Hartstreet Oil: Noble Paid A Big Price For Clayton Williams, And With Good Reason

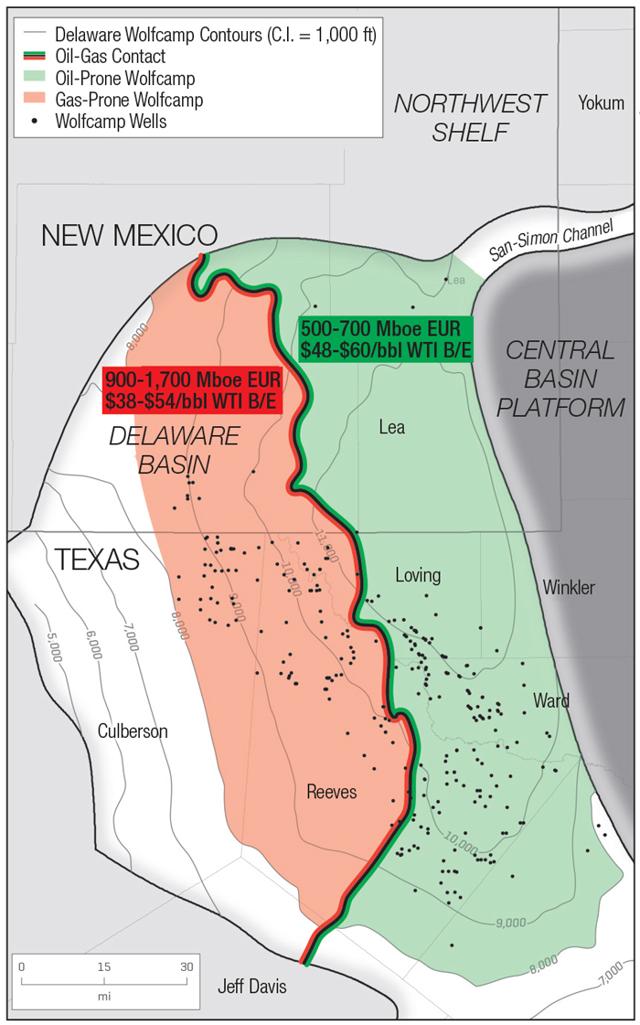

Noble (NBL) recently offered $2.7B in stock and cash to Clayton Williams (CWEI). This was a good fit for NBL, as it was near the Rosetta leasehold NBL had acquired. CWEI was looking to sell as its balance sheet looked terrible, and needed an out. Reeves County has some of the lowest breakevens in the country, and operators are rushing to add acreage or enter the basin. There are still several private operators with land in southern Reeves and Pecos. We expect consolidation. Reeves County geology is interesting. As seen in the map below, north and western Reeves is in the gas window, while the east and south are oil bearing with respect to the Wolfcamp.

(Source: Permian Perseveres)

The basin is the deepest in Loving County. This depth lessens as we move into Pecos County.

The majority of production growth in the United States will occur in Permian. Lower breakevens and greatest upside will keep operators active. Increased Permian production will help to offset declines in other plays like the Bakken and Eagle Ford. To evaluate production from this area I pulled 212 wells in the Southern Delaware.

