Gold Slumps. Why?

Investors and advisors who’ve seen gold as a crisis hedge have been whipsawed by bullion over the past couple of weeks. First there were price spikes fueled by COVID-19 fears. To be expected, really. After all, quarantine is not a good look for business. Recession anxiety ramped up mightily as the downstream effects of the contagion hove into view. Bloomberg’s monthly recession predictor, for example, jumped up 25 ticks to 53 percent on March 10.

Then gold’s bottom fell out.

The reason? Mounting stock losses triggered margin calls and de-risking imperatives, forcing investors to shed assets. Highly appreciated gold was one of those assets tossed overboard.

“Investors are selling anything with a bid and running for cover, and that includes typical hedges like gold,” said Brien Lundin, editor of the Gold Newsletter.

The selloff has done violence to gold’s chart. Technically, bullion could soften another $170 before traction’s regained.

Gold’s Up and Down … or Down then Up

But think back, if you can, to the parlous days of the Great Recession. What happened to gold back then? From peak to trough, bullion prices slumped more than 25 percent in 2008. Why? Pretty much for the same reason, gold’s currently selling off.

Now, look at the chart above and note gold’s historic uptrend from the 2008 Great Recession bottom. Bullion costs more than doubled in less than three years.

Can gold rebound like it did in 2008?

It’s likely, especially as investors and advisors increase their appreciation of the financial stimulus ahead. Central bank intervention in the form of rate cuts and quantitative easing, coupled with government fiscal measures, could ignite more aggressive bullion buying than we saw in the wake of the 2008 economic nosedive.

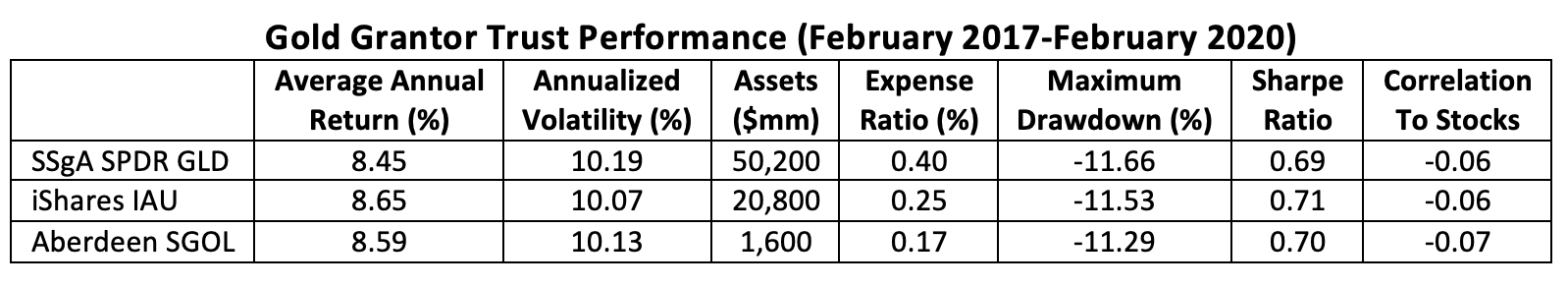

Investors looking to capitalize on a bounce in gold prices have an array of choices available. For those seeking basic exposure, three non-levered grantor trusts have been seasoned over the past three years.

As all these products derive their value from vaulted bullion, their performance is pretty evenly matched. Any disparities can usually be attributed to the differential in holding costs. Still, there are distinctions. In an environment where the odds tip in favor of continuing stock market weakness, for example, the Aberdeen Standard Gold Trust (NYSE Arca: SGOL) is likely to have a slight—a very slight—return advantage over the SPDR Gold Shares Trust (NYSE Arca: GLD) and the iShares Gold Trust (NYSE Arca: IAU).

Disclosure: None.