Goldman Goes "Lehman Weekend" On Oil: Expects Chaos When Trading Reopens

Exactly 11 years to the day traders organized an emergency impromptu CDS unwind session on Sunday afternoon ahead of Lehman's shocking September 15, 2008 bankruptcy filing. Now major banks are preparing for similar Sunday chaos, only this time in the crude oil market in the aftermath of Saturday's shocking drone attack on the most important oil processing plant in Saudi Arabia (and the world). This may result in a production shortfall of millions of bpd that stretches for days if not weeks, and lead to an explosion in oil prices (for those who are reading this early on Sunday afternoon, gas up your car now before gasoline prices surge on Monday).

First, we present the email that was just sent out by Saxo's Christopher Dembik, indicating that when Brent reopens, it will surge as much as $5-10 in the Asian session:

Very short comment on what is happening in the oil market.

Following the events in Saudi Arabia, well-informed market participants expect that oil prices may increase by $5-10 per barrel in the Asian session.

Higher pressure on CNY, but also negative for TRY and INR due to elevated current account deficits.

Too early to assess the exact macro impact by it is bright clear we don’t need an oil shock…

The bottom line: oil may spike much more if the return to normal production takes longer than expected. Sure enough, that is the main point conveyed in an email that was just blasted out by Goldman sales (not research) to the bank's top clients around the globe, with a message is simple: expect chaos when oil reopens... and sharply higher prices.

Exactly 11 years to the day since traders organized an emergency impromptu CDS unwind session on Sunday afternoon ahead of Lehman's shocking September 15, 2008 bankruptcy filing, major banks are preparing for similar Sunday chaos, only this time in the crude oil market in the aftermath of Saturday's shocking drone attack on the most important oil processing plant in Saudi Arabia (and the world) which may result in a production shortfall of millions of bpd that stretches for days if not weeks, and lead to an explosion in oil prices (for those who are reading this early on Sunday afternoon, gas up your car now before gasoline prices surge on Monday).

First, we present the email that was just sent out by Saxo's Christopher Dembik, indicating that when Brent reopens, it will surge as much as $5-10 in the Asian session:

Very short comment on what is happening in the oil market.

Following the events in Saudi Arabia, well-informed market participants expect that oil prices may increase by $5-10 per barrel in the Asian session.

Higher pressure on CNY, but also negative for TRY and INR due to elevated current account deficits.

Too early to assess the exact macro impact by it is bright clear we don’t need an oil shock…

The bottom line: oil may spike much more if the return to normal production takes longer than expected. Sure enough, that is the main point conveyed in an email that was just blasted out by Goldman sales (not research) to the bank's top clients around the globe, with a message is simple: expect chaos when oil reopens... and sharply higher prices.

A shocking lack of additional information has been released since the initial headlines yesterday afternoon that attacks on Saudi infrastructure would halt nearly half of Saudi output.With even Donald Trump quiet on the issue there remains more questions than answers.

A thorough summary of events and quick market backdrop from my colleague, Elise Backman, is attached.The long and short of it being that the Saudi’s Abqaiq facility processes up to 7mbd of crude and Khurais that was also hit produces about 1.5 mbd. It’s not an overstatement to call Abqaiq and its surrounding areas the heart of Aramco’s empire. In our view, the flaring pictures from NASA satellites make it very likely that some production is down; these flares are likely not from the attacks but more from the facilities going into emergency shutdowns.Aramco is built and setup with a lot of redundancies which is why you rarely hear of major outages – given the importance of Abqaiq we expect these redundancies (extra piping, spare stabilization units, extra tanks, etc.) to be even more prevalent at the facility.

However, this is a meaningful change for the crude market and highlights the vulnerability of Saudi infrastructure, and ongoing instability of the Middle East.While the market needs more information in order to make a determination on the direct impact to balances our expectation is for the market to trade definitively stronger with high levels of activity from the discretionary, systematic and corporate community likely creating a raft of opportunities.

Expect chaos to begin at 6pm sharp, when futures reopen:

We will be staffed globally from Market Open this evening (6pm EST/11pm BST) with best efforts on pricing subject to market tradability.

