Gold Prices May Struggle If US PPI Helps Cool Fed Rate Cut Bets

Gold prices pulled back, erasing over half of Wednesday’s Fed-inspired rally after US CPI data unexpectedly showed that core inflation accelerated in June. Cooled rate cut bets and sent bond yields higher alongside the US Dollar, tarnishing the appeal of non-interest-bearing and anti-fiat assets. Crude oil prices marked time, digesting yesterday’s rise to a seven-week high.

US PPI DATA MAY LIMIT SCOPE FOR GOLD, CRUDE OIL PRICE GAINS

Bellwether S&P 500 futures are pointing higher in late Asia Pacific trade, hinting at a risk-on bias as both yields and the Greenback pull back anew. That might be supportive for commodities if momentum is sustained. Follow-through may be cut short if incoming US PPI data echoes yesterday’s CPI results however and inspires another rethink of Fed easing prospects.

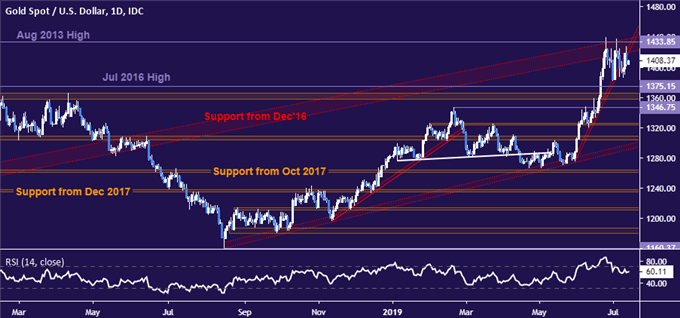

GOLD TECHNICAL ANALYSIS

Gold prices continue to oscillate in a choppy range below resistance clustered around the August 2013 high at 1433.85. An upside breakout opens the way for a foray above the $1500/oz figure. A dense support bloc extends down from 1375.15 through 1346.75, leaving sellers’ work cut out for them if a downside reversal is attempted in earnest.

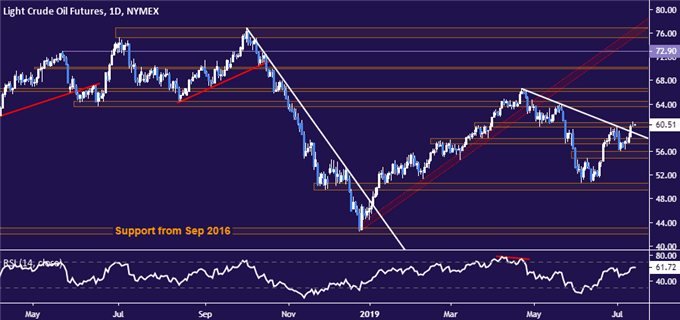

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices have stalled at resistance in the 60.04-84 zone after breaking trend line resistance set from late April. The setup hints the uptrend late-December 2018 lows has resumed. A push higher from here targets the 63.59-64.43 congestion area. A series of back-to-back support levels runs down through 54.84, with a turn back below that opening the door to retest the $50/bbl figure.