Hartstreet Oil: Concho Is Killing It In The Permian

There are opportunities in the Permian. Although much of the Midland Basin core has been leased, there are still relatively large leaseholds held by private operators in the Delaware. We expect the accumulation of acreage to continue, and this should be positive for acquirers. As consolidation continues, so will downspacing. Additional viable intervals will also be tested. There are a number of intervals virtually untested. As big wells are added to the list, acreage valuations will increase.

Decreased regulations for the oil industry may benefit the Permian the most, given it has driven production increases even with low prices. It may further benefit from an increase in the price of WTI, and the US Oil ETF (USO). OPEC production cuts and a new tax system could push WTI to $65/bbl during the driving season. This could make for a bullish 2017.

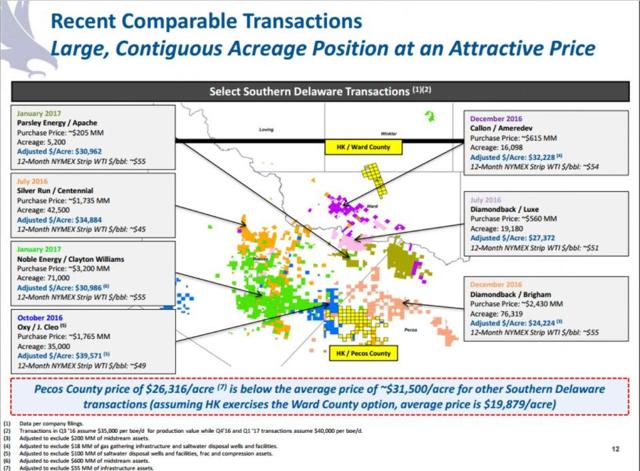

(Source: Halcon)

A number of large purchases are shown on the map above. Adjusted acreage valuations are in the $30K to $40K range in southern Reeves. Diamondback Energy (FANG) may have received the best deal, as there are a large number of payzones that could be economic at today's oil prices. Pecos County has a more shallow Wolfcamp. This lends to the assertion it will lag in production. Recent Brigham results tend to provide comparable resource level. If done properly, Pecos values could inch closer to that of southern Reeves. It will take one or two big wells from other intervals, but there are still a number to test.

To provide additional clarity, we have broken down the production results by operator. We looked at 212 locations and listed below.

|

Name |

Well Count |

CUM Gas (MCF) |

CUM Oil (BBL) |

|

OXY USA WTP LP (NYSE:OXY) |

72 |

7,548,237 |

5,708,539 |

|

COG OPERATING LLC (NYSE:CXO) |

37 |

9,882,762 |

4,789,985 |

|

OXY USA INC. |

19 |

1,813,180 |

1,625,167 |

|

THOMPSON, J. CLEO |

14 |

4,792,593 |

2,331,952 |

|

PATRIOT RESOURCES, INC. |

12 |

1,819,197 |

1,628,389 |

|

CENTENNIAL RESOURCE PROD (NASDAQ:CDEV) |

11 |

2,607,557 |

1,009,181 |

|

ROSETTA RESOURCES (NASDAQ:ROSE) |

8 |

2,237,934 |

795,618 |

|

PARSLEY ENERGY OPERATIONS (NYSE:PE) |

7 |

925,050 |

475,207 |

|

PRIMEXX OPERATING CORPORATION |

7 |

1,407,558 |

682,560 |

|

BRIGHAM RESOURCES OPERATING |

6 |

1,643,668 |

887,248 |

|

WILLIAMS, CLAYTON ENERGY |

6 |

1,107,492 |

795,378 |

|

JAGGED PEAK ENERGY LLC (NYSE:JAG) |

4 |

708,073 |

716,827 |

|

Apache Corporation (NYSE:APA) |

3 |

247,327 |

217,298 |

|

DIAMONDBACK E&P LLC (NASDAQ:FANG) |

2 |

131,310 |

87,188 |

|

ARRIS OPERATING COMPANY LLC |

1 |

493,279 |

82,474 |

|

ELK RIVER RESOURCES, LLC |

1 |

246,786 |

218,139 |

|

MDC TEXAS OPERATOR LLC |

1 |

843,243 |

193,400 |

|

SAMSON EXPLORATION, LLC |

1 |

194,673 |

156,401 |

(Source: Welldatabase.com)

