Gold-Silver Ratio Tops 100! So What?

It doesn't seem to matter what the ratio of gold to silver is, or how high it goes. There are no fundamental reasons for the ratio to move up or down at any given time. Actually, there is no reason to track it, either. Except that those who love silver think it is correlated in some way with gold. It is not.

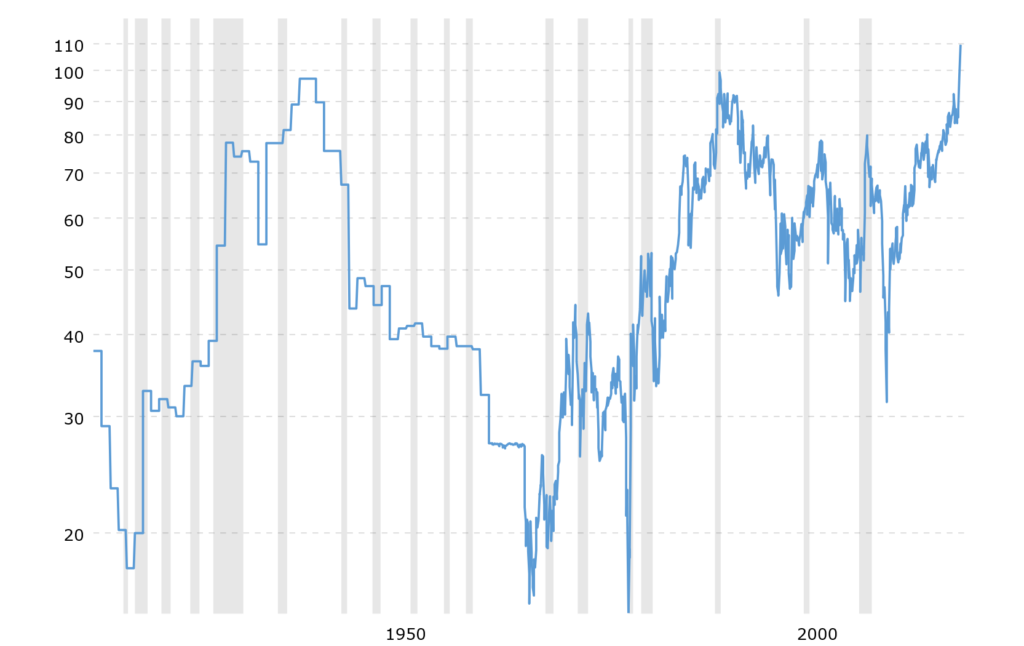

But what if there was a correlation; or inverse correlation? Shouldn't we see something on a chart that would indicate such? Below is a chart (source) of the gold-to-silver ratio over the past one hundred years...

I'm not sure what positive factors the proponents of a lower ratio that favors silver see in this. What I see is a ratio that continually moves higher over time, favoring gold, since 1967.

The two extreme exceptions occurred in 1980 and 2011 when both metals peaked with a very short-lived (a few months) advantage to silver. Otherwise, there is a pattern of higher highs and higher lows which continue to favor gold.

In looking at the chart, you might think that there is a possibility of a repeat performance from last century when the ratio declined from 97 to 17 between 1940 and 1967. Don't bet on it.

During that period silver was in high demand because of its industrial value. Also, the price of gold was fixed at an artificially low level.

Surprisingly enough, there a is a scenario that might result in a lower gold-to-silver ratio. Unfortunately, it involves still lower prices for both metals going forward.

I believe it is a possibility that the efforts of the Federal Reserve will be offset by the huge decline in asset prices - all assets. If that is the case, then the result is deflation.

In other words, there won't be enough dollars to go around, no matter how much QE we get. This could be so even if the Fed continues to pursue a zero interest rate policy.

In which case, the US dollar, i.e. cash would enjoy a period of relative strength. That, in turn, means a corresponding decline in the price of gold. If that decline is more rapid than silver's respective price descent along with all other asset prices, then the ratio would decline, favoring silver.

At some point, however, silver, because it is primarily an industrial commodity, would come under more extreme pressure as a result of the slowdown in economic activity.

Hence, any decline in the gold-to-silver ratio from this point would likely be temporary and short-lived; which is amazingly consistent with its historical pattern in the chart above.

Kelsey Williams is the author of two books: Inflation, What it is, What It Isn't, And Who's Responsible For It and more