Gold: Low Interest Rates And Bottom In Metals A Perfect Storm For Next Leg Up To 2150

Fundamentals Point to Short-Term Inflation

Gold and silver appear to be acting the opposite of the fundamentals. A lot of money has been lost listening to the experts discuss the fundamentals. They may be right at some point, but not yet. Inflation is running above expectations, but it appears to be going to be a short-term issue; not a long term problem.

Image Source: Pixabay

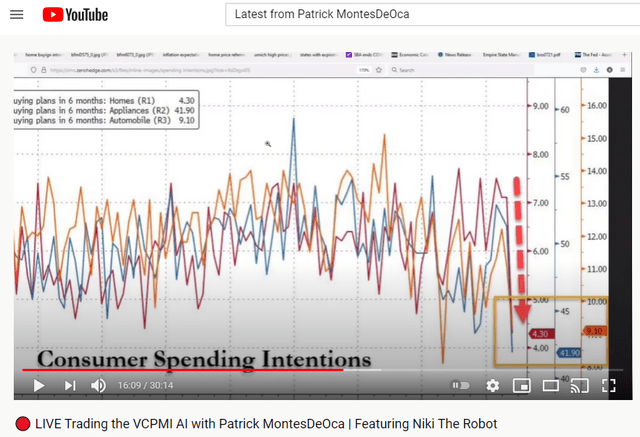

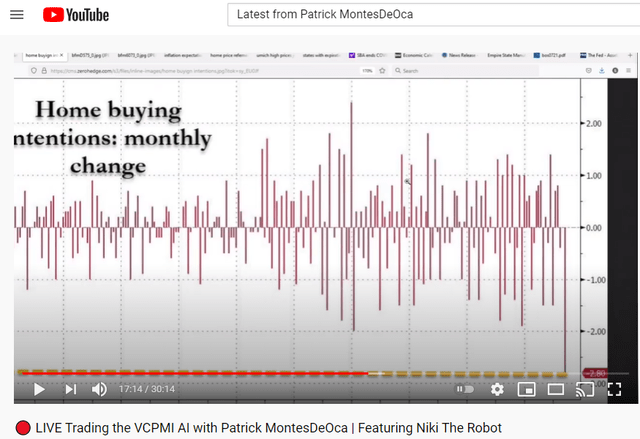

Steven Van Metre recently on his MacroShow reported that a University of Michigan survey found that the American consumer has had enough of higher prices. The Consumer Spending Intentions report from the University of Michigan found that the number of respondents who said yes plummeted when asked if they had planned to buy homes, appliances or automobiles in the next six months. The survey was as bad as back during the 2008 crisis. The monthly change in the intention to buy a home has fallen the most since 2000. The homebuilder sentiment continues to fall as demand declines. The Consumer Sentiment and Expectations Indexes also fell. The stock market often tracks the sentiment surveys.

Higher prices are not always inflationary. In this case, higher prices may lead to deflation as consumers decide to spend far less. These surveys suggest that the Fed's policies may not be enough. Interest rates may not be low enough.

The 1-year inflation expectation has risen sharply. Consumers are saying they don't want to buy now and they expect prices to rise in the next year, which suggests that inflation will be transitory, since demand should decline sharply in the next year.

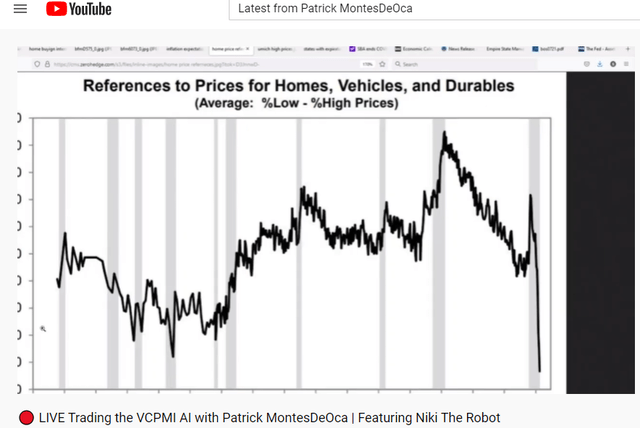

In a study of references to prices for homes, vehicles and durables, the vast majority of survey respondents say that prices are too high, which also points to deflation.

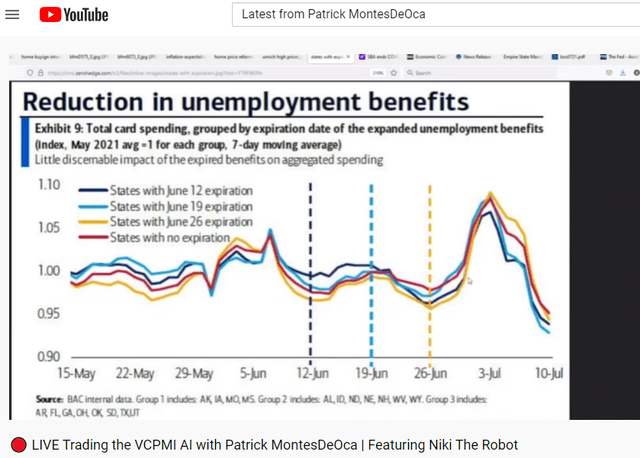

When consumers believe that prices are too high, they don't spend. We would expect that as government unemployment benefits declined, spending should also decline. A Bank of America study showed that there was little impact of unemployment benefits ending in a given state on aggregate consumer spending. So the government support of the unemployed appears to make little difference to consumer spending.

A government restaurant program to support struggling restaurants has now run out of funding. It will close on Wednesday. This might mean that restaurants will start to fail even more often, putting more people on the unemployment rolls. Congress is considering legislation to add $60 billion to the program to help continue to support restaurants. Nothing has been decided as yet.

