Gold Price: Per Ounce/Gram, Charts, News And Analysis

Gold prices did well in 2019 as problems and worries swirled, but analysts generally expect continued strength in the yellow metal in 2020. Credit Suisse analyst Fahad Tariq said he expects the price to average $1,540 per ounce this year, peaking at $1,560 per ounce in the first half of the year before falling gradually to $1,525 per ounce by the end of the year.

hamiltonleen / Pixabay

This article will focus on developments in the gold price in 2019 and 2020 and factors that have been affecting prices over the last couple of years.

Gold price tracker

In mid-to-late January, gold was trading at $1,582 an ounce, compared to $1,517 at the beginning of the month. The current gold price is the highest it has been in the years following the financial crisis. A black swan event that is driving traders to the metal is the virus emerging out of China. While it is unclear how bad the outbreak of coronavirus is, it already starting to impact the economy. CNBC is reporting that automakers are evacuating workers from China due to the outbreak.

Early in January, The price of gold was at its highest levels since 2013 at $1,588 an ounce, before settling at $1,567.7 for a spot ounce at the time of this writing. What will come next? No one is sure, although analysts are now turning with favor to the precious metal as prices raise. Stay tuned for further updates and see below for some prior commentary on how gold price trading works.

Following the Fed’s decision in December, spot gold inched up to $1,478 per ounce. The central bank chose not to cut interest rates again largely due to better than expected consumer prices. Analysts at OCBC Bank told Reuters that the global economy appears to have stabilized after more than a year of uncertainty.

Paul Schatz of Heritage Capital told Yahoo Finance that gold will continue to rise in the 2020s. It could go up to $2,500 or $3,000 per ounce from current levels. It’s not just gold ETFs and institutional investors driving up demand for gold. Wealthy individuals are also hoarding physical gold.

A positive surprise in the U.S. consumer confidence index weighed on gold prices on Jan. 28, 2020. The U.S. Conference Board said the index climbed to a January reading of 131.6, compared to December’s reading of 128.2. Economists had been predicting a reading of 128.2 for January as well. January’s reading is the highest consumer confidence reading in five months.

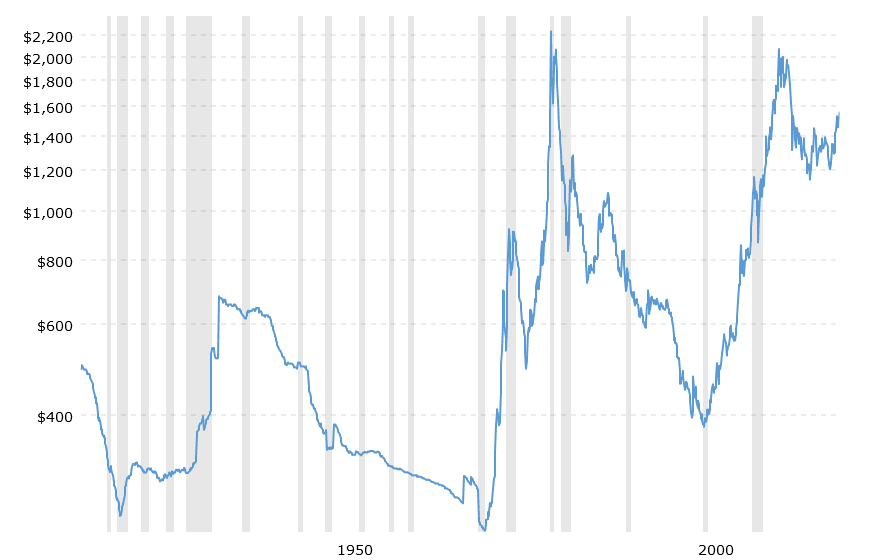

Here’s a look at where gold prices have gone over the last 100 years, courtesy MacroTrends.net:

(Click on image to enlarge)

Historic gold price widget

geralt / Pixabay

Gold price outlook

Gold could face some challenges in 2020 if inflation goes up. Higher inflation could encourage the Fed to raise interest rates. The U.S.-China trade deal is still unpredictable, but a global economic stability could also hurt demand for safe-haven precious metals such as gold. However, an analyst predicts that gold could jump to around $1,700 per ounce in the next 2-3 months.

