Gold Technical Analysis: Eyeing $1900

Gold futures continued to rise, benefiting from a combination of a weak US dollar and rising inflation fears (GLD). Now that the price of gold settled above the psychological resistance of $1800, which increased buying until its gains reached the resistance level of $1868, its highest in five months. Eyes are on the next psychological peak of $1900s. This will depend on the dollar's path and investor sentiment towards risk appetite or not (UUP). Gold prices succeeded in making a weekly jump of about 2.7%, to reduce its decline since the beginning of the year 2021 to date to less than 2%.

Silver, the sister commodity to gold, is also enjoying lukewarm gains (SLV). Silver futures rose to $25.335 an ounce. The price of the white metal advanced by 4.5% last week, reducing its loss in 2021 to less than 4.5%.

Image Source: Pixabay

All in all, the metals market saw a significant rally last week as investors sought a shelter from rising inflation. The traditional roles of gold and silver were announced as a hedge against rising inflation over the past week (GLD, SLV). As more traders flock to these metallic commodities, it is likely to push prices up to $1,900 an ounce, as market analysts expect. In this regard, Neil Wilson, chief market analyst at Markets.com, wrote in a daily note: “Inflation is at the forefront of investors’ minds after the US CPI report, which led to a sharp rise in the value of gold and the US dollar.”

Individual investors can also buy gold after the University of Michigan Consumer Confidence Index fell to 66.8 in November, down from 71.7 in September. The market had expected a reading of 72.4. It also revealed lower consumer expectations, while opinions on current economic conditions also declined. Inflation expectations rose slightly to 4.9%.

It is a pressure factor on gold's gains. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major competing currencies, fell to 95.18. The US Dollar Index achieved a weekly gain of about 0.8%, raising its 2021 annual gains to date to nearly 6%. Double the profit is beneficial for dollar-denominated commodities because it makes them cheaper to buy for foreign investors.

Another factor affecting the gold market. US Treasury yields rose as the trading week closed, with the benchmark 10-year yield rising to 1.575%. One-year bond yields rose to 0.165%, while 30-year yields jumped to 1.954%. The environment for a higher price is usually bearish for gold and silver because it raises the opportunity cost of holding non-yielding bullion.

In other metals markets, platinum futures fell to $1090.70 an ounce. Copper futures rose to $4.4495 an ounce. Palladium futures rose to $2,120.00 an ounce.

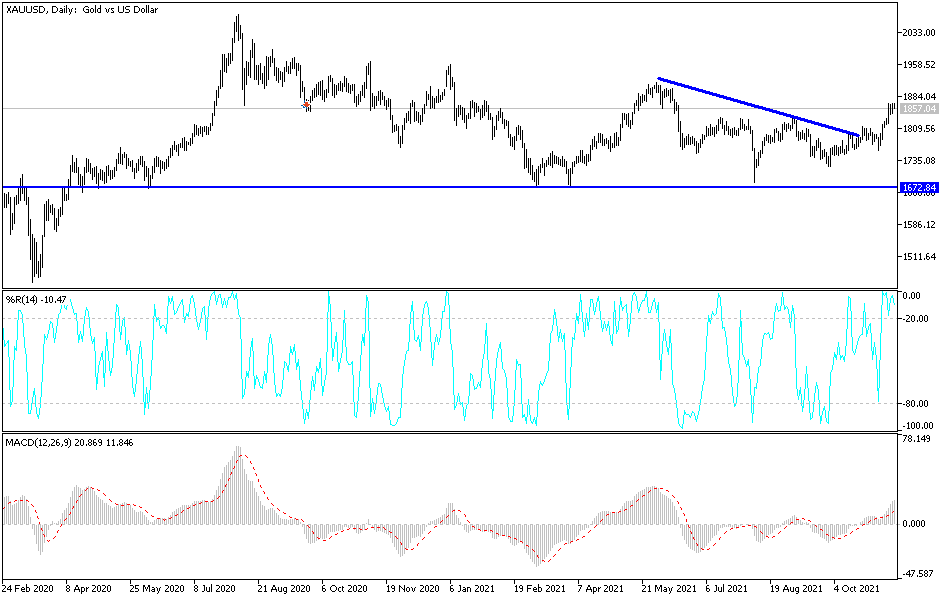

Technical analysis

The stability of the gold price above the psychological resistance of $1800 will continue to support the continuation of the upward trend, which will not change without penetrating below it. The continued fears of the markets and investors regarding COVID, which may disrupt the path of global economic recovery, in addition to the level of the dollar, are all factors that will affect gold in the coming days, not to mention the policies of global central banks. Currently, the closest bullish targets are $1878 and $1900. The latter may push the technical indicators towards strong overbought levels, which warns that profit taking could happen at any time.

(Click on image to enlarge)

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more