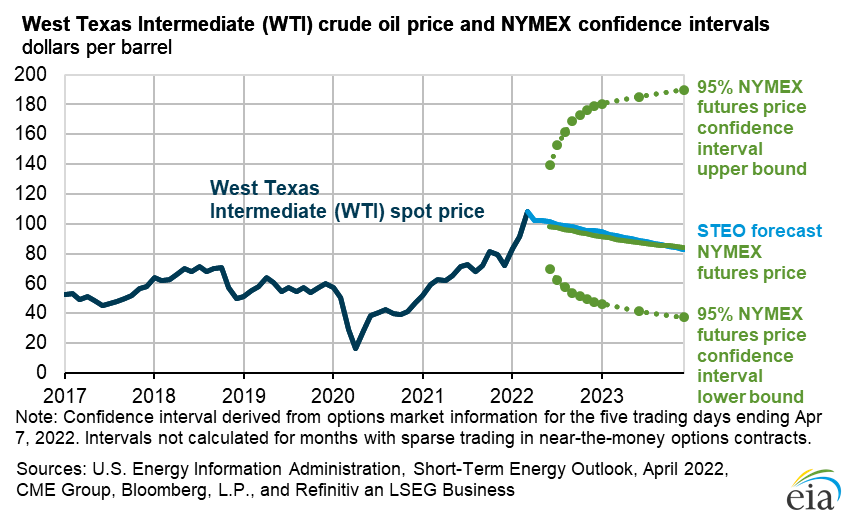

Clearly, as noted in yesterday’s post, the course of gasoline prices — which is linked to oil prices — will determine inflation’s trajectory in the short term. Here, the forecast is for a decrease — but with a very wide confidence interval (I’m assuming Brent has the same forecast and uncertainty attributes).

Source: DOE EIA.

If oil prices do decline in April, then gasoline prices should deduct from headline inflation. But given geopolitical conditions, I wouldn’t bet on that occurring.

See more from CEA, especially on how vehicles added to CPI inflation.

Disclosure: None.

Comments

No Thumbs up yet!

No Thumbs up yet!