Wolfe Research analysts John Roque and Rob Ginburg told investors in December that gold was “very overbought” in August-September, and it has corrected since then. Now it is set to make its next short-term move in January-February of 2020. The analysts predict the yellow metal could surge up to 15% in the next 75 days.

According to Wolfe Research, there have been seven “turns” in gold prices since 2015, and each time the metal has rallied around 15% over 75-80 days.

The U.S. Federal Reserve decided to keep rates unchanged following its meeting in December. The central bank also signaled that it’s unlikely to change the rates in 2020 amid low inflation. It is looking to change the interest rates once in 2021 and then in 2022. The Federal Reserve expects moderate economic growth in 2020.

The gold price outlook for 2020 is not that clear because there are mixed signals about the state of the U.S. and global economy. The U.S. job market remains resilient, and global equities continue to perform well. The S&P 500 is up nearly 25% this year. JPMorgan analyst Dubravko Lakos-Bujas expects the S&P 500 to rise 8% in 2020.

In the few months of 2019, there was a lot of noise about the inverted yield curve in the U.S. Historically, the yield curve inversion has been a sign of an impending slowdown. But private consumption remains robust in the U.S., showing the resilience of the world’s largest economy.

Leading European and Asian nations are planning to unleash fresh fiscal stimulus to counter the slowdown in trade, manufacturing, and consumption. The potential fiscal stimulus should help boost economic growth in the year ahead.

Experts said the gold price would stagnate or go down as stocks soared; however, as of Jan. 6, 20202, this has not been the case. In just the last few days, geopolitical tensions have skyrocketed amid serious concerns about a potential conflict in Iraq and Iran. The assassination of General Soleimani (former head of the Iranian Revolutionary Guard) even if well deserved, brought back memories of the disastrous invasion of Iraq in 2013. Investors have flooded into safe-haven assets such as gold and even cryptocurrency. Oil prices have also soared amid concerns over disruption to supplies.

Factors affecting performance

The U.S.-China trade tensions, federal rate cuts, easier monetary policies all over the world, and massive gold buying by central banks all ensured that gold had an impressive performance in 2019. With only a few weeks left in 2019, most investors had an optimistic gold price outlook for the next year.

More problems typically mean higher gold prices, but despite the positive economic signs we’ve been seeing, there are still a number of reasons to believe that investors will be rushing to the safety of gold and other haven assets. The U.S.-China trade war was the biggest reason behind gold’s rally in 2019, and it will likely remain the biggest driver.

Two of the world’s largest economies have agreed to a partial accord, and the phase-one of the trade deal could be imminent. But President Donald Trump has warned that if the trade deal is not signed by Dec. 15, the U.S. could impose tariffs on more Chinese imports, escalating the already complicated trade tensions.

The U.S. presidential elections will have a direct impact on the trade war, and indirect on gold. President Trump has signaled that he could wait until after the Presidential election to sign the trade deal with China. Given President Trump’s mood swings, I wouldn’t even attempt to forecast anything about the trade war.

Another reason is that the U.S. Federal Reserve has maintained a dovish stance on rate cuts. A series of rate cuts this year have prompted investors to shift a portion of their assets to safe-haven investments such as gold. Analysts at UBS Securities and Goldman Sachs expect gold prices to surge to $1,600 in 2020. They have also warned that the yellow metal could settle at around $1,400 by the end of next year.

Gold demand

If the global economy witnesses a slowdown in 2020 as several analysts and economists have predicted, the Fed will lower rates further, the equity markets will decline, and gold will become a safe haven investors will rush to.

Standard Chartered analyst Suki Cooper told Bloomberg that the gold rally in 2019 was largely driven by the U.S.-China trade war and central banks purchasing massive amounts of bullion. But gold will get its next push from “retail investors as risks remain skewed to the upside.” Cooper expects gold to hover around $1,570 toward the end of 2020. A similar trend was seen in 2011 when retail demand drove gold to a record high of $1,921.17 per ounce.

Ken Lewis, CEO of OneGold, commented in January 2020 on using gold as a hedge:

“During times of economic unrest or uncertainty, the world turns to precious metals as a safe-haven asset. In the past, this hedge was only available to those with connections, portfolio managers, or access to large funds. New technology is leveling the playing field, giving retail customers quick, cost-effective access to this wealth preservation safety net.”

Gold price by GoldBroker.com

Disclaimer: This article is NOT an investment recommendation, Please see our disclaimer - Get our 10 free ...

more