Gold Price Update – XAU/USD Rally Struggling To Find Traction

Gold is back around $1,828/oz. after falling to a fresh multi-month low on Monday at around $1,787/oz. but the move higher looks set to struggle. The precious metal was boosted yesterday by much worse-than-expected NY Empire State Manufacturing data (-11.6 vs. f/c 17) and marginally lower US Treasury yields. The US dollar faded lower at the start of the week as well, but these moves lacked conviction and any real follow through and suggest a pause rather than a trend reversal. Later today (19:00 UK), Fed chair Jerome Powell is speaking and his comments, as always, must be followed.

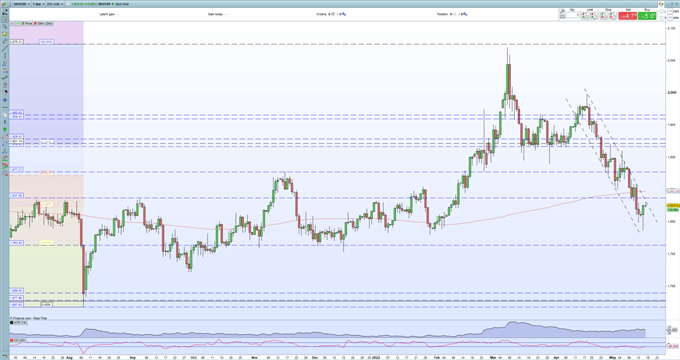

The daily gold chart highlights the prevailing trend and sell-off over the last month. The bearish hammer candle made on April 18 was joined by another on May 5 and these continue to keep downward pressure on gold. Any recent bear market rallies have been sold and the bearish channel from early April remains in place. If this channel is broken convincingly, the next level of resistance is seen at around $1,858/oz. before the 50% Fibonacci retracement at $1,871/oz. comes into play. If the current bear market rally fails then yesterday’s low at $1,787/oz. comes back into play.

Gold Daily Price Chart

(Click on image to enlarge)

Retail trader data show 85.24% of traders are net-long with the ratio of traders long to short at 5.78 to 1. The number of traders net-long is 1.05% lower than yesterday and 2.72% lower from last week, while the number of traders net-short is 11.65% higher than yesterday and 9.86% lower from last week.

We typically take a contrarian view of crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Gold trading bias.

What are your views on Gold – bullish or bearish?

Disclosure: See the full disclosure for DailyFX here.