How To Profit More From Trading Gold: Insider Tips You Should Know

Gold is considered a safe-haven investment that acts as a safety net during a recession or when markets decline. However, as history has shown, gold prices have not always been on an upward trajectory. Gold trading has become popular as investors from all walks of life use gold as a hedge against any market decline.

Here are a few tips to help increase your profit when trading gold (GLD).

1. Mindset: Determine if you are trading or investing

We must know which side we are going for before venturing into gold trading. This is important as the strategies, time horizon, and platforms we are going to use will differ greatly.

Investing in gold means that we are purchasing gold to store on a long-term basis. We would recommend that investors buy physical gold or gold certificates instead of opening a position on a trading platform as the holding costs will deplete the profit greatly in the long term. One downside would be the storage costs for physical gold when you buy a huge quantity.

On the other hand, if you are trading gold, it is usually on a shorter time frame and allows you to avoid hefty fees as a result of holding costs.

2. Understand the four factors that affect gold price movements

Like any other commodity, there are several factors that influence the movement of gold prices:

Central Bank's monetary policy

We recognise that the price of gold is closely linked to the US Dollar (USD), so inevitably, the value of USD will have an impact on the movement of gold. Thus, traders should note that any USD-related movement is very much capable of moving the market, particularly in tandem with policy changes/developments.

Supply and demand

Demand and supply influence every commodity that is traded, and gold is no exception, especially since it is considered as both a SAFE HAVEN and a scarce NATURAL RESOURCE.

Many investors will search for assets that are called risk-off assets, one of which is gold. If global market conditions are poor, the demand for gold will increase because supply is limited for such natural resources.

Geopolitical events

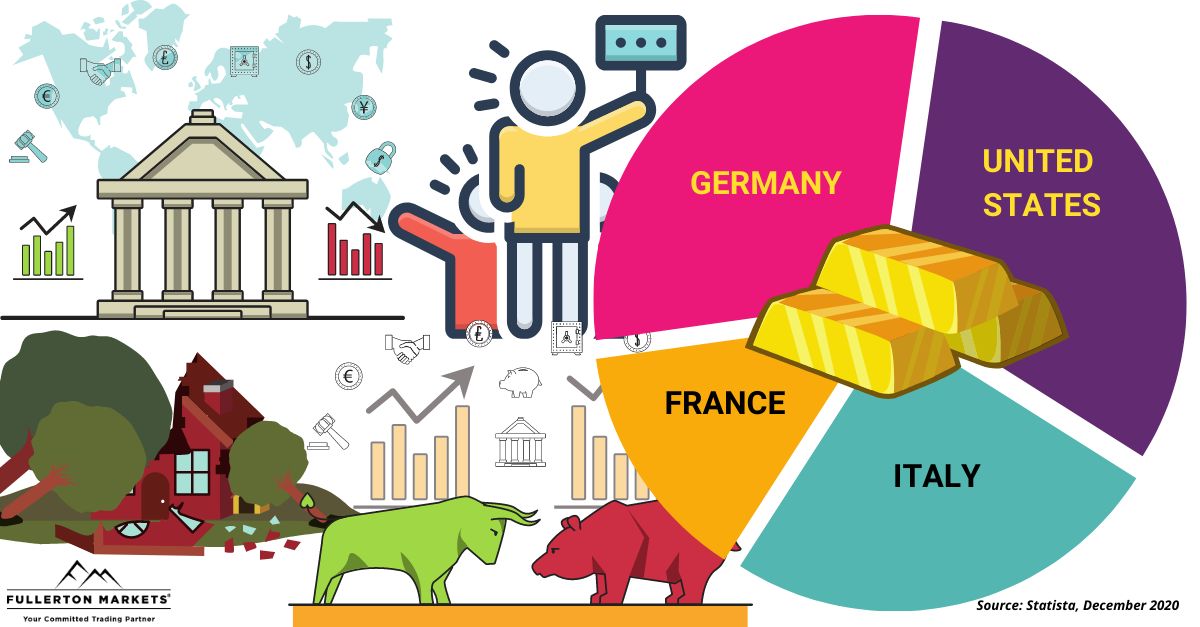

Geopolitical conditions between countries, especially those related to countries with large gold reserves, will also have an effect on the movement of gold. Tensions or unfavourable conditions between these countries will cause the market to shift to investments in risk-off assets. In such cases, safe-haven assets will always be an option.

Natural disasters

Natural disasters may also be one of the factors that boost demand for gold since these large-scale occurrences generally affect government policies. In large countries hit by natural disasters, especially, investors might exercise caution and have diminished trust in the economy, and thus, might channel their funds into gold.

Immediate actions to take to increase your profitability based on correlations

1. Focus on Central Bank events

If the sentiment for USD is not supported by Federal Reserve policies, then be prepared to BUY GOLD. If the sentiments towards USD are negative due to central bank policies, then look to SELL GOLD.

2. Pay attention to geopolitical tensions

BUY GOLD is an option if the conflict between major countries continues to escalate or draw out. Meanwhile, going short on gold (i.e. SELL GOLD) is an option when the tensions subside.

3. Be mindful of risk sentiment

Risk sentiment refers to how the financial market participants (mainly traders and investors) are feeling and behaving. In layman terms, we can think of it as the mood of the overall financial market.

There are two sides to risk sentiment: risk-on or risk-off. In a risk-on period, the market takes on more risk by selling safe-haven assets (such as gold and bonds) and moves to riskier assets like stocks. On the other hand, in a risk-off period, the market starts selling riskier assets and seeks safe havens for protection.

Once we can identify the risk sentiment of the market, we can increase the chances of going in the correct direction when buying or selling gold.

Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more