Gold: Will Bitcoin Be A Currency?

Fundamentals

Trading is a very individual process. The more that you let emotions and the chatter in the media influence your trading, the worse you will do. Instead, listen to the market, especially now that the fundamentals have been shattered by this pandemic. The fundamental market collapsed in March. The thing that kept the market alive was the change from a real market to a virtual market.

We could look at it as a big margin call on the economy and the US dollar. The US has to come up with a large amount of stimulus, as demanded by the market, just like a huge margin call. The US dollar, as the world's reserve currency, has seen a large amount of supply in the form of stimulus come into the market. That supply threatens the purchasing power of the US dollar since more dollars means a weaker dollar.

In March, gold transitioned into a currency. Even though the dollar benefits short-term from the stimulus and as a safe-haven for international investors, in the long term, it will decline against gold. When the US dollar was taken off the gold standard in 1971, it created a fiat currency that led to a new debt economy. Debt in 1971 was a few hundred billion. Now we are at about $27 trillion. The debt to GDP ratio is above 120%, which is unsustainable. The amount is mind-boggling. It raises questions about the integrity of the system and of the US dollar with such debt levels.

The US, however, as opposed to its creditors, can as much of its currency as it needs or wants. Our creditors cannot print US dollars. We are going to see defaults on foreign loans, as we did in 1981 with Mexico. The only alternative Mexico had was to devalue the Peso against the dollar. Then the Mexican economy entered a long period of inflation and the Peso went from 16 to 46 almost overnight against the dollar. By devaluing the Peso, it devalued the debt in that currency, but it led to massive inflation. The US will face a similar situation at some point in the future. Financial assets will then collapse.

Russia, China, and Third World countries that are in debt in US dollars are beginning to see a credit crunch as demand for US dollars increases. In response, the US is printing more and more dollars to meet that demand. The US also had to print money to maintain confidence in the system. The government also had to keep interest rates at almost zero. In Europe, interest rates are negative, if you take inflation into account. If or when interest rates rise, then the defaults on this massive global debt are going to be common.

The US is talking about another trillion dollars injected into the system. The market, however, is screaming for more money. The demands for more stimulus will only increase next year. New lockdowns will only make those demands even more strident.

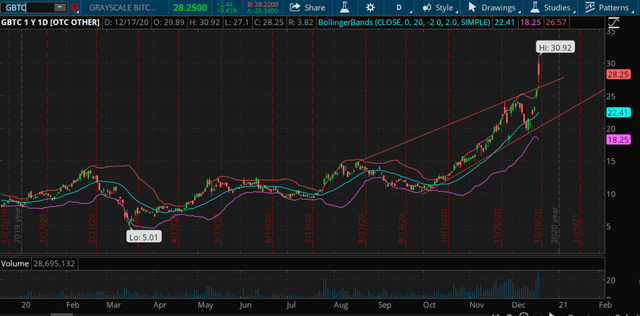

With the massive printing of money, it will artificially inflate stocks, real estate, and other assets valued in dollars. But, at some point, the dollar will collapse. All of these factors are good for gold, because gold, unlike the dollar, has intrinsic value. It appears that we are going to be looking at a new economic system next year. The question is what form that new system will take. Will Bitcoin be a currency? Bitcoin is explosive today; will it be a new currency? Bitcoin Grayscale Investment Trust (GBTC) is at 30.92. It is breaking out. The breakout is a reflection of the uncertainty about the US dollar and the mistrust of fiat currencies. Bitcoin has more than $600 billion invested in it. Investors are looking for alternatives to the US dollar. We trade the Grayscale Bitcoin Trust, which is registered on the exchange, as opposed to trading Bitcoin in an unregulated market. With GBTC, you can trade Bitcoin, but be somewhat safer. Our Bitcoin investment is up six times since March. We view it as an investment or virtual asset. It is not a currency. You can't borrow against Bitcoin, unlike gold or other currencies.

