Hartstreet LLC: Possible Acquisitions In The Permian Part 2

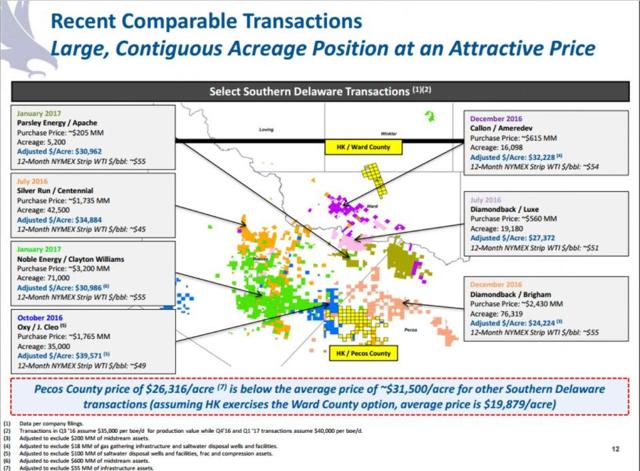

In Part 1 of Possible Acquisitions in the Permian, we covered J. Cleo as one of the premiere private operators in the southern Delaware Basin. Given the opportunities in the area, acreage prices have increased significantly. The map below provides some of the larger acquisitions by publicly traded companies. Adjusted acreage values in southern Reeves are in the $30K to $35K range. Concho's (CXO) acknowledgement that there is little value in the western Permian, seems to point to increasing acreage prices in the near term. The only question is which operators are willing to pay. Increasing acreage valuations could push Delaware players' market caps higher. It could also mean there is upside even at today's prices. The southern Delaware is much less developed than Midland. This means de-risking and downspacing will continue to increase current economics.

(Source: Halcon)

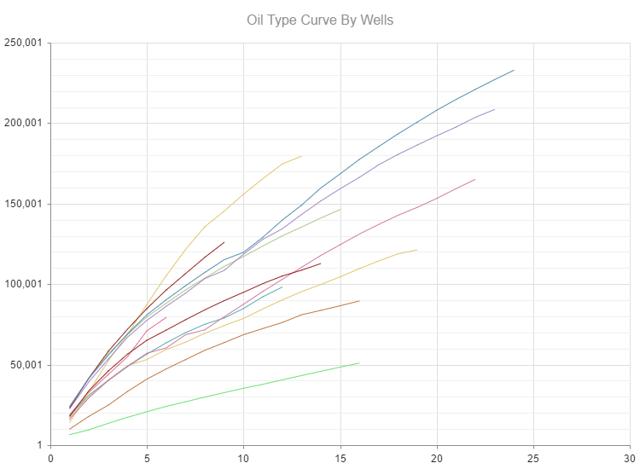

While J. Cleo may be the most intriguing name, there are others producing excellent results. These results are more appealing given the expansion of well design, and very good results from enhanced completions. Patriot is another operator with acreage in southern Reeves County. It has 12 current completions. Oil production of each well is plotted on the graph below.

(Source: Welldatabase.com)

It's longest producing well is 24 months. It has produced over 230K BO. The results have been variable, but many of the newer completions are on pace to produce as much if not more oil than its best well.

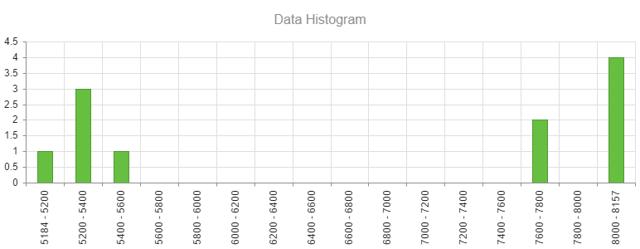

(Source: Welldatabase.com)

The variability of results have much to do with lateral length. The differences range from 5 locations under 5,600 feet and six from 7,600 to 8,157 feet.

