Gold: The Pandemic Just Uncovered A Broken System

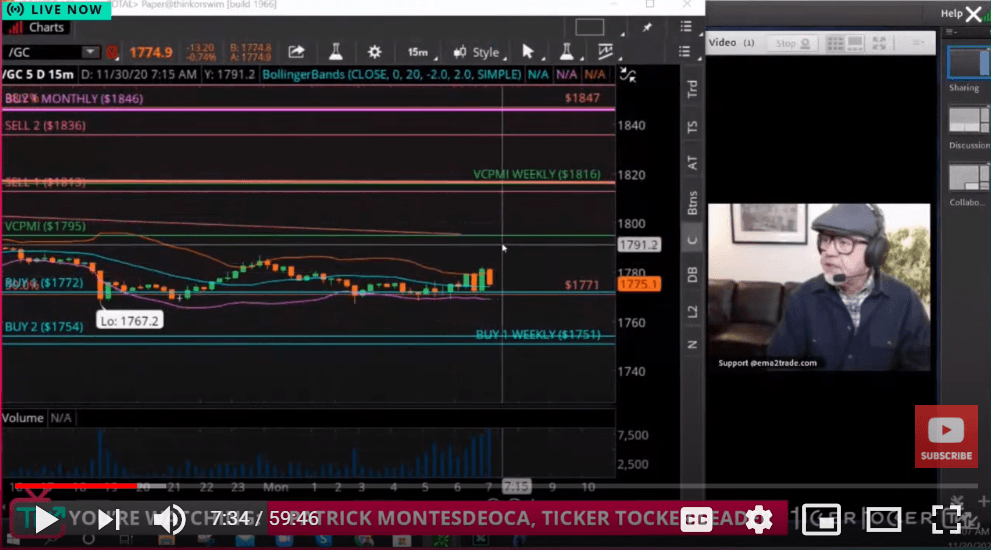

Monday 30, 2020 7 am PST. Gold is trading last at $1778.30, down 9.80. The Variable Changing Price Momentum Indicator (VC PMI) daily Buy 1 level is $1772 and the market has activated that buy signal. The target is $1795. The Buy 1 level has a 90% probability that the price will revert from that level back to $1795. You can use the levels below as your protective levels. We do not use straight stops.

Volatility

(Click on image to enlarge)

Courtesy: Ticker Tocker

The market is tremendously volatile. Gold has moved about $300 from the highs not too long ago. Gold rallied from $1451 in March to about $2089. It appeared to be the first wave of a five-wave pattern. In September 2018, we were at $1269. From that point, over two years, we made about an $800 rally. That kind of rally also occurred in 1981. Gold also reached that $800 or $900 level from just a couple of hundred dollars. In 1971, President Nixon took the dollar off the gold standard and the fiat currency that is the US dollar has lost value against gold since then significantly. That also marked the time when the US started to print more and more dollars, thereby reducing its value. Debt also has increased tremendously. We entered a debt economy based on the printing of money.

Highly volatility is great for traders. Without volatility, you can’t make money. Gold is one such market with such volatility. Futures contracts are risky, in that you can get a margin call. But you also can use a small amount of money to leverage a great deal of gold. Originally futures contracts were designed for farmers to sell their crop forward. Then speculators got involved to determine the most accurate price for each commodity. It was not until about 1976 that futures contracts were used in a broad range of commodity markets beyond the grains. Futures spread to crude oil and the COMEX became active, allowing the trading of sugar, coffee, and other commodities.

Futures

Futures contracts give you a greater ability to anticipate the future price of a product. Having such information is an advantage in knowing where you want to trade, whether it's to trade futures or to use futures as a directional instrument to tell you the direction of the market and then to use that information to trade stocks or derivatives.

Debt

US debt levels have been exploding, even before the pandemic. That was the philosophy that drove the Fed to lower rates to almost zero or, with inflation, to negative rates. We are now in monetary territory where we have never been before, with negative interest rates. It's unclear how the world economy can grow in a negative interest rate environment. How can funds maintain their capital if they have to pay banks to keep their money? How can anyone who lives on income from bonds survive?

The pandemic just uncovered a broken system. We already had more than $20 trillion in debt, which has now risen to $28 trillion. Interest rates already were near zero.

