How Battery Metals Have Helped Us Outperform During The Slump In Gold Price

Gold hasn’t been getting much love from investors lately due to rising bond yields, and bullion-backed gold mutual funds and ETFs have seen significant outflows so far this year through the end of February.

Before pulling your money out, though, I would advise investors to double-check what’s in the fund. During this period, we’ve managed to outperform many of our peers thanks to a substantial rotation into metals and minerals that will increasingly be needed in advanced technology, including lithium-ion batteries. Besides lithium, we like copper, nickel, cobalt, and graphite, and we see great upside potential in companies that not only produce these minerals but also develop the technology behind the batteries.

Further down, I’ll be sharing one of these companies with you and how it’s helped us outperform during the gold correction.

Record-Setting Money Printing Increases the Attractiveness of Hard Assets

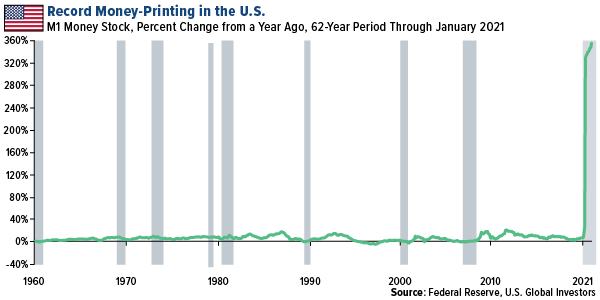

First, I think it’s important for me to say upfront that we still have strong conviction in gold and believe one of its most convincing long-term investment cases is the alarming growth in money supply in the U.S. There are different ways to define “money,” but let’s look at highly liquid M1, which includes cash outside the U.S. Treasury, money market deposit accounts and other forms of so-called “near money.”

As you can see, the amount of cash floating around the economy is up a head-spinning 355% compared to last year. This is a record rate, and it’s not even close. To combat the economic impact of the pandemic, policymakers flipped on the printing machines and never bothered to shut them off, flooding the U.S. with easy money.

The law of supply and demand may apply to currencies just as it does to any other asset. This extra liquidity has helped prop up the economy and lift stock prices, but an unintended consequence could very well be dollar depreciation—suggesting inflation may not be too far behind.

When and if that happens, I think investors with exposure to gold and gold mining would be in a much better position than those without. Historically in times of accelerating inflation, the yellow metal has improved portfolios’ risk-adjusted returns and delivered positive returns, according to the World Gold Council (WGC).

Is Inflation Already Here?

Inflation expectations over the next five years have risen to their highest level since 2011. Below you can see the five-year breakeven rate, which represents a measure of expected inflation derived from nominal five-year Treasury bonds and inflation-adjusted five-year bonds. In short, it tells you what market participants believe inflation will look like in the next five years. On Tuesday, March 2, the rate hit 2.4%, the highest reading since May 2011.

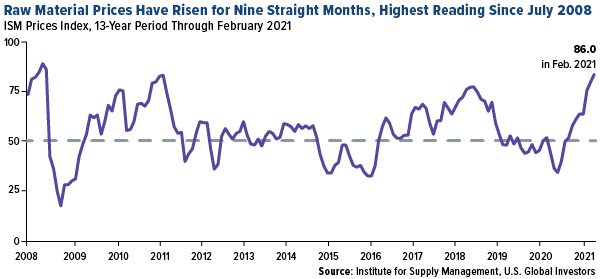

A more immediate measure of real-world inflation is the ISM Prices Index, issued by the Institute of Supply Management (ISM) as part of its monthly “Report on Business” survey. A number of purchasing and supply executives reported higher prices for raw materials in February, the ninth straight month of observed inflation. The index registered a sky-high 86.0, the highest reading since July 2008. (The greater the number is above 50.0, the faster the inflation.) All 18 industries surveyed reported higher prices from their suppliers, including primary and fabricated metals, appliances, chemical products, food and beverage, and computers and electronics.

Businesses are choosing to pass the extra costs on to consumers, or else are considering it.

This week, Michelin North America announced it would be raising prices by as much as 8% on tires for select passenger and delivery trucks due to “changing business dynamics and rising costs of raw materials.” On a mid-February earnings call, La-Z-Boy CEO Melinda Whittington said that because of escalating costs on materials and freight, “we continue to evaluate the need for further pricing actions.” General Mills, maker of Cheerios, Yoplait and Blue Buffalo pet food, is reportedly weighing price hikes on its products.

Gold and Gold Mining Stocks Undervalued Compared to Broader Market

Despite its strong investment case right now, gold has fallen out of favor with some investors due to rising bond yields and expectations of a strong economic recovery. The yellow metal is currently down 17% from its 52-week high.

I believe this represents a good time to buy on the dips as gold and gold mining stocks remain greatly undervalued compared to the broader market. Metal producers are on sale right now, having fallen more than 11% year-to-date through March 3, as measured by the NYSE Arca Gold Miners Index.

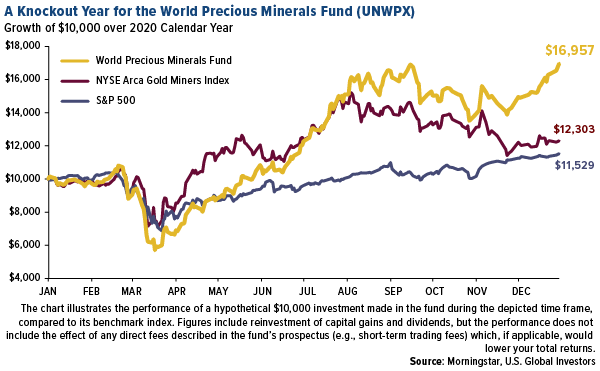

It’s also been an opportune time to get exposure to smaller precious mineral explorers and companies that source great quantities of them. This has been one of the investment strategies in our World Precious Minerals Fund (UNWPX), which gives investors additional access to junior and intermediate producers and explorers.

