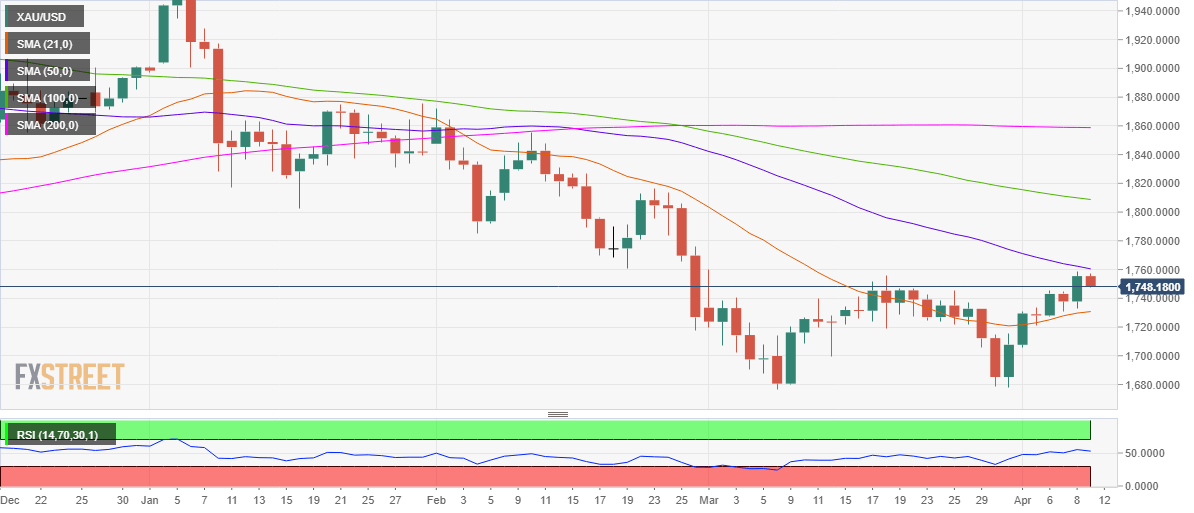

Gold Price Analysis: Rejection At 50-DMA Recalls XAU/USD Sellers, $1730 Eyed

Gold (XAU/USD) has returned to the red zone on Friday, having failed to surpass the critical hurdle at $1760 for the second straight session.

That level appears to be the downward-sloping 50-daily moving average (DMA). Sellers are back in control and remain poised to threaten the mildly bullish 21-DMA at $1731.

Image Source: Unsplash

However, with the 14-day Relative Strength Index (RSI) still defending the midline, the downside appears limited by the abovementioned 21-DMA support.

If the level gives way, the April 5 low at $1721 could be put to test. Further south, the April month low so far at $1706 will be eyed.

Gold Price Chart: One-day

(Click on image to enlarge)

Alternatively, should XAU buyers find acceptance above the powerful 50-DMA resistance on a daily closing basis, the double bottom reversal in gold could likely regain momentum.

Subsequently, a rally towards the $1800 mark cannot be ruled.

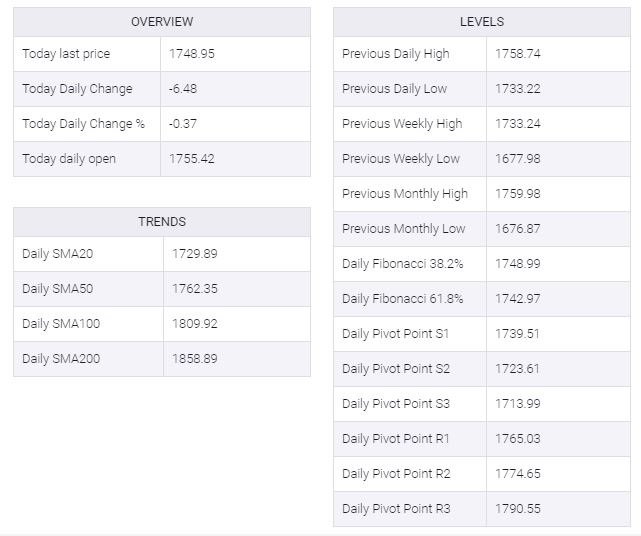

Gold: Additional levels

XAU/USD

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more