Indexes Pare Gains On Lackluster Housing Starts, Big Tech Plunge

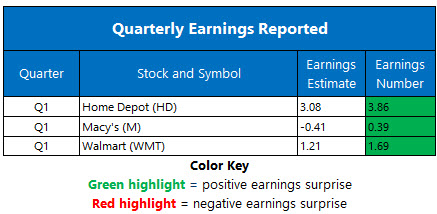

After a strong start to the session, the major indexes slipped in the afternoon hours to finish the day in the red, due to worse-than-expected housing starts data and resumption in Big Tech's extended selloff. The Dow lost roughly 270 points, despite upbeat earnings from Home Depot (HD) and Walmart (WMT). The S&P 500 and tech-heavy Nasdaq logged more modest losses, with the latter giving up gains as tech giants such as Apple (AAPL) and Amazon (AMZN) eventually shifted lower.

Investors are cautious of growth stocks, as many on Wall Street remain unsure whether the recent rise in inflation will be long- or short-term. Though the Fed has indicated it expects for it to be the latter, the central bank noted sustained inflation over 2% could eventually lead to tighter monetary policy, which would impact stocks that rely on low interest rates, specifically those in the tech sector.

The Dow Jones Average (DJI - 34,060.66) dropped 267.13 points, or 0.8% for the day. Walmart (WMT) led the Dow components with a 2.2% rise, while Chevron (CVX) paced the laggards, falling 3%.

Meanwhile, the S&P 500 Index (SPX - 4,127.83) fell 35.5 points, or 0.9% for the day. The Nasdaq Composite (IXIC - 13,303.64) shaved 75.41 points, or 0.6% for the day.

Lastly, the Cboe Volatility Index (VIX - 21.34) added 1.6 point, or 8.2% for the day.

GOLD LOGS FOURTH-STRAIGHT WIN, TWO-YEAR HIGH

Oil prices fell from a two-year high on Tuesday, after a tweet from BBC Persia indicated there may have been progress in talks regarding the 2015 Iran nuclear deal seeking to limit Tehran's nuclear activities. Some believe the talks are related only to inspections, however, rather than the lifting of sanctions. As a result, June-dated crude shaved 78 cents, or 1.2%, to settle at $65.49 per barrel.

Gold prices were higher, however, notching their fourth consecutive win and settling at a fourth-month high. A weaker U.S. dollar, market valuations and inflation fears continued to boost the yellow metal, as many on Wall Street doubt the Fed will adjust its monetary policy. In turn, June-dated gold rose 40 cents, or a little less than 0.1%, to settle at $1,868 an ounce.