How The Recent Natural Gas Surge Boosts Crude Prices

This could be an interesting week for both energy commodity markets!

Market Analysis

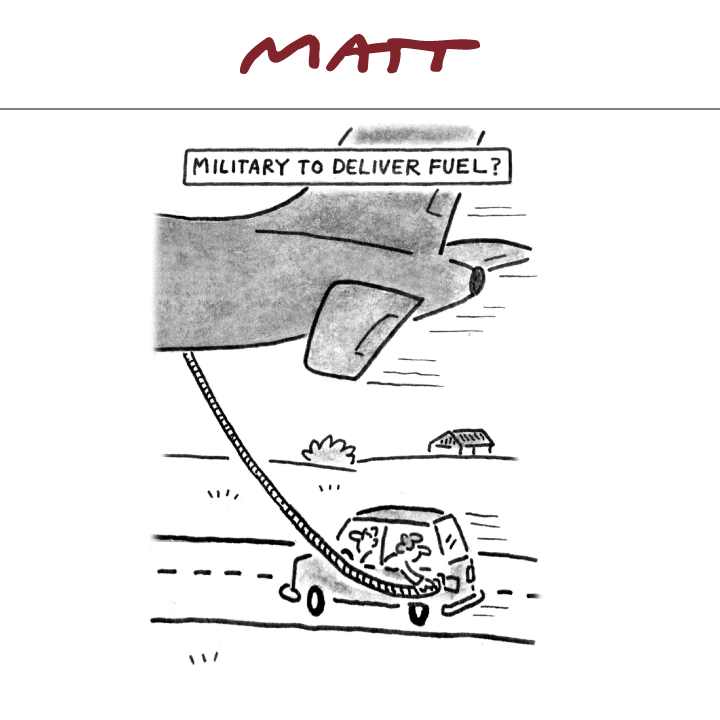

While most of the UK fuel crisis is resolved, the British government suggested that the military truck drivers will be helping out to facilitate the arrival of fuel to the South-East region, including London, where shortages still remain to be fixed around the capital.

(Source: Matt Cartoons)

As I already mentioned in a number of previous editions of our Oil Trading Alerts, we are still witnessing a very particular phenomenon of gas demand shifting to oil demand, as crude is nowadays relatively more competitive. Thus, this switch in energy demand could come in the following forms:

- From a slowdown in electricity production in Asia.

- From a hedging effect in the anticipation of a colder than normal winter in the northern hemisphere.

OPEC+ members are meeting today and, therefore, might increase their production a little more than expected to rebalance supply. So, would it help the black gold to make a new dip?

Figure 1 – WTI Crude Oil (CLX21) Futures (November contract, daily chart, logarithmic scale)

Figure 2 – Henry Hub Natural Gas (NGX21) Futures (November contract, daily chart, logarithmic scale)

Disclaimer: All essays, research and information found in this article represent the analyses and opinions of Sunshine Profits' associates only. As such, it may prove wrong and be ...

more