Gold To Soar On High Stock Volatility And Other Lies They Tell You

When the general stock market declined in the previous months, many people called for much higher gold prices, supposedly based on the allure of the safe-haven demand for the yellow metal. And while there is some truth to it as gold would be likely to rally if the US economy got into severe trouble, this simply does not apply to the link between the short-term volatility of the stock market and the gold price. We proved there is no translation of the former into a certain price action of the latter. In the past, the implications of volatility spikes were rather neutral and since the 2011 top they are actually bearish for the gold price. Let’s dive into the details.

Gold - Stock Market Volatility Link and Other Costly Misconceptions

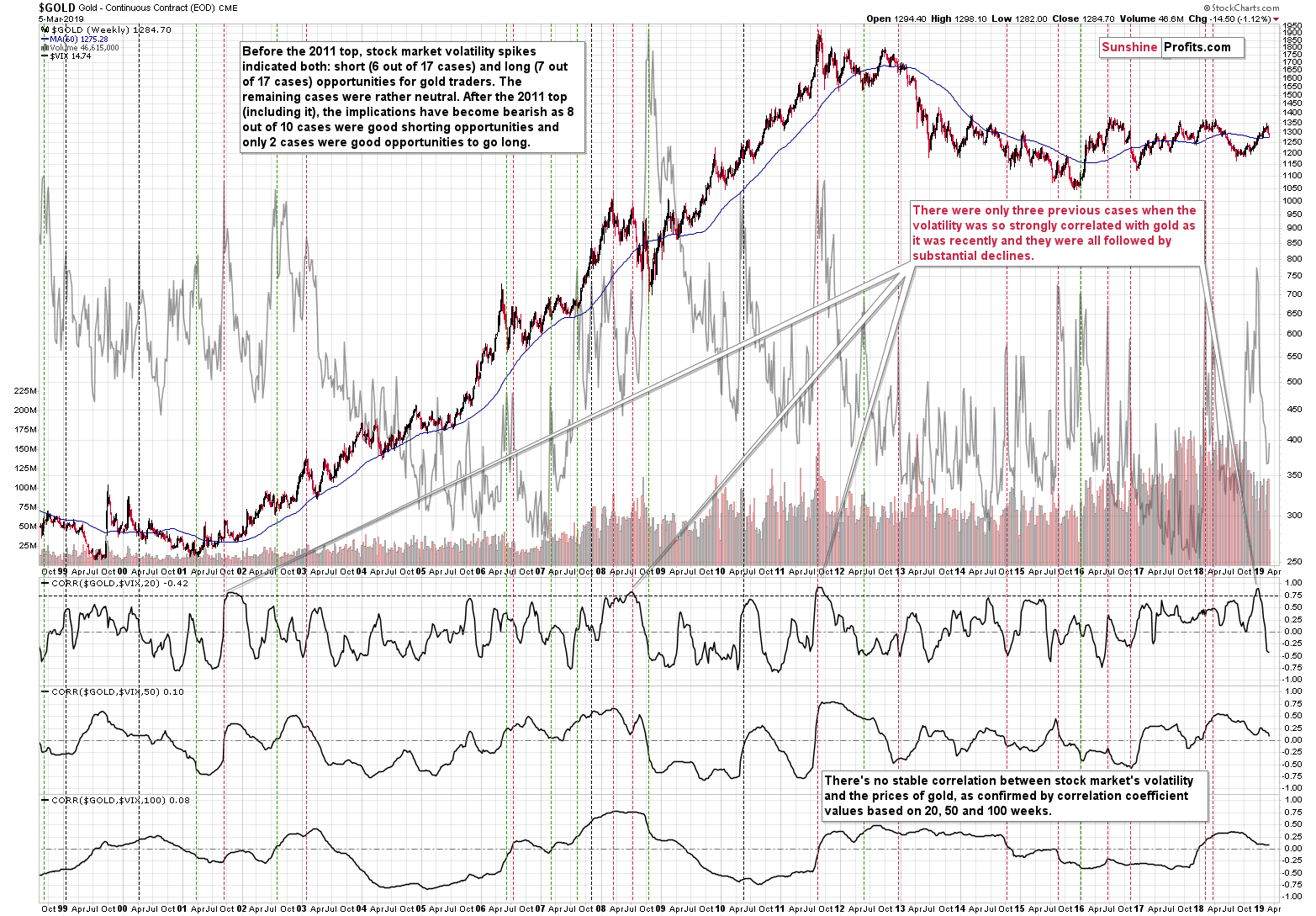

We’ll start with the lower part of the above chart that features both gold and the VIX index, which we use as a proxy for the stock market’s volatility. If gold was to reflect the stocks’ volatility, it should be taking place more or less all the time – or at least for the significant majority of time. That clearly wasn’t the case and the variety of correlation coefficients depicted reflect that.

We checked the relationship between gold and the VIX in terms of correlation in three time periods: based on the 20 weeks, then based on 50 weeks and finally based on 100 weeks of data. The value of the correlation coefficient moves back and forth around 0 in all cases (and in all other cases that we checked but that we don’t feature on the above chart to preserve its readability).

This means that there is no stable correlation between the two. This alone is something that should make you think that it’s not safe to base the bullish outlook on stocks’ volatility.

But wait, there’s more.

Putting correlations aside, let’s see what happened when the volatility spiked, just like what we saw recently. Maybe the relationship is not present at all times, but it’s there during critical times.

Wrong again. This time a bit less, because there is a mildly strong tendency for gold to reverse its course during the VIX’s spikes. It doesn’t mean that gold always bottoms at that time, though. Remember the 2011 top in gold? It was accompanied by a spike in the VIX – the measure that’s supposed to indicate breakouts and trigger further rallies.

We marked the noteworthy spikes in the VIX with vertical lines on the above chart. Before the 2011 top, there was a similar number of cases that were good opportunities to go long (7 out of 17 cases) as there were good opportunities to go short (6 out of 17 cases). It’s not clear which positions would be better in the remaining cases (too much depends on one’s individual approach). In other words, a spike in the volatility of stocks usually suggested that some kind of move was about to be seen, but it didn’t indicate what kind of move (the direction) that would be. Consequently, it was not a useful sign for detecting good moments to go long or short – at least not on its own.

