Gold: Short Squeeze On Physicals

Short Squeeze On Physicals

The cause of this whole crisis is the coronavirus, which has led to a lot of mines to shut down. The mines provide liquidity for physical gold to the exchanges. The London exchange is running very tight on supplies and is paying traders not to take delivery on physical gold. This is a potential short squeeze; traders on the short side of the physical trade cannot cover their position in the futures market without paying a hefty premium for physical gold, and it will take a long time to get it delivered.

In short, physical gold cannot be obtained at current paper prices, so the other side of the trade, which are held by banks primarily, are in a really bad situation because they sold short on the metals they do not have. They now could be facing default on the futures contracts.

The integrity and trustworthiness of capitalism is at stake. Are these exchanges going to default? Is the government going to default on the debt? I don't think so. If it did, that would really create a global economic collapse. It was stupid what central banks did to get us to where we are today, but default would be a total disaster. I do not think that the system will collapse because governments cannot allow the capitalistic system to collapse. Free markets are a major representation of that system, so governments cannot allow such markets to collapse. The world has gone into a margin call.

We need to find a way to refinance this entire fiasco. Governments need to provide the cash or liquidity to get us through this crisis. A lot of cash is going to be needed since the coronavirus is affecting every sector in the economy. Governments are going to have to print as much money as they need to in order to ensure the trustworthiness of various markets and exchanges. We are going to need some creative financing to merge the balance sheet of the Treasury with the Feds to consolidate the asset base. Then, they can leverage their assets as much as needed. They might need to offer some 100-year bonds. There are very few alternatives.

The crisis has led to a massive disruption in the availability of many products. The inability to get physical gold is a precursor of what is going to happen in the area of food and other areas. We may be entering a period where food will be scarce, given the breakdown in supply chains. I believe we are strong enough as a country to survive if we wake up and realize that the coronavirus is the tip of the iceberg. The virus is not the cause of the collapse; it is just the trigger. This crisis has been developing for at least 40 or 50 years. In 1971, when the US went off the gold standard, it was the beginning of the downfall of the American empire. It removed the confidence that the US dollar was solidly backed. Instead, the dollar became backed with oil. Now, we have the consequences of that. Crude oil is not the other side of the dollar and is not a currency; it's a commodity. Gold is a commodity, too, but it is also an ages-old currency.

Looking back to 2008, when it looked like the world was going to end, we managed to refinance a way out of that crisis. But the debt we added in 2008 has almost doubled as of 2020. Such debt is unsustainable. Eventually, interest rates are going to go up. With such debt, a one percentage point of an increase in interest rates will make it almost impossible for most countries to continue to pay their debt. Rates have fallen to almost zero percent, but that means the Fed has no room to lower rates to try to get the economy going again. The policy now is to pump money into the economy until it gets going again. But it is not working. A lot of companies are going to go bankrupt. The old way is not working.

There is no one who is providing the confidence the world needs to get the economy going again. No one has confidence or trust anymore in the markets. Officials are playing politics. They need to act, but they are not.

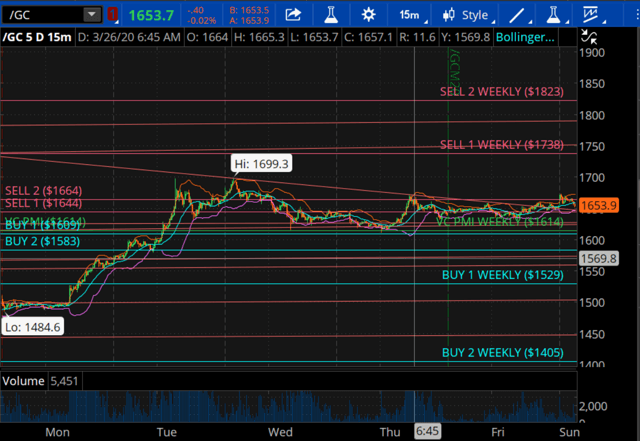

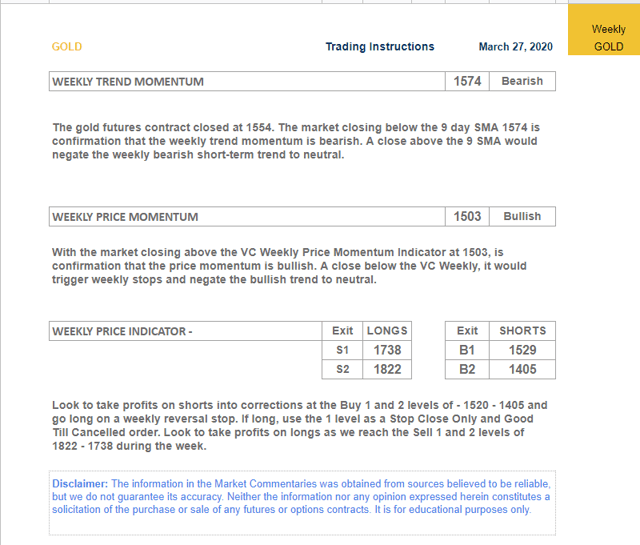

Gold Weekly Report

The weekly trend-momentum of 1,574 is bearish.

The weekly VC PMI 0f 1,503 is bullish.

A close below 1,503 stop, negates this bullishness neutral.

If short cover 1,529 - 1405 to go neutral.

If long cover 1,738 -1822 to go neutral.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check out our Marketplace service, Mean Reversion Trading.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from SA. I have no business relationship ...

more