GBTC

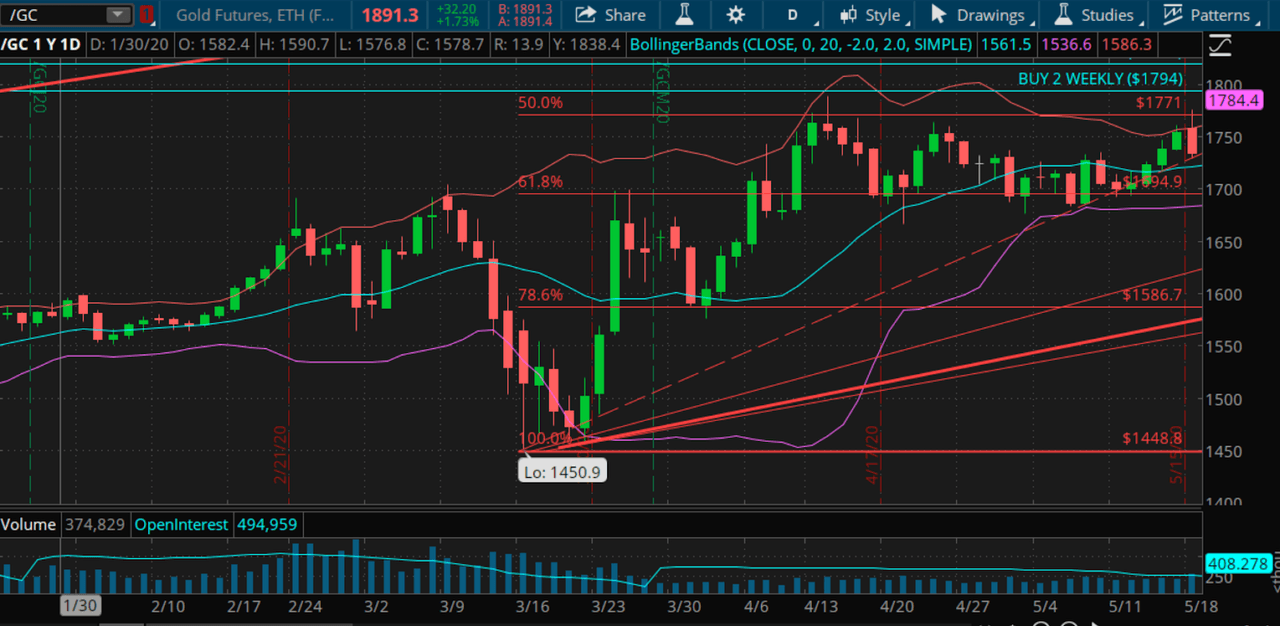

Gold

Courtesy: Ticker Tocker

Gold is up $37.70, trading last at $1897.40. The market is in an uptrend from the low that was made at $1820 on December 14. The recent high was $1902. That is what you call volatility. It is a trader's dream come true if you manage the risk. We are heading toward the weekly Variable Changing Price Momentum Indicator (VC PMI) target of $1904. The monthly Sell 1 VC PMI level is $1913. This is the signal that we are targeting for the completion of the monthly pattern after the market closed above $1840.

At $1913, the monthly signal is telling us that we are entering an area where gold is overbought with targets of $1913 and $2045. For the daily, the targets were $1877 to $1894, which were completed. Therefore, the daily is now neutral. If the market breaks resistance, it then becomes support. Gold completing those targets turns them into support.

We have a weekly and monthly signal, both in an uptrend. The targets are into $1904, $1913, and $2045, for the monthly. We want to see how much buying strength can penetrate this set of levels. If buyers can absorb the selling pressure at these levels, then the price will continue to rise.

After making the low of $1767, gold reverted back up past this descending channel. It tested the top of the first leg and the recent low marks the end of a second leg. The low of $1767 to the high of $1879 is a $120 move. If this is the second leg of an Elliott Wave count, then the second leg is always corrective. The third leg should be double the first leg. Therefore, the third leg from $1820 should be a $240 move with a target of $2060.

The market completed the second wave low at $1820, which coincided with the weekly VC PMI low. It marks a market symmetry. We are now in the third leg of the pattern. The fibonacci analysis further supports this analysis and target. It looks like a head and shoulder bottom. The market has broken the right shoulder with $1947 as the next target, and then the $2060 target comes into play.

Disclosure: I am/we are long NUGT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from SA). I have no business ...

more