Gold Price Analysis: XAU/USD Consolidates The Break Above 50-HMA, Focus On Yields

Gold (XAU/USD) is consolidating the advance to $1745 levels, as the bulls catch a breath before resuming their journey towards the two-week highs of $1756.

The latest leg higher in gold was driven by the retreat in the US Treasury yields across the curve, which somewhat eased overheating fears and lifted the market mood. The safe-haven US dollar took a hit, in turn, offering support to the bright metal.

At the time of writing, the benchmark US 10-year rates are down nearly 2.50% on the day, below the 1.70% level. The yields hit the highest levels since January 2020 at 1.74% on Thursday.

Image Source: Pixabay

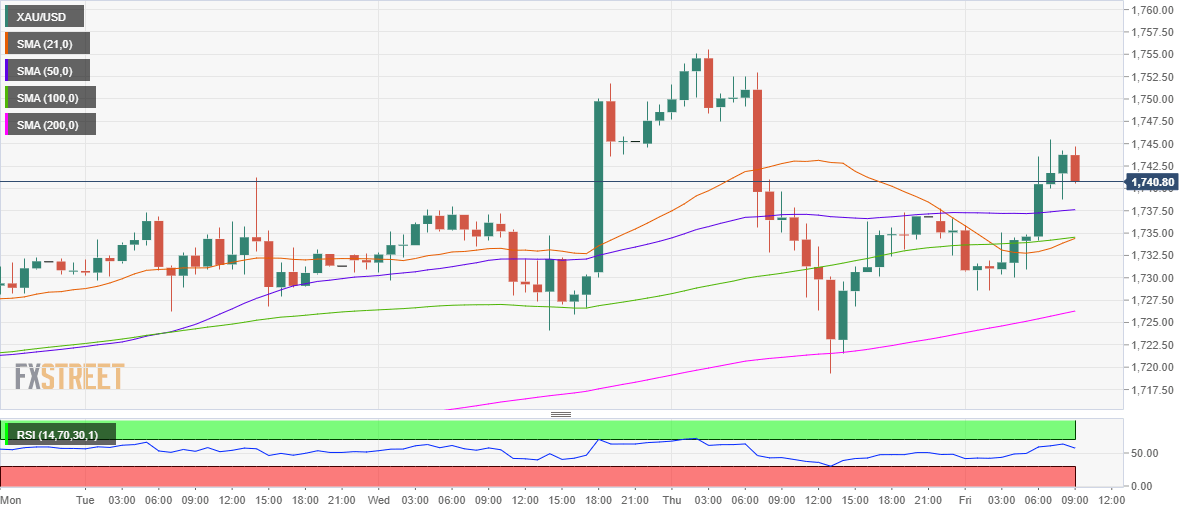

Meanwhile, the short-term technical setup for gold remains constructive, especially after the buyers found acceptance above the critical 50-hourly moving average (HMA) at $1738.

Therefore, the XAU bulls could find some support on any pullback from higher levels. A breach of the last could expose the powerful support at $1734.50, where the 21 and 100-HMAs intersect.

However, with the Relative Strength Index (RSI) still holding firmer above the midline, the upside bias remains intact.

Adding credence to the upbeat outlook, the intersection of the 21 and 100-HMAs has confirmed a bull crossover.

The next relevant target to the upside is seen at $1750, the psychological level, above which the two-week highs could be retested.

The March high at $1760 continues to remain on the buyers’ radars.

Gold Price Chart: Hourly

(Click on image to enlarge)

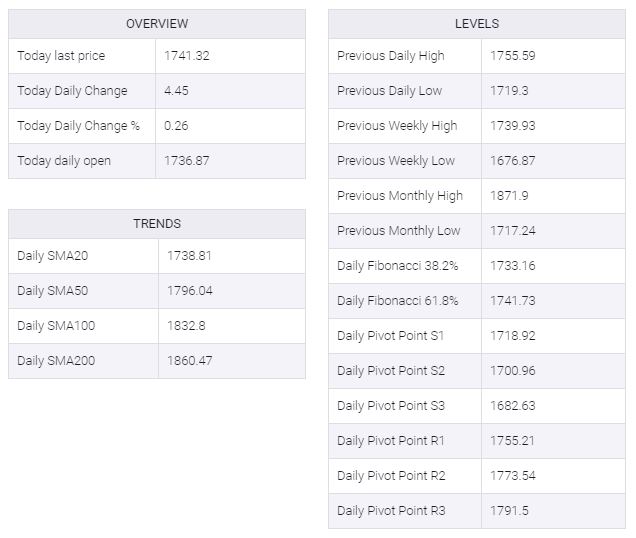

Gold: Additional levels

XAU/USD

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more