|

Name |

Well Count |

CUM Gas |

CUM Oil |

|

OXY USA WTP LP (NYSE:OXY) |

72 |

7,548,237 |

5,708,539 |

|

COG OPERATING LLC (NYSE:CXO) |

37 |

9,882,762 |

4,789,985 |

|

OXY USA INC. |

19 |

1,813,180 |

1,625,167 |

|

THOMPSON, J. CLEO |

14 |

4,792,593 |

2,331,952 |

|

PATRIOT RESOURCES, INC. |

12 |

1,819,197 |

1,628,389 |

|

CENTENNIAL RESOURCE (NASDAQ:CDEV) |

11 |

2,607,557 |

1,009,181 |

|

ROSETTA RESOURCES OPER |

8 |

2,237,934 |

795,618 |

|

PARSLEY ENERGY OPERATIONS (NYSE:PE) |

7 |

925,050 |

475,207 |

|

PRIMEXX OPERATING CORPORATION |

7 |

1,407,558 |

682,560 |

|

BRIGHAM RESOURCES OPERATING |

6 |

1,643,668 |

887,248 |

|

WILLIAMS, CLAYTON ENERGY |

6 |

1,107,492 |

795,378 |

|

JAGGED PEAK ENERGY LLC |

4 |

708,073 |

716,827 |

|

Apache Corporation (NYSE:APA) |

3 |

247,327 |

217,298 |

|

DIAMONDBACK E&P LLC (NASDAQ:FANG) |

2 |

131,310 |

87,188 |

|

ARRIS OPERATING COMPANY LLC |

1 |

493,279 |

82,474 |

|

ELK RIVER RESOURCES, LLC |

1 |

246,786 |

218,139 |

|

MDC TEXAS OPERATOR LLC |

1 |

843,243 |

193,400 |

|

SAMSON EXPLORATION, LLC |

1 |

194,673 |

156,401 |

|

Total |

212 |

38,649,919 |

22,400,951 |

(Source: Welldatabase.com)

Occidental and Concho are producing the most crude, followed by Cleo Thompson. Rosetta is the operating name for Noble. All wells were completed on 12/14 or later. Anadarko (APC), Energen (NYSE:EGN), Chevron (NYSE:CVX), Cimarex (NYSE:XEC), EOG Resources (NYSE:EOG), Devon (NYSE:DVN), Exxon (NYSE:XOM), Resolute (NYSE:REN), Parsley, Conoco (NYSE:COP) and Diamondback (FANG) are other operators near this area. The wells in this analysis are located in the map below.

(Source: Welldatabase.com)

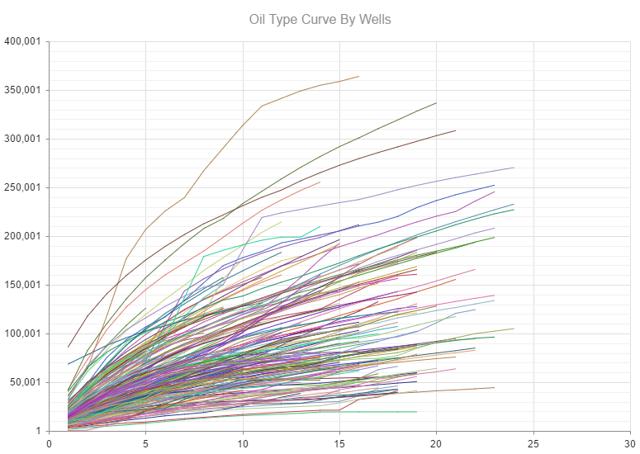

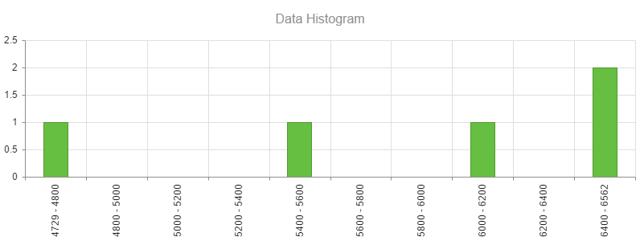

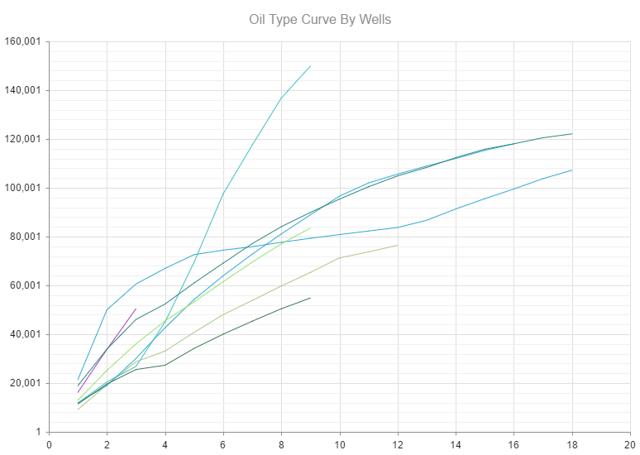

The graph below provides the type curve for all 212 locations. At the most, individual wells have 24 months of well life.

