Gold Outlook: Bears Control Under $1,850 Amid Hawkish Fed, US Yields

The gold price outlook is bearish as the hawkish Fed and rising US yields support the US dollar. However, Covid jitters are providing support to the metal as a safe-haven asset.

After falling to nearly two weekly lows in the Asian session, gold has hovered just below the $ 1,850 mark, near the top of its daily trading range. The worsening situation in Europe during COVID-19 helped XAU/USD attract some buyers in the downturn on Tuesday.

Image Source: Unsplash

The Austrian government said it would be the first country in Europe to restore full isolation to deal with growing infections, while Germany warned it could follow suit. In addition, concerns about inflation have made precious metals even more attractive as a protection against them.

However, gold price gains could be curtailed by the Fed’s restrictive expectations and a stronger US dollar. Fed fund futures suggest that the Fed may hike rates by July 2022 and by November 2022 at the latest. In response to the speculation, US Federal Reserve Governor Christopher Waller said that the US Federal Reserve should accelerate tightening to create more space for higher interest rates.

US Treasury yields continued to be dampened by the prospect of Fed tightening soon. Due to this and the prevailing bullish sentiment against the dollar, traders are unlikely to bid aggressively on dollar-denominated commodities.

Gold has now broken its two consecutive losing days streak and appears to have halted its correction from last week’s multi-month high. However, a significant influence on the unprofitable yellow metal will continue US dollar movements and US bond yields in the absence of major US economic news.

Traders should consider the recent Coronavirus saga developments to take advantage of some short-term opportunities around XAU/USD shortly.

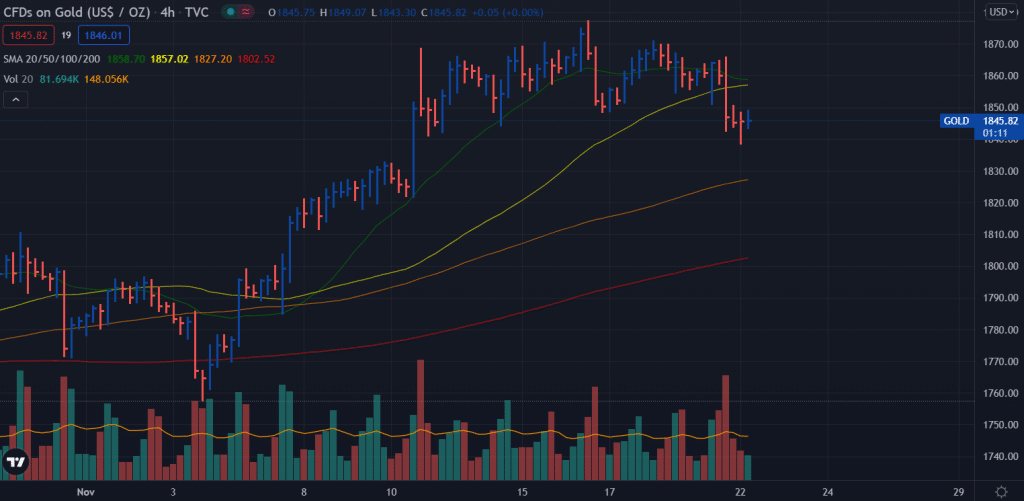

Gold Price Technical Outlook: Bearish Crossover To Support Sellers

(Click on image to enlarge)

The gold price fell below the 20-period and 50-period SMAs on the 4-hour chart. Both SMAs are going to make a death crossover which may exacerbate selling. Further sell-off may test the 100-period SMA around $1,825 ahead of 200-period SMA around $1,800. Volume data remains supportive of the downfall. However, the probability of an upside correction cannot be ruled out. The price may test the horizontal level around $1,852 ahead of 20/50 SMA congestion near $1,860.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more