Gold Price Analysis: XAU/USD Challenges 50-HMA On The Road To Recovery Towards $1700

Gold (XAU/USD) looks to extend its recovery from nine-month lows of $1677, heading into the European session this Tuesday, having found solid bids around the $1685 region.

At the time of writing, gold is wavering within a potential two-week-old falling wedge formation, challenging the bearish 50-hourly moving average (HMA) at $1694.

An hourly candlestick closing above that level could boost the renewed upside, calling for a test of the powerful hurdle at $1703. That level is the intersection of the downward-sloping 100-HMA and falling trendline resistance.

Acceptance above the critical resistance could validate a falling wedge breakout, opening doors for a test of the bearish 200-HMA at $1727.

The Relative Strength Index (RSI) edges higher above the midline, suggesting that there is extra scope for the recovery.

Gold Price Chart: One-hour

(Click on image to enlarge)

Alternatively, the 21-HMA at $1686 offers an immediate cushion, below which the falling trendline support at $1673 could be put at risk.

A sharp sell-off towards the $1650 psychological level cannot be ruled out if the bulls fail to resist above the June 2020 low near $1670.

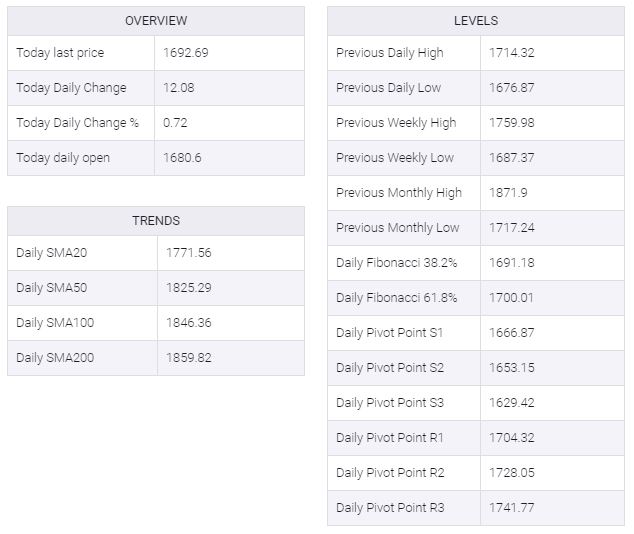

Gold Additional levels

XAU/USD

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more