In Case Gold Melts Down

Molten gold being poured into bullion molds (Photo credited to Reuters/Osman Orsal via Business Insider).

More Good News For Gold Longs

Gold bulls, including those long the yellow metal via the SPDR Gold Trust ETF (GLD), got a bit of good news last month, as President Trump announced he was nominating Stephen Moore to serve on the Federal Reserve Board.

It is my pleasure to announce that @StephenMoore, a very respected Economist, will be nominated to serve on the Fed Board. I have known Steve for a long time – and have no doubt he will be an outstanding choice!

— Donald J. Trump (@realDonaldTrump) March 22, 2019

As the Washington Post's Catherine Rampell points out in this thread, Moore is inclined to be dovish, claiming that current Fed policy is causing deflation.

Trump reportedly wants to put Stephen Moore on the Fed, which Moore says should loosen monetary policy because the Fed policy is causing "deflation." We do NOT actually have deflation right now.

— Catherine Rampell (@crampell) March 22, 2019

On Monday, Rampell tweeted that Moore had made some controversial comments about women years ago.

Stephen Moore wrote that women should be banned from refereeing, announcing or beer vending at men's college basketball games, asking if there was any area in life "where men can take vacation from women." (From @KFILE and Paul LeBlanc) https://t.co/RWrQefVI9F pic.twitter.com/IeXkPbJUd3

— Catherine Rampell (@crampell) April 22, 2019

In the event, this sinks Moore's nomination, and President Trump ends up with more hawkish Federal Reserve Board members, this could put pressure on gold. A bit of good news, though, is that GLD is extremely inexpensive to hedge now. So, gold bulls who are concerned that economic growth might come in stronger than expected over the next several months and prompt the Fed to tighten can buy cheap protection against the impact of that on their GLD shares now, as I detail below.

Adding Downside Protection To GLD

A lot of times, for hedging examples, I show protection against greater-than-20% drops. I got the idea for that, initially, from this market commentary by John Hussman:

An intolerable loss, in my view, is one that requires a heroic recovery simply to break even… a short-term loss of 20%, particularly after the market has become severely depressed, should not be at all intolerable to long-term investors because such losses are generally reversed in the first few months of an advance (or even a powerful bear market rally).

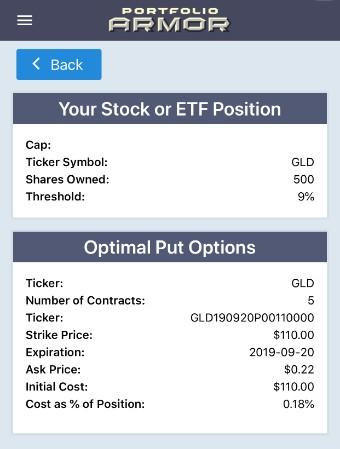

Essentially, a 20% decline tends not to be an insurmountable one; so, since it's typically less expensive to hedge against a greater-than-20% decline than, say, a greater-than-15% decline, I usually aim for 20% decline thresholds. In the case of GLD today, though, since it's so cheap to hedge against >9% declines, I've used a 9% decline threshold in the example here, which assumes you have 500 shares of GLD. The screen captures below are via the Portfolio Armor iPhone app.

Uncapped Upside, Positive Cost

As of Monday's close, these were the optimal, or least expensive, put options to hedge 500 shares of GLD against a >9% decline by late September.

The cost of this protection was $110 or 0.18% of position value (calculated conservatively, using the asking price of the puts; in practice, you can often buy and sell options at some price between the bid and ask).

By way of comparison, look at the cost of hedging the SPDR S&P 500 ETF (SPY) against the same, >9% decline over the same time frame.

The cost of hedging SPY in the same way, as a percentage of position value, was 1.45%, more than 8 times as expensive as the hedge on GLD.

Wrapping Up

An objection I've gotten from gold investors in the past when I've suggested hedging is that gold, or shares in GLD, is their hedge. I tend to think the best hedge is an option hedge on the underlying security because that's one that's guaranteed to limit your risk as indicated: if GLD drops significantly, the GLD puts above are going to move to offset that. If you have a significant position in GLD, it may be worth considering.