And just to help traders make an informed decision (to submit a market buy order), here is what Goldman's energy analyst, Damien Courvalin and teams, published on the situation moments ago:

Attacks on Saudi oil assets to support prices; magnitude uncertain but likely capped. High level summary from research is below.We expect estimates to be updated as new information becomes available.

Research Bottom Line:

Two oil facilities in Saudi Arabia were targeted on Saturday by drone attacks, with the extent of the damage highly uncertain yet potentially significant: half of current production was halted while reports indicate that a re-start of most oil output could occur in days or weeks. The potential for a prompt resumption of production hinges on the fact that most damage occurred at a processing plant rather than a field.

This is nonetheless a historically large disruption on critical oil infrastructure and these events represent a sharp escalation in threats to global supply with risks of further attacks. These events are therefore set to support oil prices at their open on Sunday, especially given recent growth concerns and low levels of positioning. The magnitude of such a price rally is difficult to estimate in the absence of official comments on the timeline and scale of production losses. We nonetheless provide a rough first estimate of possible outcomes based on our pricing framework and the experiences of the 2018 Iranian sanctions and the 2011 Libya production losses:

- A very short outage – a week for example – would likely drive long-dated prices higher to reflect a growing risk premium, although short of what occurred last fall given a debottlenecked Permian shale basin, a weaker growth outlook and prospects of strong non-OPEC production growth in 2020. Such a price impact could likely be of $3-5/bbl.

- An outage at current levels of two to six weeks would, in addition to this move in long-dated prices, see a steepening of the Brent forward curve (2-mo vs. 3-year forward) of $2 to $9/bbl respectively. All in, the expected price move would be between $5 and $14/bbl, commensurate to the length of the outage (a six month outage of 1 mb/d would be similar to a six week one at current levels).

- Should the current level of outage be announced to last for more than six weeks, we expect Brent prices to quickly rally above $75/bbl, a level at which we believe an SPR release would likely be implemented, large enough to balance such a deficit for several months and cap prices at such levels.

- An extreme net outage of a 4 mb/d for more than three months would likely bring prices above $75/bbl to trigger both large shale supply and demand responses.

Finally, here is a recap of events that took place over the past 36 hours from Goldman's sales team:

Following on overnight events / earlier WSJ article, please find additional color from the desk below. Note, we will have desk coverage starting at 6pm EST on Sunday.

Summary of events:

