Gold: Inflation May Be Our Salvation

Fundamentals

The effect of the stimulus on the economy and the US dollar and other currencies is bound to be inflationary. The pandemic caused global economic chaos. Now governments have to print as much money or stimulus as the economy requires to avoid an implosion of assets, which could trigger a horrendous depression. We are in something similar to the 1929 crash. The difference now is that we were able to transition into a virtual economy.

Governments also are having to deal with the increasing wealth disparity between those who benefited from the old system and those who did not. The wealthy have benefited from borrowing money at almost no cost with interest rates at almost zero and buying assets, which then increase in value in part due to the decreasing value of the dollar. This is the fuel that's changing the price of many assets. Printing so much money is inflationary and inflation already is hitting many commodities. Crude oil is above $63 a barrel. In March, we were at negative - $37. Wheat and grains also are up significantly. Central banks appear to be looking for some inflation to get us out of this potentially deflationary spiral in world assets triggered by the pandemic. We are not seeing real growth, but monetary policy triggering artificial inflation of assets. We expect to see an accelerated rate of inflation. Unemployment is still high. Supply chains are broken or stressed, which when demand increases, will further increase prices. We're also running low on supplies of silver and many other commodities compared to the increasing demand as the economy begins to restart. Inflation may be our salvation. Inflation may be the way everyone pays for the damage caused by the pandemic and for past monetary policy mistakes, which included governments taking on huge debt and printing more and more money.

In 1971, gold went from $35 to $800 after the US dollar was taken off the gold standard. Interest rates in the 1970s hit 14%. Inflation also hit new highs at the same time. We may face a similar situation in the near future. We already see short-term interest rates rising. It's a warning of inflation to come. Assets to own at such times are precious metals, such as gold and silver. The precious metals are extremely bullish - more than we have ever seen. Fundamentally and technically, gold and silver are undervalued, oversold and are highly likely to move up significantly. Precious metals tend to go up when everyone has given up.

Gold and silver do not go up when everyone is bullish. They go up when almost everyone has given up on them. The fundamentals suggest that gold and silver should be much higher, but there are too many buyers in both markets. In that situation, we should expect a major shakedown. There's an anomaly between the short sellers in the paper market and investors playing on the long side, supported by increasing physical demand for industrial uses of silver and investors seeking a safe haven from the decreasing value of fiat currencies in the form of gold and silver.