The US dollar remains a safe haven, so money is still flowing into the dollar. However, it may not be the best way to protect your net worth today. As gold is in a correction, there's an opportunity to add to your long-term gold position and balance your portfolio away from the fiat currency that is the US dollar.

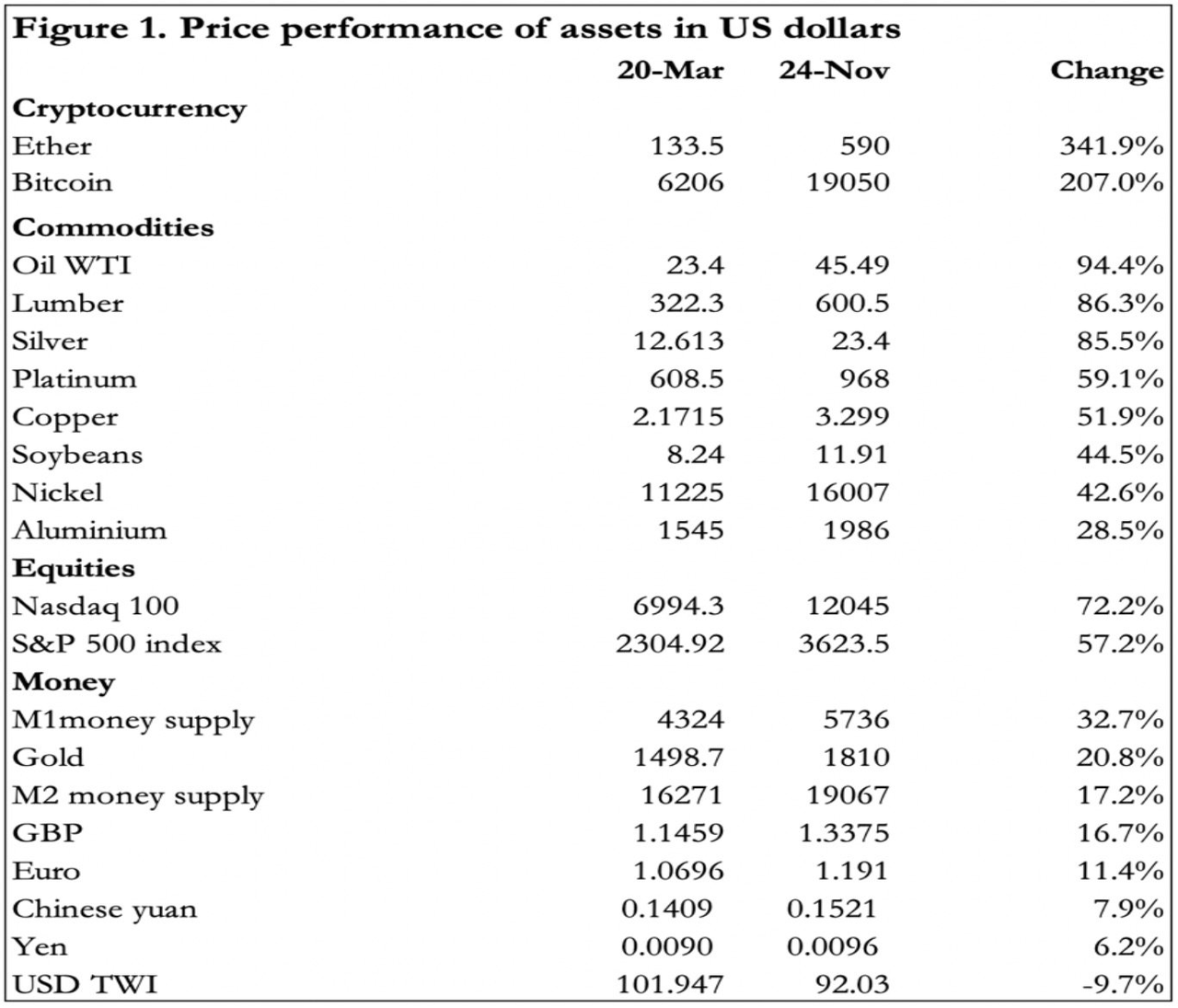

Since March 2020, cryptocurrencies have gone up more than 200%. Other commodities have also increased substantially. Crude oil is up 94%. Lumber up 86%. Silver up 85%. And on and on for almost every commodity. The M1 money supply is up 32%, M2 is up 17%, and gold is only up 28%. So there has been an incredible surge in M1 and M2 money supplies, and the US dollar is down 10%.

