Gold: Look For More Supply To Hit Metals Markets Next Week

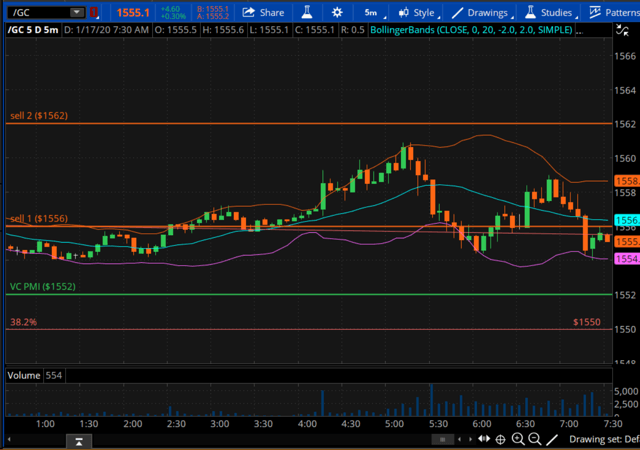

Gold was trading last at $1,557.70, up about $7.30. The Variable Changing Price Momentum Indicator (VC PMI) average daily price is $1,552. The Sell 1 level above the mean is $1,556, and the Sell 2 level is $1,562. The Buy 1 level below the mean is $1,546 and the Buy 2 level is $1,542.

The market ran up above the average price overnight and activated a bullish price momentum target. The target of $1,556 was completed. The market is trading above that Sell 1 level of $1,556 and has activated the target of $1,562. The VC PMI artificial intelligence calls this area between the Buy 1 of $1,556 to $1,562 an area of distribution of supply. We are neutral on the futures side and we are looking for a signal to be activated on a close below $1,556 using the 15-minute bar, or if the market runs up again and activates the Sell 2 level of $1,562, and closes below. We have no positions here in gold. We took profits yesterday on the Direxion Daily Gold Miners Index Bull 3x Shares ETF (NYSE:NUGT) as the market rallied into the weekly mean of $32.76.

We are in a hedge position with the Direxion Daily Gold Miners Index Bear 3x Shares ETF (NYSE:DUST), expecting the gold market to experience more supply at these levels. We should run into more supply as the weekly mean of $1,572 comes into play. Right above $1,562, we have $1,572, which is the weekly mean. The previous high is $1,564, so I would say, if I was looking to go long using the VC PMI, I would wait for the market to close above the $1,572 weekly mean and activate a bullish price momentum. We appear to have a ceiling of supply to deal with. The weekly signal, by trading below the weekly average of $1,572, is bearish. It has activated the target of $1,530 on the weekly basis.

The daily numbers are in an area of distribution of supply between Sell 1 of $1,556 to $1,562. We have no position on the day trade unless we close below $1,556 or test $1,562 and close below it. The weekly signal is short or has a bearish price momentum with a target of $1,530. This signal would be negated on a close above $1,572.

Silver

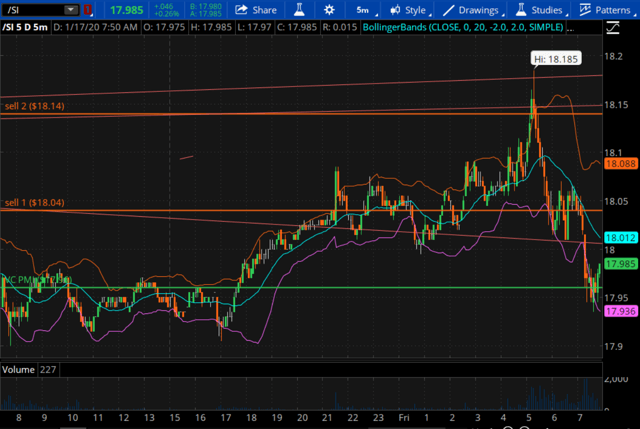

Silver has also entered a major area of supply or distribution. It already has activated a bearish trigger from $18.14. It already met the initial target of $18.04 and we are looking for a close below $18.04 to go short the silver market for day traders. If you are short, use a stop at $18.04 on a closing basis using the 15-minute bar. Your target is $17.96.

Let's watch gold and silver and see how the supply and demand affects the direction of the market. The VC PMI provides specific criteria to follow, which is what we use to trade at the Equity Management Academy.

- We have no position in gold on the day trade unless we close below $1,556 or test $1,562 and close below it.

- The weekly gold signal is short or has a bearish price momentum with a target of $1,530, but the signal would be negated on a close above $1,572.

- We are looking for a close below $18.04 to go short the silver market for day traders.

Disclosure: I am/we are long DUST.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more