The bond market is showing that bond investors do not believe that the current inflation is going to continue. Bond investors tend to be the smartest people in the room, so don't expect inflation to continue. Inventories are increasing, but with consumer intentions to buy falling, don't expect goods to continue to fly off the shelves.

Van Metre concludes that he expects retail sales to crash as Americans reject the new higher prices for almost everything. Manufacturing data is rosy, but Americans are showing little inclination to spend at higher prices.

Van Metre's report just highlights the disconnect between the fundamentals and the price of gold and silver. Precious metals should be rising, but they are not. Interest rates are likely to come down as the year progresses and the economy will slow down. Retail sales will fall. Inflation will slow. The Fed talked about tapering and that led to a collapse in precious metals. If rates come down, that will be extremely bullish for precious metals and other assets that were hit by corrections. The economy cannot handle higher interest rates in the face of this explosive debt we have on a global basis. If we do enter another downturn, what is the Fed going to do with interest rates already at almost zero and any talk of tapering leading the market throwing a tantrum? Be ready for a major downturn, which will cause gold and silver to rise in price fast.

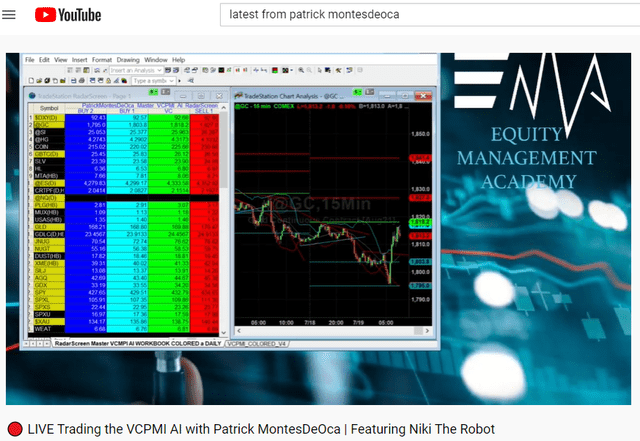

TECHNICALS

Gold is down, which is a bit of a mystery. Stimulus, short supplies and the short squeeze should drive gold up.

Gold is in a major reversion from the Variable Changing Price Momentum Indicator (VC PMI) Buy 2 level. $1818 is the VC PMI daily average price. $1827 is the Sell 1 level and $1842 is the VC PMI Sell 2 level. We are down close to $1795 this morning. We activated VC PMI Buy triggers on the daily numbers.

SILVER

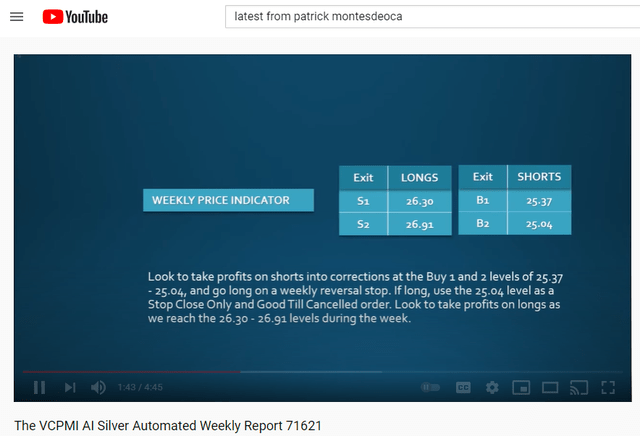

The VC PMI weekly report for silver as produced by our proprietary Nikki the Robot, states that the weekly trend momentum is bearish. A close above $25.97 will negate this bearishness to neutral. If short, you should take profits at $25.37 and $25.05. You should exit longs at $26.30 and $26.91. Looks to take profits on shorts into corrections at the Buy 1 and 2 levels of $25.37 and $25.04, and go long on a weekly reversal stop. If long, use $25.04 as a Stop Close Only and Good Till Cancelled order. Look to take profits on longs as we reach $26.30 and $26.91.

The market has come down close to the Buy 2 level of $25.05 in silver. It is trading around the Buy 1 level of $25.37. We have activated a buy trigger in silver from $25.05. By closing above $25.38, we activated another buy signal. The target is $25.96.

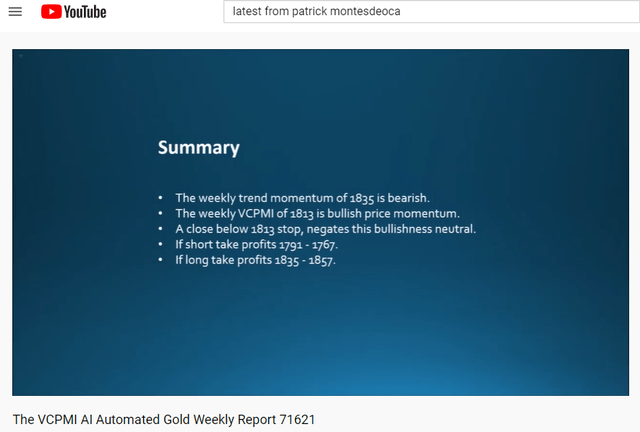

GOLD

Nikki the Robot's weekly report states that the weekly trend momentum of $1835 is bearish. The weekly VC PMI of $1813 is a bullish price momentum. A close below $1813 would negate the bullishness to neutral. If short, take profits at $1791 and $1767. If you are long, the VC PMI recommends taking profits at $1835 and $1857.

Gold has come down close to $1795 and the Buy 2 daily level. The market then reverted from that level as Nikki the Robot suggested. Nikki said not to sell into that level. Do not go short between the Buy 1 or 2 levels. Use that area to add to your long positions. Gold appears to be on its way to $1818.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on Ticker ...

more