(Click on image to enlarge)

Courtesy: King World News

As the pandemic spikes into the end of the year, lockdowns are more imminent. A slowdown in economic activity also is more likely. The next three to six months will be problematic until the vaccines that are showing great promise begin to roll out across the country and around the world. The key question now is how fast is the velocity of money going to be? How much inflationary pressure will there be? We are facing an explosion in demand as the economy restarts, and supply chains have been broken. It appears that inflation is likely to increase over the next six months.

With record levels of debt, the bond market is facing the risk that interest rates might rise. If inflation rises quickly, the Fed may need to raise interest rates, which would be crippling for debtors and the entire economic system. The current policy is to keep interest rates at nearly zero for a long time, but inflation could change that policy. The US dollar could be shaken if inflation kicks in. Inflation would jeopardize the role of the US dollar as the global reserve currency, but would also threaten the value of other currencies.

The rise in commodity prices suggests that there will be inflation in the next three to six months. The Davos economic summit in January may give us a little clarity in how governments will react to inflation and how much more money is going to be printed. The current system appears to be headed for destruction, so how will world leaders reshape the system to avoid a collapse? Maybe they want to bring in a new economic and monetary system. The pandemic has provided an excuse to eliminate the US dollar and transition to crypto or electronic currency. It began in 1971 when the US dollar was taken off the gold standard. Now the petrodollar is being destroyed and we are inflating our way to make the petrodollar worth zero. Inflation will help bury the debt in the US dollar currency since they will be worthless. The faster governments provide stimulus, the faster those currencies will rush to zero. Other new currencies that are not fiat currencies will have to replace them. An electronic or virtual currency might be tied to gold, to provide new currencies with much-needed credibility, If so, gold will be even more valuable than it is today. If governments create a virtual currency, it may lead to the end of central banks. The role of such banks would no longer be required. Governments could provide currency directly to individuals, cutting out the commercial banks as the middlemen, who distributed previous stimulus.

Bitcoin

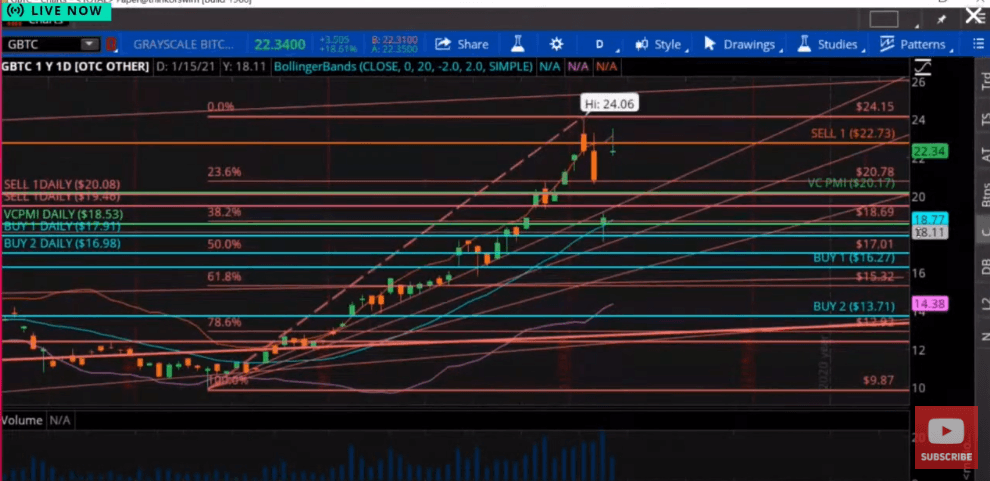

(Click on image to enlarge)

In this market, we trade the Grayscale Bitcoin Investment Trust, which tracks the price of Bitcoin. The market is tremendously volatile. It's not for the faint of heart. It can make large gaps. For active traders, it's a great instrument to trade. We are building a position in Bitcoin and other virtual currencies. If virtual currencies become regulated or if central banks issue a government virtual currency, I doubt if they will make it legal for anyone else to issue virtual currencies.

