Guinea Coup Sends Aluminum Prices Soaring To Fresh Decade Highs

Aluminum prices soared to a new decade high after a military coup in Guinea stoked concerns over the supply of bauxite, a sedimentary rock with high aluminum content, according to Bloomberg.

Aluminum prices increased in London and Shanghai. London Metal Exchange (LME) contracts rose nearly 2% to $2,775 on the news of the military coup in the West African country on Sunday that could threaten bauxite supply.

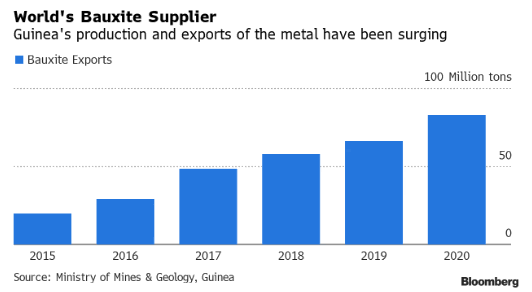

According to UK-based commodity research firm Marex, Guinea is one of the world's largest bauxite exporters. The country mines about a quarter of the world's supply. So far, there are no signs yet of supply disruptions.

Guinea exported 82.4 million tons of bauxite to make alumina that eventually produces aluminum in 2020. For the last half-decade, exports from the country have surged. Some of the top buyers of bauxite are Australia and China.

The coup "might have a speculative impact on the price of aluminum but will have a bigger impact on the alumina price because it's more immediately exposed to the event," said Tom Price, head of commodities strategy at Liberum Capital Ltd. "It's an event which will create a new risk of security to supply."

Aluminum prices on the LME have surged more than 40% over the past year and are at a new decade high, not seen since 2011.

Shares of aluminum producers are also rallying over the political unrest in the country. Industry leader Aluminum Corp. of China or Chalco is up 10%, United Co. Rusal traded 15% higher, and Norsk Hydro rose to the highest intraday level since November 2017.

The head of the elite military unit in the West African nation, Colonel Mamady Doumbouya, declared the country's takeover on Sunday and immediately imposed a curfew around 8 pm local time.

Doumbouya told the nation the coup was essential to address the gross financial mismanagement and corruption under President Alpha Conde. He added the president is safe.

"If you see the condition of our roads, of our hospitals, you realize that it is time for us to wake up," Doumbouya said. "We are going to initiate a national consultation to open an inclusive and peaceful transition."

The unexpected events of the coup added more fuel to the fire for aluminum prices as smelters in top producer China faced stricter power controls measures by Beijing to curb carbon emissions.

"Investors are quite concerned given China buys a big chunk of bauxite from Guinea," Xiong Hui, the chief aluminum analyst with Beijing Antaike Information Development Co. He said there have yet to be any reports of supply disruptions. The situation is ongoing and comes at an inopportune time as China's Guangxi province cuts production, tightening the market.

A combination of political unrest in Guinea and China's smelter crackdown has resulted in challenges for the aluminum market that has pushed prices to decade highs. So much for the Federal Reserve's transitory narrative.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more