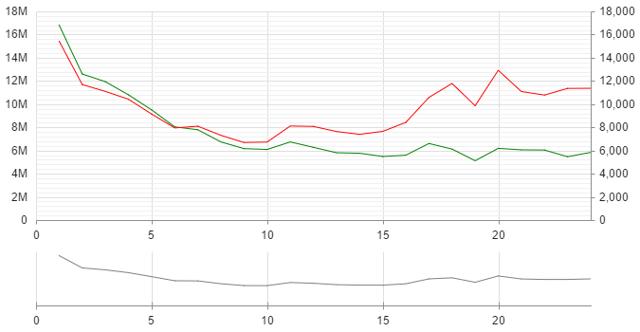

J. Cleo currently has the best results in this area. Patriot's results have been better on average than CXO, although both are relatively close in average barrels of oil. The average type curve of Patriot's oil (green) and natural gas (red) production is graphed above.

|

EUR: 179,584.75 |

179,584.75 |

|

|

Months: 24 |

24 |

|

|

Selling Price: |

$50 |

|

|

Initial Capital Expense: |

$7,000,000 |

|

|

Lease Operating Cost (monthly): |

$74,827 |

|

|

Total |

NRI |

|

|

Total: |

$8,979,237.38 |

$6,734,428.04 |

|

Recovered: |

$8,979,237.38 |

$6,734,428.04 |

|

Total |

NRI |

|

|

Total: |

($8,795,848.00) |

($8,795,848.00) |

|

Recovered: |

($8,795,848.00) |

($8,795,848.00) |

|

Total |

NRI |

|

|

Total: |

$183,389.38 |

($2,061,419.96) |

|

Recovered: |

$183,389.38 |

($2,061,419.96) |

E(Source: Welldatabase.com)

The average Patriot well produces approximately 180K BO in 24 months. After costs are pulled along with NRI, there is still a little over $2 million without figuring in revenues from natural gas and NGLs.

Core Permian acreage is getting more difficult to obtain at a value. While there are still several private operators that may be willing to sell acreage, the value per acre is much higher than it was just a few months ago. Many of the distressed sellers have sold, with others holding out for a better payday. There are a number of operators that may be interested in the acreage. Operators like XOM, CVX, or COP wont see much of a move in market cap, and may not be interested in a purchase this small. Others like HK, PE, CDEV, FANG, and CPE are all possibilities that may see significant upside in the case of an acquisition. It is more likely a name like CXO, OXY, APA, or XEC would be in a better position to add. Although difficult to pin point which names will purchase private operators, it will be positive for ETFs like the SPDR S&P Oil & Gas Exploration and Production ETF (XOP) or to a lesser extent the Energy Select Sector SPDR ETF (XLE). If oil prices move higher as expected, the recent pullback in both may be a buying opportunity. Other ETFs with significant Permian exposure are:

- Direxion Dly S&P Oil&Gs Ex&Prd Bl 3X ETF (GUSH)

- Direxion Dly S&P Oil&Gs Ex&Prd Br 3X ETF (DRIP)

- Direxion Daily Energy Bull 3X ETF (ERX)

- Direxion Daily Energy Bear 3X ETF (ERY)

- Vanguard Energy ETF (VDE)

- ProShares Ultra Oil & Gas (DIG)

- ProShares UltraShort Oil & Gas (DUG)

- iShares US Energy (IYE)

- iShares US Oil&Gas Explor&Prodtn (IEO)

- PowerShares Dynamic Engy Explr&Prdtn ETF (PXE)

- Fidelity MSCI Energy ETF (FENY)

- First Trust Energy AlphaDEX ETF (FXN)

We believe acquisitions will continue in the Permian, and as fewer names are left to sell acreage values will head higher. This is regardless of whether oil prices increase to $80/bbl or remain at today's prices. As economics continue to improve due to lower costs and or multiple economic intervals, these areas will turn into relatively large cash flows for operators.

Disclosure: Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access ...

more

Thanks for sharing