History Says Stocks Can Perform Very Well After Big Oil Shocks

HOW CONCERNING IS THE RECENT SPIKE IN OIL PRICES?

Monday’s news was filled with blurbs similar to the one below from CNBC:

“Stocks fell on Monday amid fears that a surge in oil prices following an attack in Saudi Arabia could slow down global economic growth.”

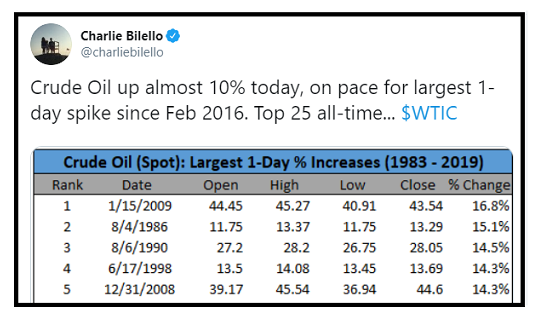

Thus, it may be helpful to know how stocks have performed after big one-day spikes in the price of oil. Charlie Bilello’s Twitter feed (@CharlieBilello) contains dates of the largest one-day spikes in the price of oil (1983-2019).

(Click on image to enlarge)

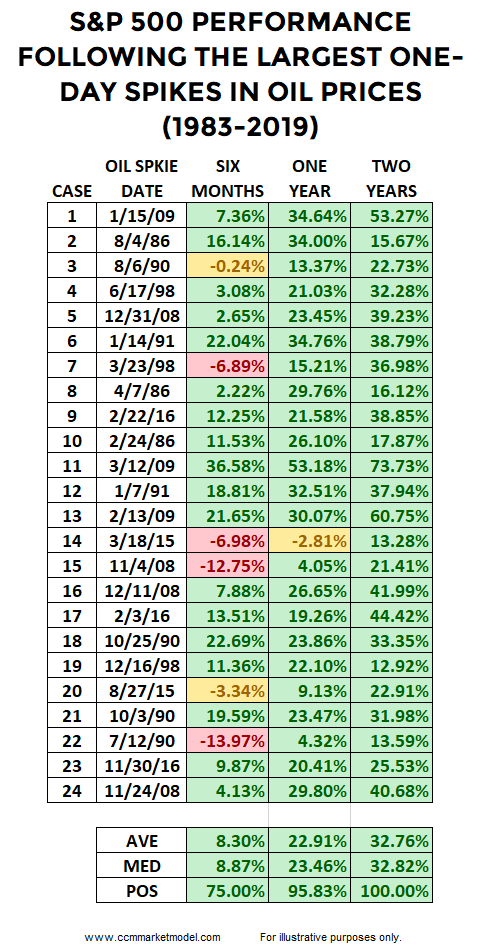

HOW DID STOCKS PERFORM WALKING FORWARD?

Instead of marking the end of civilization as we know it, in most cases, the stock market posted satisfying returns after one-day spikes in the price of oil. In fact, 100% of the cases below featured significantly higher stock prices two years from the date of the “concerning” spike in oil prices. The median gain two years later was 32.82% and the worst case saw stocks rise by 12.92%. The present-day case will follow a unique path, but history tells us not to be overly concerned about Monday’s pop in oil.

(Click on image to enlarge)

TESTING THE LONGER-TERM BULLISH HYPOTHESIS

The stock market provided a clear “be open to better than expected outcomes” signal in January 2019 aftermarket participants created a rare breadth thrust. Did last week’s shifts related to value vs. growth and interest rates negate the longer-term bullish breadth thrust thesis? You can decide after watching this week’s video.

REALISTIC EXPECTATIONS

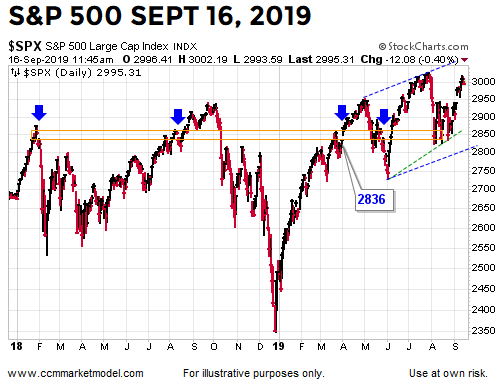

While life would be easier if it were not the case, in the real world the stock market is a volatile and difficult-to-tame animal. Having realistic expectations about a wide range of scenarios, including those on the bearish side of the ledger, can help us avoid emotional surprises. Based on numerous timeframes, a push back toward 2880-ish on the S&P 500 would not be shocking, even under a longer-term bullish scenario.

(Click on image to enlarge)

As always, we will continue to take it day by day and see how the data unfolds in the coming days, weeks, and months.