Meet Nano One Materials

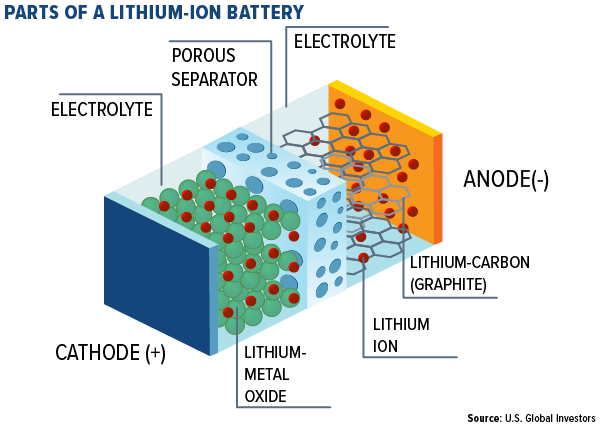

One of our favorite stocks at the moment is Nano One Materials, a small-cap tech firm that specializes in developing high-performance cathode materials used in next-generation lithium-ion batteries for the still-emerging electric vehicle (EV) market.

Right now, most standard EV batteries contain polycrystalline cathode particles, which can fracture and break apart from the stress of repeated charging, reducing range and longevity. Nano One’s patented technology uses individually coated nanocrystal cathodes that resist fracturing, thereby boosting batteries’ durability and performance.

A cathode, by the way, is the positive electrode, often made from lithium cobalt oxide (LiCoO2), that “accepts” electrons during cell discharge. This is opposed to the anode, which is the negative electrode, made from graphite, that “donates” electrons.

We like Nano’s leadership team, which has over 150 combined hours of experience in advanced technology, battery metals (particularly lithium) and equity market finance. The British Columbia-based company employs six PhDs and currently has 16 patents, with 30 more pending, helping to protect its various breakthroughs.

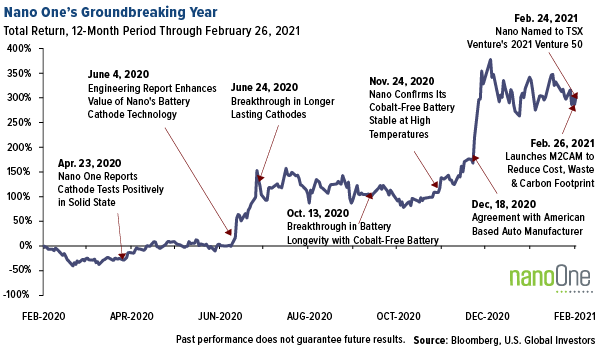

Indeed, there’s no lack of breakthroughs. See Nano One’s performance chart below. The company has unveiled a number of advancements over the past 12 months alone, including longer-lasting cathodes and high-voltage batteries that do not require cobalt. Most recently, Nano One announced its M2CAM (metal-to-cathode active material) initiative, enabling cathode materials to be made directly from metal using nickel, manganese and cobalt metal powders, thereby reducing cost, waste and carbon footprint.

To be clear, Nano One is a speculative play and highly volatile, with a 52-week range between CAD$0.75 and $6.20. Trading on Canada’s Toronto Stock Exchange (TSX) Venture Exchange, it currently has no revenue; instead, it receives its funding mostly from government assistance programs and its strategic partners, including Volkswagen’s research group, China’s Pulead Technology, France’s Saint-Gobin and an undisclosed North American auto manufacturer.

In late February, the company announced that it had been named to the TSX Venture’s 2021 Venture 50, an annual ranking of theUNWPX top-performing Canadian companies based on 2020 share price appreciation, trading volume and market cap growth. Shares of Nano One soared 425% in 2020, while its daily trading volume exploded 10,801%, from as little as 2,400 shares at the end of 2019 to more than 260,000 shares by December 31, 2020.

Rotation into Battery Metals

Our conviction in Nano One and its future is such that it was the top holding in our World Precious Minerals Fund (UNWPX) as of December 31, 2020. Battery technology is big business, requiring incredible amounts of metals and minerals, and we plan to increasingly position UNWPX to play the trend. To see the top 10 holdings in UNWPX, click here.

To give you an idea of the significant growth in battery metal demand, global battery capacity in all newly sold EVs combined jumped 93% in the second half of 2020 compared to the same period a year earlier, according to Adamas Intelligence. Battery-grade nickel usage rose 69% over the same period, battery-grade cobalt 85%, and lithium carbonate equivalent (“LCE”) 96%.

We believe the rotation into battery metals and technology was wisely made. UNWPX returned 70.60% in 2020, putting it in the very top percentile rank of funds in the Equity Precious Metals category for the year ended December 31, 2020, out of 68 funds, according to Morningstar data, based on total returns.

Had you invested $10,000 in UNPWX at the beginning of 2020, you would have ended the year up nearly $7,000, according to Morningstar data. Although you can’t invest in an index, had you made a similar hypothetical investment in the benchmark NYSE Arca Gold Miners Index, you would have seen a return of around $2,300. For the S&P 500, the return would have been approximately $1,500. To learn more about the World Precious Minerals Fund, click here.

Disclosure:

Past performance does not guarantee future results.

Please consider carefully a fund’s investment objectives, risks, charges, and expenses. For this and other ...

more