If We Were To Implement A Gold Price Target, What Should The Fed Funds Rate Be?

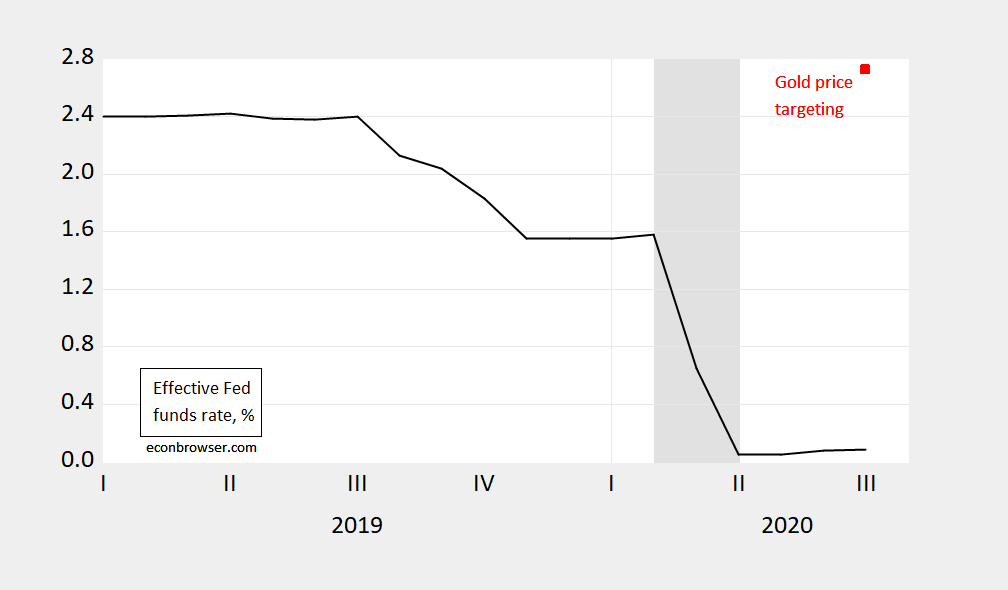

Given the Senate Banking Committee’s approval of Judy Shelton’s nomination to the Board of Governors of the Federal Reserve, it seems like a good time to see what stabilizing the price of gold in US dollars would’ve required in terms of the policy rate (akin to how the exchange rate is managed). Using the policy rate to stabilize the dollar price of gold at the February 2020 levels would require the increase of the Fed funds rate by 1.15 percentage points higher than it was at that time. The Fed actually decreased the Fed funds rate by 1.5 percentage points by June 2020.

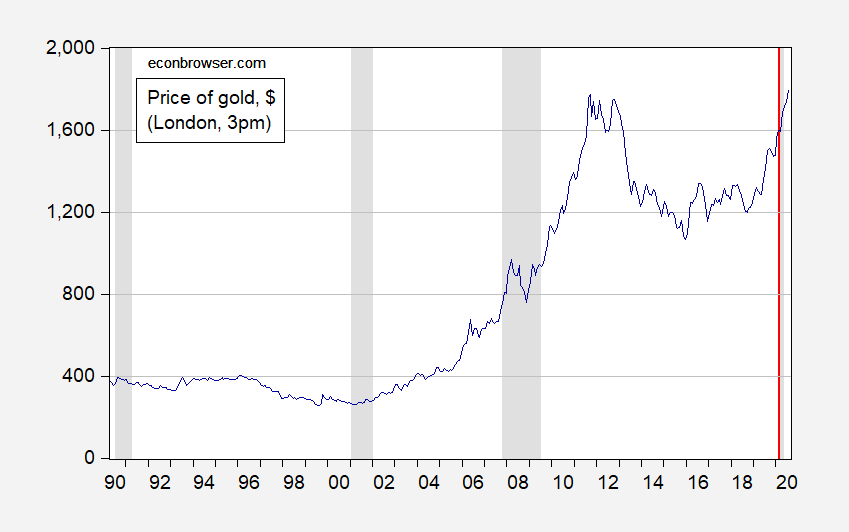

Figure 1: Price of gold (blue). Red line at NBER defined peak. Source: London bullion market 3 pm via FRED.

To obtain this estimate this out, consider the relationship between the log price of gold and the nominal Fed funds rate, estimated over the 1968M03-2019M02 period.

pgold = 6.423 – 10.210 fedfunds

Adj-R2 = 0.17, DW = 0.007 n = 612. Bold figures denote significance at the 1% msl, using HAC robust standard errors. fedfunds expressed in decimal form, i.e., 5% = 0.05.

In log terms, the price of gold is 11.8% higher in July (through 20th) than in February 2020. This implies that the Fed funds rate would have to be 0.118/10.210 = 0.0115, i.e., 1.15 percentage points higher than in February 2020. That would mean the Fed under this targeting should have raised — not lowered — the Fed funds rate, as shown below.

Figure 2: Effective Fed funds rate, % (black), and implied gold price target at 2020M02 levels (red square). Source: Federal Reserve Board and author’s calculations.

More on the gold standard, here.

Disclosure: None.