Gold’s Uptrend Intact But May Need A Breather

We said to be bullish on gold in 2020 as per our gold forecast, and similarly bullish on silver as per our silver forecast. The first week of 2020 was great for precious metals prices. However, miners were reluctant to consistently follow their ‘leaders’ higher. After a spike early this week we now ‘sense’ that the entire gold market needs a breather. Bulls with a long term time horizon should not worry too much as our 2020 and 2021 forecasts still look great for gold investors. However, short term we may see some consolidation and some choppy price action until bullish energy returns.

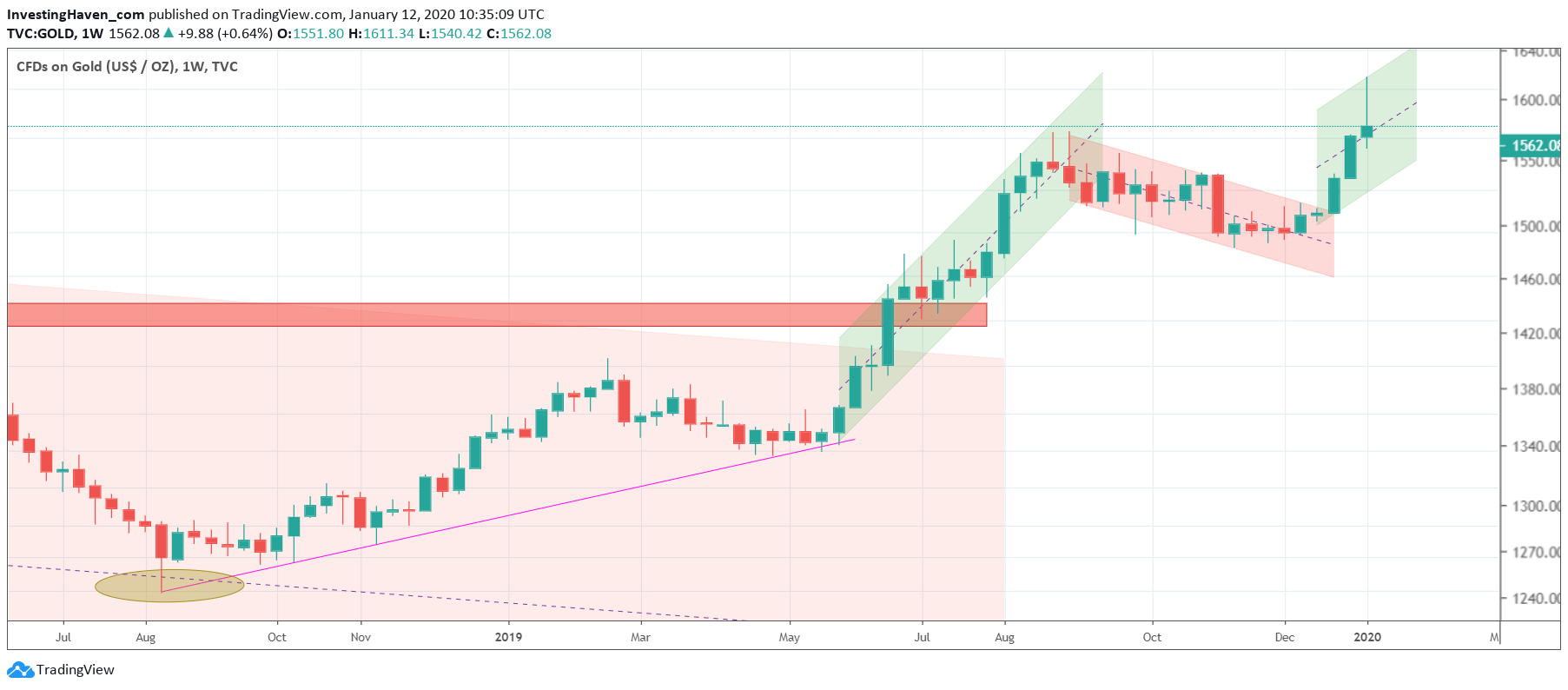

The weekly gold chart says it all.

Without any doubt the greatest thing about this gold chart is its new bullish trend in the form of a rising channel.

The first 2 trading weeks of 2020 clearly marked a breakout in gold after a 4-month retracement that started on the day we flashed a sell alert on our favorite silver miner.

At InvestingHaven we like to keep things clear and clean, especially the charts. The gold chart below is the cleanest possible version you can imagine, without a bunch of technical indicators and other lines that make your head spin around for an hour.

This gold chart shows 4 phases in the last 24 months (even though only 19 months are shown):

- A secular downtrend (long term bear market) until May 2019. This is the same bear market that started in September of 2011.

- A breakout and tactical uptrend in June/July/August of 2019. No coincidence, we played this uptrend with a Momentum Investing trade to book an 80% profit on a silver miner.

- A retracement in the last 4 months of 2019.

- The new tactical bull market starting in 2020.

Even though this new bull market looks solid we believe it went up too fast.

One of the likely scenarios is that we will see a few weeks of sideways price action until the lower area of this new rising channel is tested. If this is the scenario that will play out we will keep a very close eye on $1,550, our price target in our 2019 forecast which was met exactly as predicted. The 2019 peak might become the low of the 2020 tactical bull market.

We remain open for other scenarios to play out though, and we believe we will hit a big winner in 2020 in the precious metals market with a Momentum Investing trade. You too can hit this with us, by following our Momentum Investing methodology which is designed to double our capital annually.

Disclaimer: InvestingHaven.com makes every effort to ensure that the information provided is complete, correct, accurate and ...

more