Gold Price Slides Below 1800 Ignoring Declining US Yields

Gold price traded at $ 1803.23 on Thursday, July 22nd, down about 0.4% on the day after, falling from an $ 1813 peak to a $ 1794.66 low. However, the precious metal rebounded from lows as the US Dollar bounced off a three-month high, and the stock market rallied amid risk appetite.

SPY added 0.65%. However, players remain cautious amid concerns about inflation and the spread of the COVID-19 Delta strain.

In the middle of the New York session, the DXY, which reflects the value of the US currency against other major currencies, fell to 92.788. The daily peak was at the level of 93.191. A day earlier, the indicator had reached more than a 3-month peak.

Investor concerns about Delta and inflation are supporting the Dollar. However, due to high inflation rates in the United States, the Federal Reserve may relax stimulus, which hurts the price of gold.

Positions in the gold market

As noted by TD Securities, money managers have not significantly increased their long positions in gold, ignoring the decline in real yields in the United States.

According to experts, gold continues to struggle to strengthen its position, regardless of the extremely positive change in real yields for the precious metal, which has returned the value of 10-year bonds, protected from inflation to pandemic highs.

Meanwhile, the precious metal lacks the strength to break up the 200-day moving average. This reflects a clear divergence in capital flows.

According to ANZ Bank, regardless of the vaccination rollout, ANZ Bank said markets are not ready to cope with the coronavirus. There has now been a shift in sentiment towards the belief that expected growth and profits are exaggerated.

So, the idea of bringing the global economy back to normal at the same time seems flawed, as it did at the beginning of last year, and bond dynamics are perfect for tracking market sentiment.

The yield on 10-year US government bonds again hit 1.12% this week and rebounded to 1.3%.

The dollar performed well despite lower yields. The American currency is strengthening both thanks to a decrease in risk appetite and positive economic data. However, yields fell across the board.

Such a dynamic may remain in place or even gain momentum, given that coronavirus fears are approaching the peak whenever it comes.

Real rates have plunged as fears of a further recovery led to a reduction in nominal yields. Still, they are expected to normalize, and the inverse relationship will continue to negatively affect gold in the long term.

The price of gold is vulnerable to further declines as the precious metal’s continued weakness in the face of real yields speaks of a vulnerable microstructure. Gold’s unsuccessful attempts to build up momentum amid falling risk appetite show that speculative flows are still sluggish, which only exacerbates the likelihood of a serious pullback.

The number of cases of coronavirus infection in Southeast Asia and many states of America is increasing. Of greatest concern is the spread of the highly contagious Delta strain. Some vaccines may not be as effective against Delta as recent research suggests, and risk aversion may persist for the foreseeable future.

Markets are most concerned about whether this will lead to a slowdown in the global economic recovery.

This factor can serve as the main driver for the growth of demand for the dollar currency, especially since the latest data indicate the Fed’s “hawkish” attitude.

Since the previous meeting of the Federal Reserve’s Open Market Committee, the labor market, retail sales, and inflation have strengthened, ANZ Bank reported. While the increase in COVID-19 infections raises strong concerns, the risk remains that market participants will take an overly lenient stance on the tone of the Federal Reserve in the coming week.

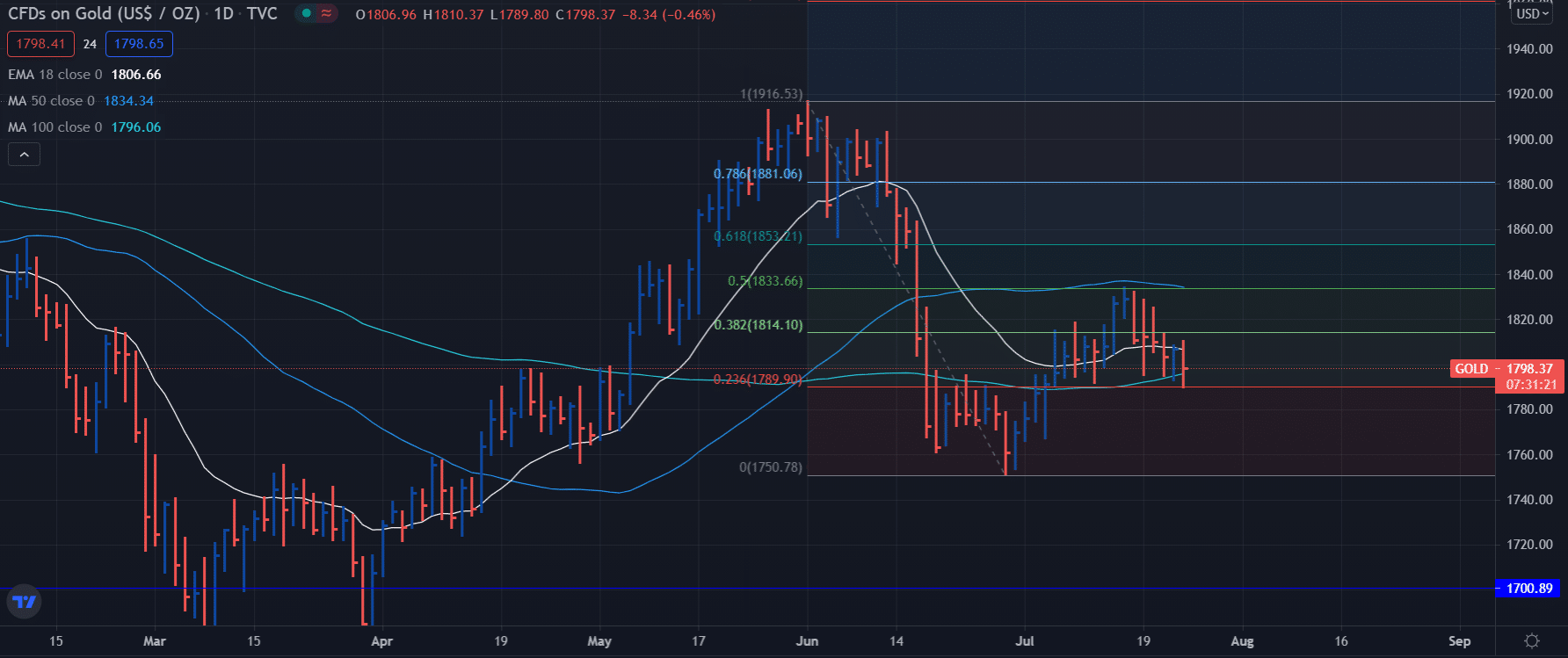

Gold price technical analysis: Bears may dominate

Gold broke out of the price channel, which will attract the attention of traders. Still, the precious metal turned and fell below the convergence of the moving averages, reflecting the average price of gold for 20 days, near the $ 1810 mark, and approached the psychologically significant level of $ 1,800.

On Thursday, the price of gold set a minimum on the $ 1794 line, which must have upset buyers. The convergence of the 20-day EMA and a return to the average of 50% can be a powerful barrier.

Gold price daily chart analysis

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more