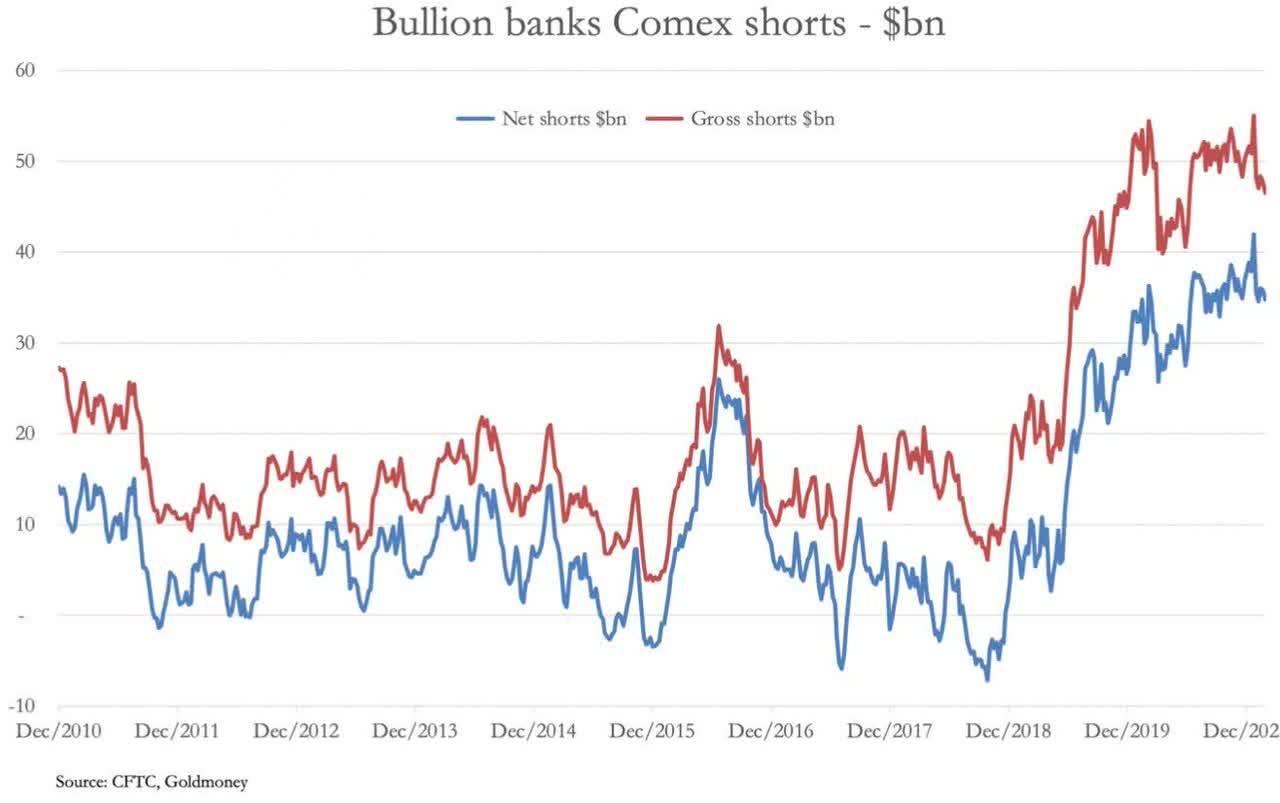

The massive short position in gold and silver is allowed because the uptick rule was eliminated a few years ago. Before, an asset had to be going down to short it. Now you can short it whenever you want and however much you want. Paper shorts in silver total $40 billion at a time when the physical market is tight. Gold and silver, given the fundamentals, should be far, far higher in price, if you price it compared to interest rates, the debt, Bitcoin and other assets. It's just a matter of time before the precious metals adjust in price. The lows are slowly rising as buyers are stepping in and paying more for gold and silver each time there's a reversion.

Gold

(Click on image to enlarge)

Courtesy Ticker Tocker

Gold is trading at $1786. It activated a Variable Changing Price Momentum Indicator (VC PMI) daily Buy 2 trigger from $1785. A close above $1785 is a buy trigger. The Buy 1 level is at $1781. From those levels, you do not want to go short. The odds favor the market reverting from these levels. It may continue to go down, but it's less likely than a reversion. You want to wait for the market to complete the pattern and find some buyers to take the price above $1785. Then on the close above $1785, it is a buy trigger. For this trade, the first target is $1789 and then $1795. The daily average is $1804, which is the third target for this trade. $1810 is the annual mean and the monthly target is $1781. The market also is activating a monthly trigger above $1781. If it goes above $1810, it would activate a bullish price momentum which could take us all the way to $1874.

We appear to be completing a descending wedge. If we get through $1812 or $1826, then we should go all the way up to $1874 through an air pocket. The VC PMI sees this area as extremely bullish. Now is the time to buy into this correction for the long term.