Since 2011 things have changed as 80% of cases (8 out of 10) were good shorting opportunities. The remaining 2 cases were good opportunities to go long. So, on average, it seems that as far as the current stage of the gold market is concerned, spikes in the VIX should be viewed as sell signs for gold rather than buy signs.

The most interesting thing about the above analysis is that… We already presented it last April. The decline that followed simply confirmed the above points. And the current implications are bearish once again.

Naturally, the above is not strong enough on its own to make the outlook bearish, but it’s a useful confirmation technique that can supplement other gold trading suggestions. The key factor that we have right now is the profound link between the 2013 and now (as we discussed on Monday), but there are many more that point to much lower gold prices in the following months, for instance, the situation in gold priced in Japanese yen, that we outlined in yesterday’s Alert.

Moving back to the lies about the gold market – gold price is not likely to soar on high volatility alone. If volatility is very high (it spiked), it usually means that gold is already after a rally, not before it. Being after a rally is generally a bearish situation as it implies either a horizontal trend, or a decline. It’s definitely not bullish.

We already discussed a few of the most common misperceptions about the gold market recently, so we will only recapitulate them now. In the very first article of this year, we explained why the CoT reports for gold and silver are not useful timing indicators anymore, despite the many claims to the contrary. In yesterday’s Alert, we explained why gold to silver ratio is not yet at its true long-term highs, even though we keep reading about it being there already. Long story short, it’s because the real long-term resistance is at the 100 level, not close to 85, where the ratio currently is.

The final misconception about the gold market that we want to debunk, is the one about the gold stocks to gold ratio. People say that gold stocks are showing strength relative to gold. Really, are they?

Another Look at the Gold Miners to Gold Ratio

There is actually some truth to it – gold miners may be showing strength on a day-to-day basis, just like what we saw this week. But does it change anything with regard to the big picture? Absolutely not – it remains very bearish. It doesn’t even change the medium-term downtrend and outlook.