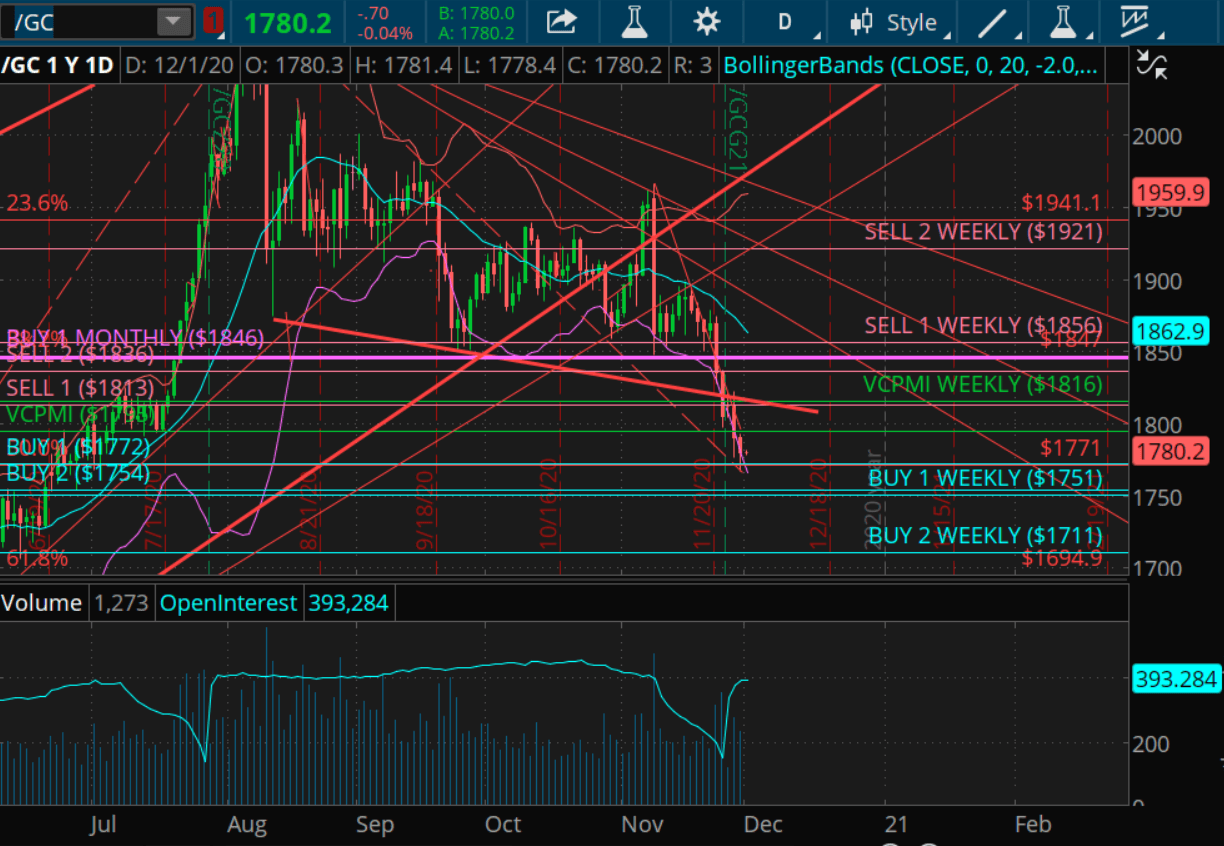

Gold Technicals

(Click on image to enlarge)

The weekly Buy 1 level is $1751 and Buy 2 daily is $1754. These levels are where buyers are likely to come into the market. These also are levels to cover your shorts. The weekly Buy 1 level is $1751 and the Buy 2 level is $1711. The Buy 2 level has a 95% chance of a reversion to the mean. A buy trigger has been activated with a target of $1795 on the daily. Gold will either run up to $1795, in which case you go neutral, or it will come down to $1754 or $1751 and activate a harmonic signal between the daily and the weekly. If it comes down to those levels, do not sell, since there's only a 5% or 10% chance of the market going any farther down. Those are levels at which to buy since they have 90% and 95% chances of the market reverting back up to the mean.

Disclosure: I am/we are long GDX

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more