Gold Price Forecast: XAU/USD Bulls Insist But Treasury Yields Surge Could Play A Spoil Sport

The reflation trade emerges as the key theme starting out a new week this Monday, limiting the recovery in Gold (XAU/USD) from seven-month lows of $1761. Expectations that US President Joe Biden’s $1.9 trillion stimulus package could be approved next week, refueled the market optimism and reflation trade, which drove the US Treasury yields sharply higher. The benchmark 10-year US Treasury yields reached one-year highs, capping the advance in the non-yielding gold.

The rally in the US rates put a fresh bid under the dollar across its main peers, keeping the additional upside elusive in the metal, for now. Positive developments on the covid vaccine front could also likely weigh on gold. Markets now look forward to the testimonies by the Fed Chair Jerome Powell due on Tuesday and Wednesday for fresh trading impetus.

The risks of ongoing business failures in the US "remain considerable" even as the economy emerges from the coronavirus pandemic, the Fed said on Friday in its semi-annual monetary policy report to Congress.

Gold Price Chart - Technical outlook

Gold: Hourly chart

(Click on image to enlarge)

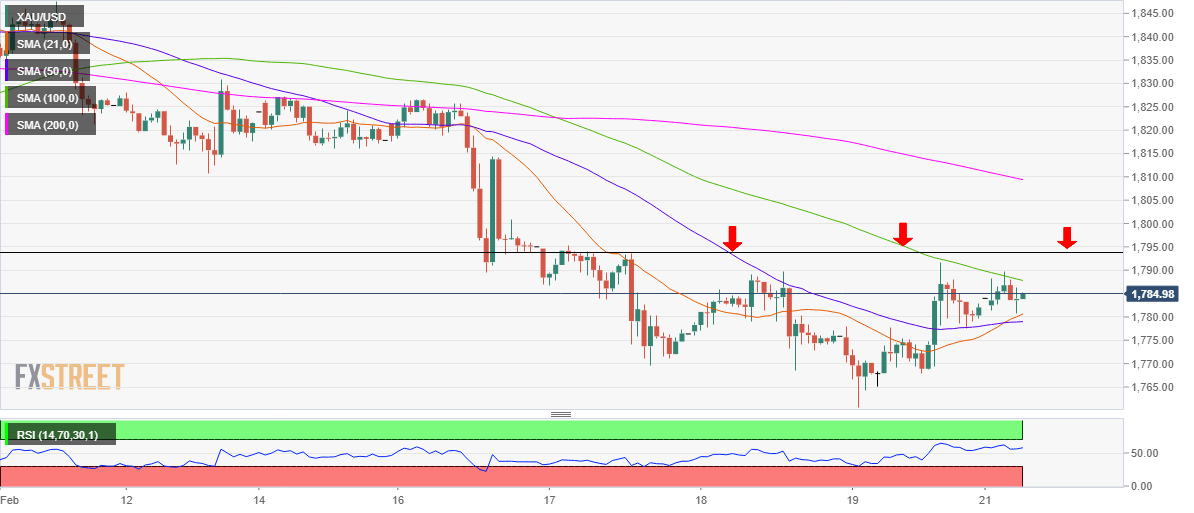

Gold’s hourly chart shows that the price gyrates between the bearish 100-hourly moving average (HMA) and upward-sloping 21-HMA, awaiting fresh catalysts for a range breakout.

A break above the 100-HMA at $1788 could prompt the XAU bulls to challenge the key horizontal trendline barrier at $1793 levels. Acceptance above the latter is needed to stimulate the recovery mode.

The Relative Strength Index (RSI) edges higher above the 50 level, suggesting the metal could see a fresh leg higher in the sessions ahead.

Meanwhile, a breach of the critical support around $1780 could trigger a sharp fall towards the multi-month lows of $1761.

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more