Let’s take a look at the very long-term HUI-gold chart. It starts at the turn of the millennium and therefore covers the full history of the previous gold bull market and the subsequent gold bear market that we are currently still in (don’t be deceived, the bear is not over yet - again on Monday, we discussed how bear markets tend to end: with fear and blood in the streets). Let’s start patiently from the past as such perspective will help us uncover the current gold market outlook.

A quick note for those who have just started their adventure with the precious metals market – the HUI Index is a mining stock index that is one of the best (in many cases the very best) proxy for the gold stocks sector as it doesn’t include companies that are heavily engaged in hedging their gold production. There are also others, like the XAU (it includes also silver stocks, but also includes the hedgers), or GDX, which is not really an index but a tradable gold ETF that by definition provides us with volume data, but – as an ETF – has a certain drift toward lower prices due to fund’s expenses. By the way, this is downward price tendency similar to another popular ETF, this time in the oil market – the USO. Contango applies not only to gold but also to oil and other (e.g. agricultural) commodities. All the rich and actionable details are within our Oil Trading Alerts.

Coming back to the gold miners to gold ratio again.

In late 2000, the HUI ratio made a sharp dive that was accompanied by a slow grind down in the gold price (gold made the second bottom in early 2001). Since the ratio’s late 2000 bottom, it had been leading the gold price higher (as befits a young bull market). Since the great liquidity crunch of the 2008 financial crisis, however, it has been lagging behind the gold price and never overcame its previous highs (unlike the gold price which went to its parabolic top of autumn 2011).

The ratio was on a downward path since mid-2011, heralding the arrival of the gold bear market shortly thereafter. Its brief rallies were punctuated by more profound declines and the ratio made a low in late 2015 that was retested in early 2016. This is the context of the strong gold countertrend rally of 2016. As the gold rally stalled in mid-2016, the ratio embarked again on a downward path and made several verified breakdowns, each time verifying the breakdown below the previous low by moving back to it and declining only after the verification was complete. The mid-2018 upswing was a verification of the breakdown below the late-2016 low. And the most recent upswing was the verification of the breakdown below the mid-2018 low.

The ratio is declining below the red resistance line – we haven’t seen any decisive, invalidating move higher. This is what has historically preceded another decisive move lower in the ratio. The implications remain bearish for the entire PMs sector. We have marked with a red circle the area of likely bottom in the ratio – it’s located at the declining black line that connects the late 2000 and late 2015 ratio bottoms. And yes – it does have extremely bearish implications for gold miners if the ratio and gold bottom together. As a reminder – gold’s downside target is at about $890.

Interestingly, the ratio not only proves why the current gold rally is so unlike the 2016 countertrend rally but also shows why we are not yet in a gold bull market. If we were, it would be perfectly reasonable to expect the ratio to vigorously lead the gold price higher. Remember, back in 2000-2001, first came the bottom in the ratio and that was followed by the second bottom in gold price. We’re seeing none of that currently.

What we are likely to see, is a huge decline that leads to the final bottom – just like what we saw in 2000. The starting point for the decline was higher back then, so this time, the ratio is likely to decline well below the previous lows and take all the constituent parts of the precious metals complex with it.

Summary

Summing up, it’s almost certain that the next big move lower has already begun and that the 2013-like slide is in its early stage. Based on the updated version of the 2013-now link, the implications are even more bearish than we had initially assumed. The downside target for gold remains intact ($890), but it seems that the price moves in silver and mining stocks will take them even lower than we had originally thought. A move below $9 in silver and a move to or below 80 in case of the HUI Index (perhaps much lower on a very temporary basis) are not out of the question.

In other words, the precious metals market is likely to erase everything that it had gained in the last several days, weeks, and months, and then decline much more before THE bottom is in.

Even if the USD Index fails to rally here and consolidates some more, we don’t expect any significant strength in the precious metals sector. We may see some brief relief, but anything more than short-term hints at strength is very unlikely.

Naturally, the above is up-to-date at the moment of publishing it and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above ...

more