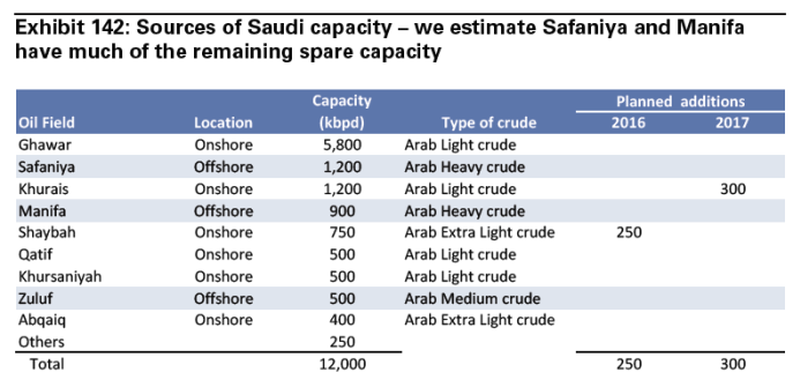

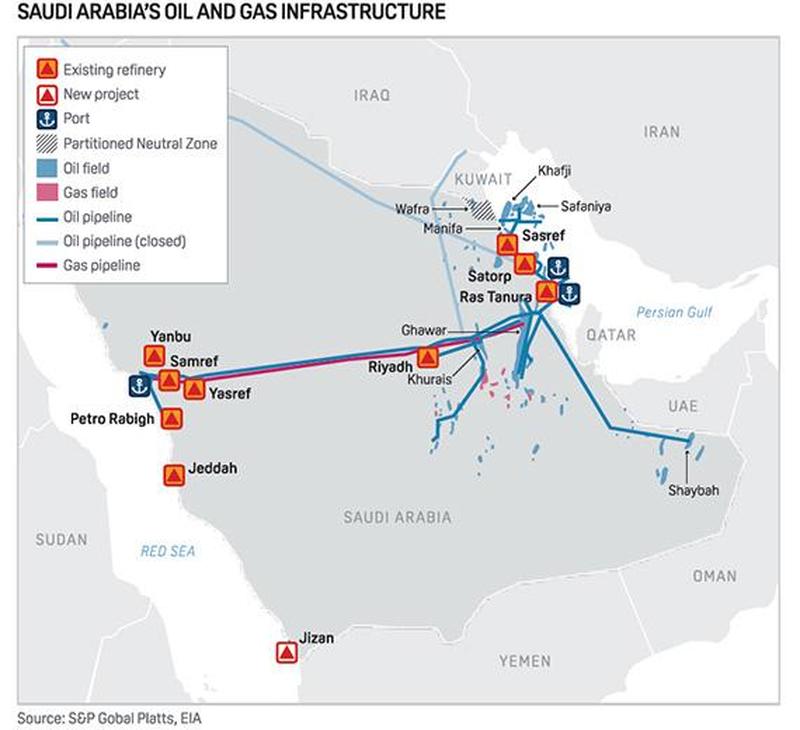

- Saudi Arabia has shut down approximately half (5 mb/d) of its oil output after coordinated drone strikes have hit Saudi oil processing facilities at Abqaiq (7 mb/d capacity) and Khurais (approximately 1.5 mb/d production capacity of Arabian Light). This facility is about 70 km from Dhahran, the headquarters of Aramco, and 328 km to Riyadh. (https://www.cnbc.com/2019/09/14/saudi-arabia-is-shutting-down-half-of-i…)

- Houthi rebels have taken responsibility for the attack and stated that it occurred through firing 10 drones. Official Iranian representatives have remained silent, and Saudi coalition leadership said investigations are underway to identify the perpetrators. News outlets have flagged that some of the missiles that crash-landed (i.e. did not strike their targets) were linked to “IRGC proxies.” (https://www.cnn.com/2019/09/14/middleeast/yemen-houthi-rebels-drone-att…)

- Israeli representatives have also remained quiet (note: Israeli election is on Tuesday - https://www.nytimes.com/news-event/israel-elections-2019).

- US has yet to officially respond but Secretary Pompeo tweeted “Iran behind nearly 100 attacks on Saudi Arabia, says "no evidence" drone attacks on oil facilities in Saudi Arabia came from Yemen” and called for Iran to be “held accountable” (https://www.wsj.com/articles/drone-strikes-spark-fires-at-saudi-oil-fac…)

- Given the importance of Abqaiq in Aramco infrastructure, it has been a target of several prior Houthi attacked but prior to these events was unaffected in recent years. (https://www.aljazeera.com/news/2019/09/timeline-houthis-drone-missile-a…)

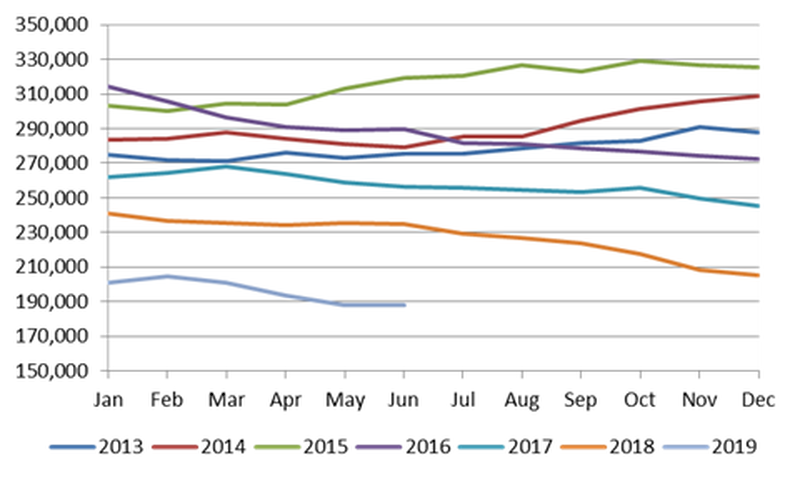

- Saudi has noted that exports will be unaffected by production shut-off (drawing on existing commercial inventories) and also stated that production would renormalize by Monday. Saudi crude stocks are currently at 76 mb (near the highs of the year of 78 mb – chart below of closing stocks per JODI). - https://www.wsj.com/articles/saudi-officials-say-oil-production-to-retu…

