Gold Is The Ultimate Reserve Asset

Imagine your favorite company getting sued for holding too much cash.

I know, that’s a big statement. But hear me out.

Corporations, pension funds, and insurance companies – anyone responsible to stakeholders - could one-day face class-action lawsuits if they don’t diversify into other reserves assets. It’s not beyond the realm of possibility, especially in today’s litigious-happy world.

Michael Saylor famously bought bitcoin last year to diversify and protect the buying power of MicroStrategy’s surplus cash…half a billion dollars’ worth. Elon Musk recently did the same for Tesla, plowing $1.5 billion into bitcoin. Before either of these was Overtstock.com.Remember them?

That was back in 2018. Then CEO Patrick Byrne moved Overstock.com into blockchain and cryptocurrencies in a big way. Shares are up almost 500% since.

Clearly, these are sharp stewards of their companies. Their move into bitcoin and blockchain was wise in hindsight, having paid off handsomely.

Many sit on massive mounds of cash. And it could soon, almost literally, start burning holes in their pockets.

Too Much Cash

Alphabet’s (GOOGL) pile is $137 billion, Microsoft’s (MSFT) is $132 billion, Apple (AAPL) has $77 billion, Amazon (AMZN) $84 billion, and Facebook (FB) is sitting on $62 billion.

That’s half a trillion dollars, just amongst these five.

Many large companies, the world over, have huge cash reserves. It’s not that surprising. With stocks at all-time highs and dizzying valuations, there’s not much to buy without overpaying.

Maybe that’s at least one reason so many have resorted to stock buybacks. We know several have borrowed, at historically low-interest rates, to do this. From management’s perspective, at least, it’s a no-brainer. But is it really in shareholders’ best interest? Saylor recently took his bitcoin binge to another level. In December, MicroStrategy took on $650 million in debt to buy even more bitcoin.

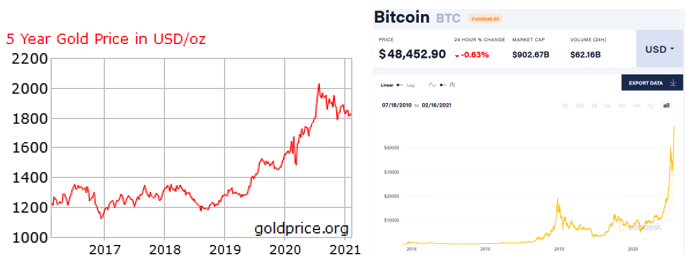

Don’t get me wrong. I like bitcoin. I think it’s worth owning. But I also think that, right now, there could be more value to be had in gold. Here’s how they look side by side.

(Click on image to enlarge)

Last year, Berkshire Hathaway bought shares of Barrick Gold Corp., the first gold investment for Warren Buffet. In doing so, he joined other seasoned fund managers, like Bridgewater’s Ray Dalio and Greenlight Capital’s David Einhorn.

But the attraction to gold, for its diversification and inflation-hedging properties, has infected others.

In mid-2020, the Ohio Police & Fire Pension Fund approved a 5% allocation into gold. It was a move for the exact reasons I just mentioned, to diversify its portfolio and hedge against the risk of inflation. Wilshire Associates, the fund’s investment consultant, made the recommendation.

A few years back Shayne McGuire, Director of Global Research launched and managed a gold fund for the Teacher Retirement System of Texas. He said, “Before 2008, counterparty risk was not a consideration if you had the backing of Lehman Brothers or Citigroup or even the largest bank, RBS, or the backing of a colossal insurance company like AIG. Gold is ultimate financial insurance, the only viable and liquid investment asset that is not another entity’s liability and pension funds are talking about this.”McGuire continued, “In this regard, a renowned natural resources entrepreneur with a strong historical take on the gold market shared this thought with me last week: ‘Just as the prudent man rule would have prohibited asset managers with a fiduciary responsibility from owning gold just a decade ago, one day we are likely to see the exact opposite. Everyone will need to own some gold in their portfolio, which will have notable consequences for the price of gold in the future.’” (emphasis mine)

Winds Blowing Towards Gold

Today, a dozen U.S. states have changed their laws to recognize and accept gold and silver as legal tender, some even eliminating taxes on precious metals. After all, Article 1, Section 10, of the U.S. Constitution, states that “No State shall… make any Thing but gold and silver Coin a Tender in Payment of Debts.”

Idaho is taking things a big step further. That state just passed House Bill 7, the Idaho Sound Money Reserves Bill with overwhelming support. The Bill, to be heard in the Senate, would permit – but not require – the State Treasurer to hold some portion of state funds in physical gold and silver to help secure state assets against the risks of inflation and financial turmoil and/or to achieve capital gains as measured in Federal Reserve Notes.

The legislation has support from the Sound Money Defense League, a national public policy group working to promote gold and silver as recognized currency in the U.S.According to the League’s policy director, JP Cortez, "Because of market conditions and statutory constraints, Idaho's reserves are invested almost exclusively in low-yielding debt paper – such as corporate bonds, tax-anticipation notes, municipal bonds, repurchase agreements, CDs, treasuries, and money market funds…These debt instruments appear to have low volatility, but they carry other risks – including pernicious inflation and the steady erosion in the real value of principal, coupled with interest rates that are negative in real terms.

Did you grasp that? Idaho has lost confidence in Federal Reserve Notes, otherwise known as “the dollar”.

Gold may be in a weak period right now, as the world turns to bitcoin, cryptocurrencies, and even silver as an alternative.I would treat that as an opportunity.

Consider Tesla’s recent 10-k filing:

In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds, and other assets as specified in the future. (emphasis mine)

The winds of change are blowing. Pension, corporate and even government fund managers are looking for alternative reserve assets. Is it such a stretch to think one day it will be expected and considered prudent?

One thing is certain. Gold’s proven itself as the ultimate reserve asset and financial insurance for millennia. And it’s set to fulfill that role once again.

So it’s no coincidence that, despite their public disdain for the metal, central banks continue to store tons of gold.