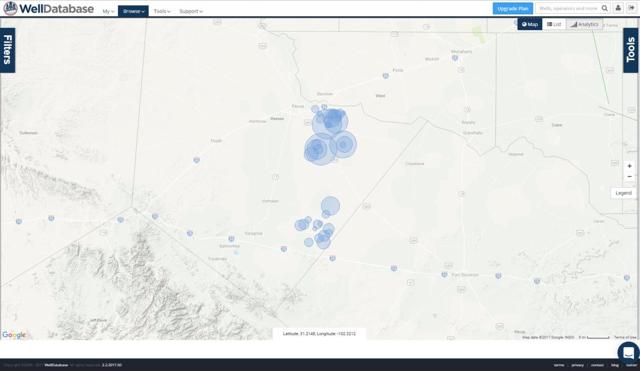

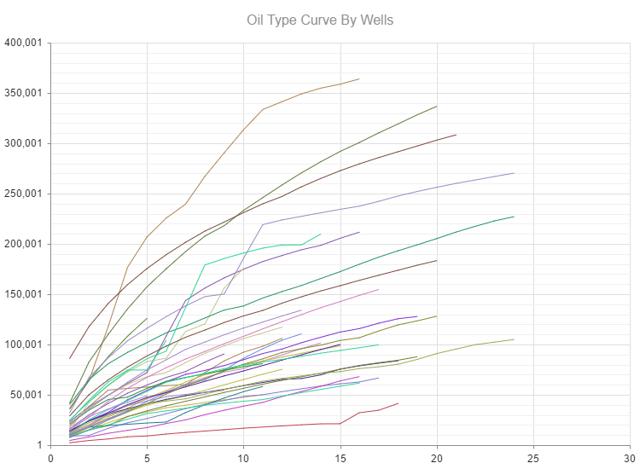

Concho has been an overachiever with respect to production per well. The Delaware has been its main focus, and its locations are shown on the Welldatabase.com map below.

(Source: Welldatabase.com)

CXO wells have produce more on a cumulative basis near Ward County. This does not account for time, and is not IP correlated.

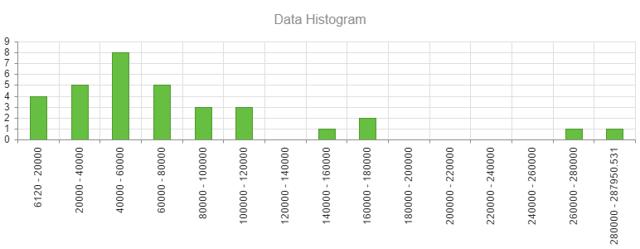

(Source: Welldatabase.com)

Two wells produced over 260,000 BO and four wells produced under 20,000 BO over the first six months. The average well has produced approximately 50K BO, but as it expands its well design, production per well is increasing on an initial production basis.

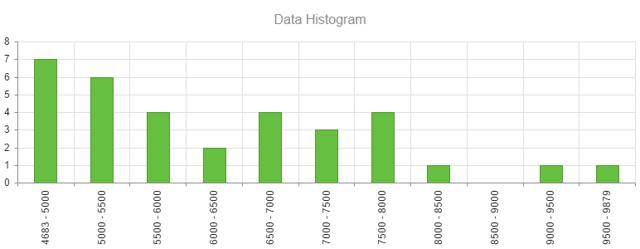

(Source: Welldatabase.com)

Roughly half of the wells have a lateral length below 6,500 feet. CXO had initially used laterals close to 5K ft., but we are starting to see long laterals. These wells are almost two miles long.

(Source: Welldatabase.com)

CXO's top performers are the best in the area. If only one well was significantly better, we could write it off as a sweet spot. It currently has three wells over 300K BO. CXO has another well north of 250K BO and three more above 200K BO. The average well produced 174,000 BO in the first 24 months. These results, on average are not the best, but close to Cleo Thompson's top production numbers.

|

EUR: 174,138.67 |

174,138.67 |

|

|

Months: 24 |

24 |

|

|

Selling Price: |

$50/Bbl. |

|

|

Initial Capital Expense: |

$7,000,000 |

|

|

Lease Operating Cost (monthly): |

$72,558 |

|

|

Total |

NRI |

|

|

Total: |

$8,706,933.65 |

$6,503,200.24 |

|

Recovered: |

$8,706,933.65 |

$6,503,200.24 |

|

Total |

NRI |

|

|

Total: |

($8,741,392.00) |

($8,741,392.00) |

|

Recovered: |

($8,741,392.00) |

($8,741,392.00) |

|

Total |

NRI |

|

|

Total: |

($34,458.35) |

($2,238,191.76) |

|

Recovered: |

($34,458.35) |

($2,238,191.76) |

(Source: Welldatabase.com)

CXO has $1.1 million to reach on its average well after natural gas revenues are added. This is after costs and royalties (25%). I would expect CXO's D&C to be lower than $7 million and average royalties to be lower, but I wanted to figure conservatively. As infrastructure is added, costs will decrease. We expect production per well to increase. Currently, CXO's payback is probably under 2 years using $50/bbl oil after differentials.

In summary, there are several variables positive for CXO going forward. The Delaware may have the most upside of any play in the US. Since the north leased first, with focus on Loving, there are still acreage possibilities in southern Reeves and Pecos. Operators with a foothold here should benefit from increased acreage values as downspacing and testing occurs. There are still several private operators to look at, and some of the larger operators would love to add to its holdings. XOM, COP, CVX, OXY, CXO, XEC, and others all have interest. In a stacked play of this size, there are just too many opportunities, and more intervals will end up economic in 2017. The oil industry could see the benefit of advantageous tax changes and decreased regulation. This ramp up is not only positive for the Bakken and Eagle Ford, but more importantly the Permian. The majority of US production growth is estimated to come from west Texas. We think this is the place to be in 2017, and look for several acreage acquisition announcements. The Energy Select Sector SPDR ETF (XLE) and SPDR S&P Oil & Gas Exploration & Production ETF (XOP) are both levered to the Permian, and may benefit if this area continues to increase production.

Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access to additional ...

more