- IEA is monitoring the situation in Saudi and says commercial stocks will enable market to be well-supplied. (https://www.reuters.com/article/saudi-aramco-iea/iea-says-oil-markets-w…)

Quick market recap:

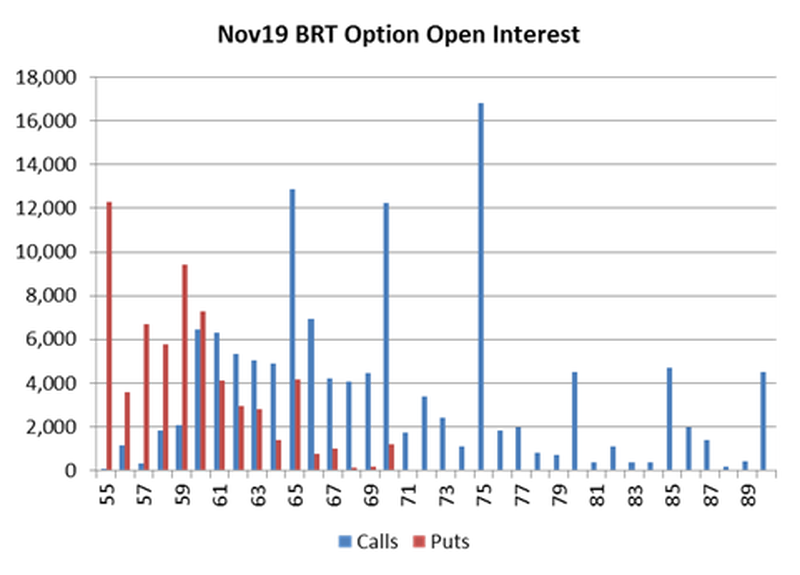

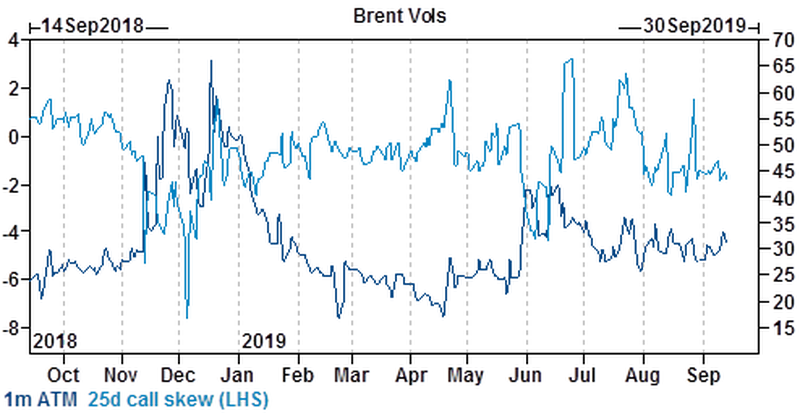

- As of Friday’s close, Nov BRT settled $60.22. 1m ATM BRT vols were around 31.3%. Call skew was around -1.8v in 1m BRT. This is about 10 vols lower than the 6m high and 4.8v lower for skew in the same time-frame.

- As of last Tuesday, investors had added about 124k contracts WoW across the oil complex (51.6k in BRT alone) – however, the complex is still down 420k contracts YoY and -150k contracts in BRT net length.

- There is about 13k on $65 Call strike in BRT, 12k OI on $70 strike, and 17k OI on $75 strike (Nov options expire 25Sep).

Key questions from here:

- Please note there has been significant speculation as to the party/parties responsible for the attacks with no official conclusion or statement yet made.

- Will Saudi actually be able to return production by Monday / what is the extent of the damage at relevant fields, oil processing facilities (is there any permanent damage)?

- Will there be future attacks on key elements of Aramco infrastructure?

- Will Saudis respond / how?

- Was Iran involved in the attack, if so how (i.e. IRGC acting independently from official government action?)

- How does this affect Trump Administration’s stance on potentially softening Iranian sanctions - particularly given the domestic political implications of higher oil prices heading into the general election / recent headlines around NSA Bolton leaving the Administration (https://www.aljazeera.com/news/2019/09/bolton-fired-disagreeing-trump-i…)?

Relevant charts (Sources are GS Securities Internal unless otherwise stated. Past performance not indicative of future results).

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more