Gold Prices May Fall As Chart Setup Warns Of Topping Before FOMC

Gold prices have languished in consolidation mode since last week, echoing a similar digestive pause in US Treasury bond yields and – broadly speaking – the US Dollar (the Greenback is up on the week against non-yielding peers like the yen, but down against commodity currencies like the Australian Dollar).

From here, the upcoming Federal Reserve policy announcement looks to be firmly in focus. The steering FOMC committee not expected to tinker with the current setup and seem likely to repeat familiar dovish rhetoric, reiterating that stimulus withdrawal is not on the menu near-term.

This much is likely to be fully priced into asset values at this point, however, meaning a status-quo result is unlikely to inspire much action. The degree of volatility to be had in the event of even a very modest hawkish tilt – or at least the perception of one – may be asymmetrically high, however.

The latest Markit PMI leading survey suggests the US economy is growing at the fastest pace in at least 11 years (data go back to October 2009). The blistering pace of recovery coupled with capacity snags along still-frayed supply chains have pushed up prices rapidly, stoking reflation fears.

For its part, the central bank has waived off worries about headline price growth, arguing that elevated readings will adjust down once base effects from the sharp disinflation 12 months ago amid the Covid outbreak are digested. That may be so in part, but soaring shipping costs warn that higher costs may prove sticky.

Fed Chair Powell will almost certainly have to field a range of questions on this as well as the inflation-stoking capabilities of fiscal largesse favored by the Biden administration. If he signals that the Fed is prepared to draw down stimulus sooner than anticipated if need be, bullion might suffer.

In the meantime, prices may continue to struggle for directional conviction. A raft of eye-catching corporate earnings reports are eyed as influences on overall sentiment trends, including Alphabet, Microsoft, and Visa. Most of the heavy-hitters are slated for US after-market hours, however.

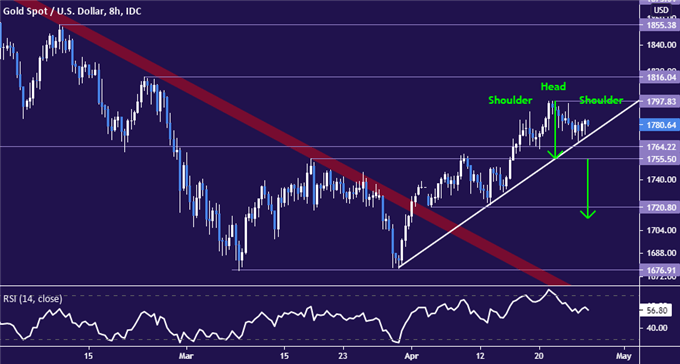

GOLD TECHNICAL ANALYSIS

Gold prices may be carving out a bearish Head and Shoulders (H&S) pattern just below the $1800/oz figure. A break below the 1755.83-64.22 zone looks to be necessary to confirm the setup. Such a move would also conveniently clear rising trend line support guiding gains since the beginning of the month.

If the H&S setup is realized, the pattern implies a measured move lower through the support shelf at 1720.80, which may set the stage for bearish extension to the double bottom at 1676.91. Breaking above the swing top at 1797.83 would invalidate topping cues and expose 1816.04 next.

Gold price chart created using TradingView