(Source: Welldatabase.com)

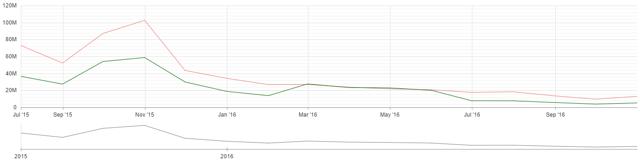

ANGLER UNIT 301H was complete by CXO and is an outperformer. The graph below provides its production by month. Natural gas is shown in red and oil in green.

(Source: Welldatabase.com)

POPPY STATE 904H was completed by CXO as well. It has produced 336K BO in only 20 months.

(Source: Welldatabase.com)

W STATE 1204H is a 6,226-foot lateral completed by Concho.

(Source: Welldatabse.com)

W State has produced 491,680 BO in 21 months of well life. All three wells were very good, and show how enhanced completions are increasing production and lowering breakevens.

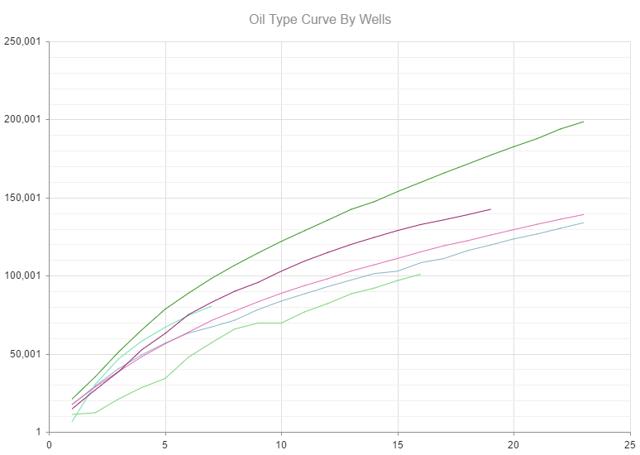

CWEI's six wells are below average. This may not matter as much with respect to an acquisition, as CWEI wells had a more limited well design. Geology is geology and there is value in that.

(Source: Welldatabase.com)

CWEI has continued to use shorter laterals. Given its financial difficulties, it has not implemented newer designs. This has hurt production per well.

(Source: Welldatabase.com)

Noble has completed 8 wells. It has two completions that look quite good. One has been on line for 3 months and the other 9.

(Source: Welldatabase.com)

The average well economics from all wells logged provides decent production results. More importantly, those results are improving. I have calculated the average well economics for all wells completed in that general area.

|

Recovered: |

144,947.02 |

|

|

Months: |

24 |

|

|

Selling Price: |

$53/Bbl |

|

|

Initial Capital Expense: |

($7,000,000.00) |

|

|

Lease Operating Cost: |

($1,449,456.00) |

|

|

Total |

NRI |

|

|

Total: |

$7,682,191.87 |

$5,761,643.90 |

|

Recovered: |

$7,682,191.87 |

$5,761,643.90 |

|

Total |

Working Interest |

|

|

Total: |

($8,449,456.00) |

($8,449,456.00) |

|

Recovered: |

($8,449,456.00) |

($8,449,456.00) |

|

Total |

Working Interest |

|

|

Total: |

($767,264.13) |

($2,687,812.00) |

|

Recovered: |

($767,264.13) |

($2,687,812.00) |

|

Natural Gas Revenues: |

945,348 |

$945,348 |

|

$178,083.87 |

($1,742,464.10) |

(Source: Welldatabase.com)

Using a $7MM D&C at $53/bbl oil and $3.38 natural gas, after royalties the average well still has over $1.72MM to breakeven. While these results are not spectacular at today's prices, more recent wells have shown production improvements. Some believe southern Reeves and Pecos counties are better than Midland. One could debate whether it is true, but this area just needs a couple of big wells for acreage valuations to increase significantly. Knowing what names to buy based on future acquisitions is difficult. Some may choose to buy the Energy Select Sector SPDR ETF (XLE) or the SPDR S&P Oil & Gas Exploration & Production ETF (XOP). This may not be a bad idea, as oil prices look to head higher and with it Delaware production volumes.

Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access to additional ...

more