Gold Price Forecast: XAU/USD Risks A Drop Below $1750 Amid Bearish Technical Setup

Gold (XAU/USD) hit four-day lows at $1765 in early Asia, as the bears look to challenge the multi-month lows near $1760 once again. Despite the ongoing bearish momentum, gold is attempting a minor recovery towards $1780 levels, as the US Treasury yields retreat following a steep rise in Thursday’s American trading.

The US rates rallied across the curve after a poor show was put on the Treasury auction, which triggered a sharp sell-off in the US government bonds. The benchmark 10-year Treasury yields surged 23 basis points to 1.6%, although the yields have slipped back below the 1.5% level, as of writing.

The tremendous surge in the yields fuelled a solid recovery rally in the US dollar from seven-week lows, exacerbating the pain in gold. In the day ahead, should the sell-off in the Treasury yields accelerate, it could drag global stocks lower while reviving the haven demand for the greenback. Such a move could limit the bounce in the metal, paving the way for the next leg lower.

The US House vote on President Joe Biden’s $1.9 trillion stimulus package later on Friday at 1400 GMT will be closely followed for the next direction in gold. In the meantime, the Treasury yields price-action could likely be the key driver for the bright metal.

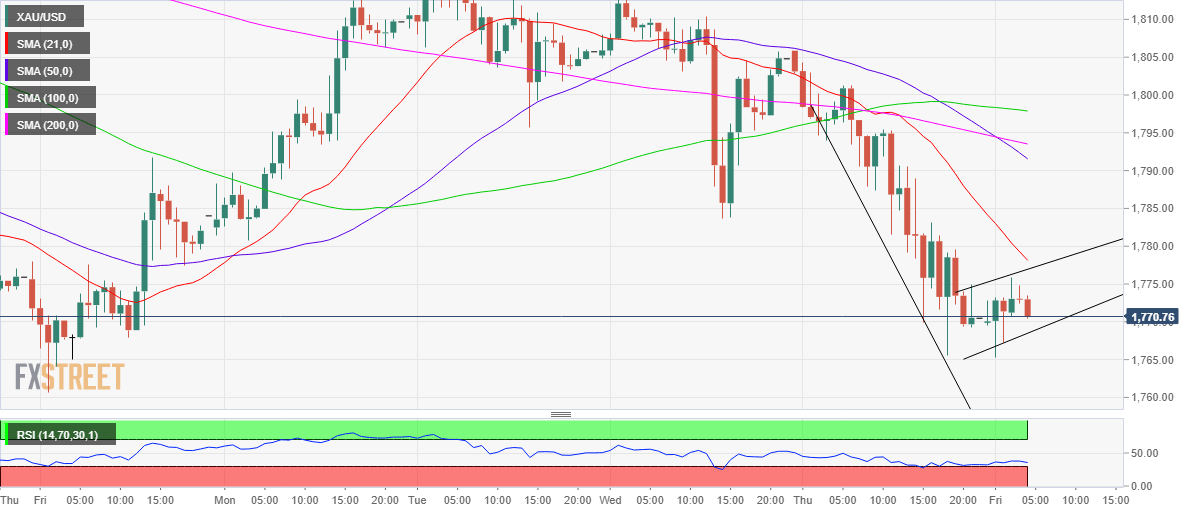

Gold Price Chart - Technical outlook

Gold: Hourly chart

(Click on image to enlarge)

The technical set up on gold’s hourly chart screams sell, as well reflected by a potential bear flag and a death cross.

The recent sell-off that following a brief consolidation in Asia charted out a bear flag formation on the said timeframe, with the pattern likely to get validated on an hourly closing below the rising trendline support at $1768.

The pattern confirmation could expose the end-July lows of $1757, below which the measured target at $1732 could be tested,

The Relative Strength Index (RSI) inches lower below the midline, allowing for declines. Meanwhile, the 50-hourly moving average (HMA) has crossed the 200-HMA from above, representing a death cross formation, backing the case for the further downside.

Alternatively, a sustained move above the rising trendline resistance at $1777 could add credence to the recovery momentum. Although the bearish 21-HMA at $1780 is likely to be a tough nut to crack for the XAU buyers.

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more