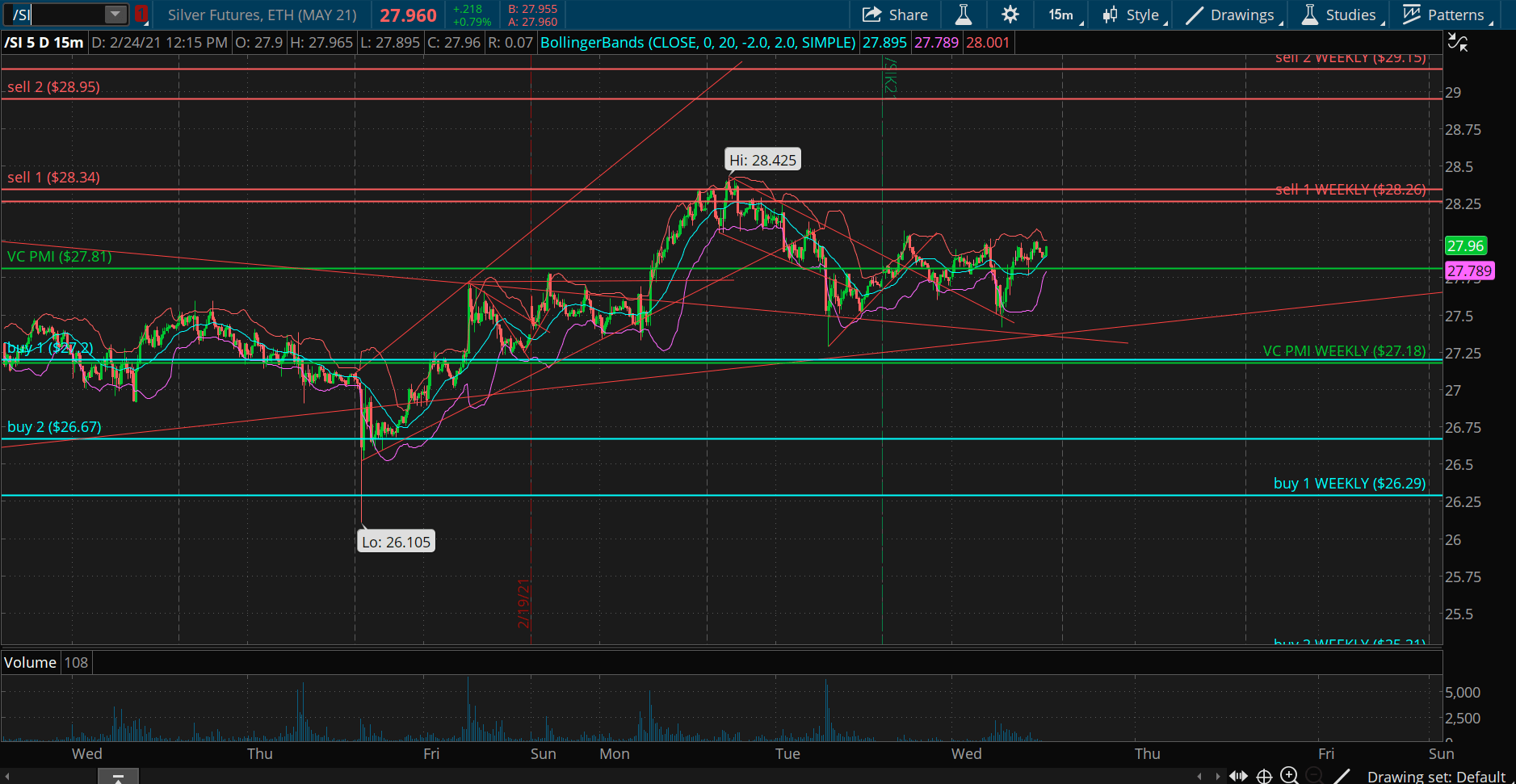

Silver

Silver is following the momentum of the gold market. It's at $27.63. The difference is that silver is trading below the average of $27.81. It's neutral to bearish. It activated the buy triggers of $27.20. It came down into trendline support and then reverted. If we close above $27.81, it will negate this bearish sentiment. A close above $27.81 will activate a bullish price momentum with targets of $28.26 to $28.34.

Silver has traded through the average of $27.81, which has triggered a bullish trend momentum.

Silver has been making headlines for the past few weeks. The Reddit crowd appears to have moved into the silver market. They appear to have identified that the physical market is tight. You cannot buy large quantities of physical silver. Premiums are rising fast. London warehouses are running very low on supplies. Paper short sellers are facing a potential short squeeze. Silver has record levels of short positions.

We are looking at $28.34 as the next level. Supply appears to come into the market at that level, which it did recently.

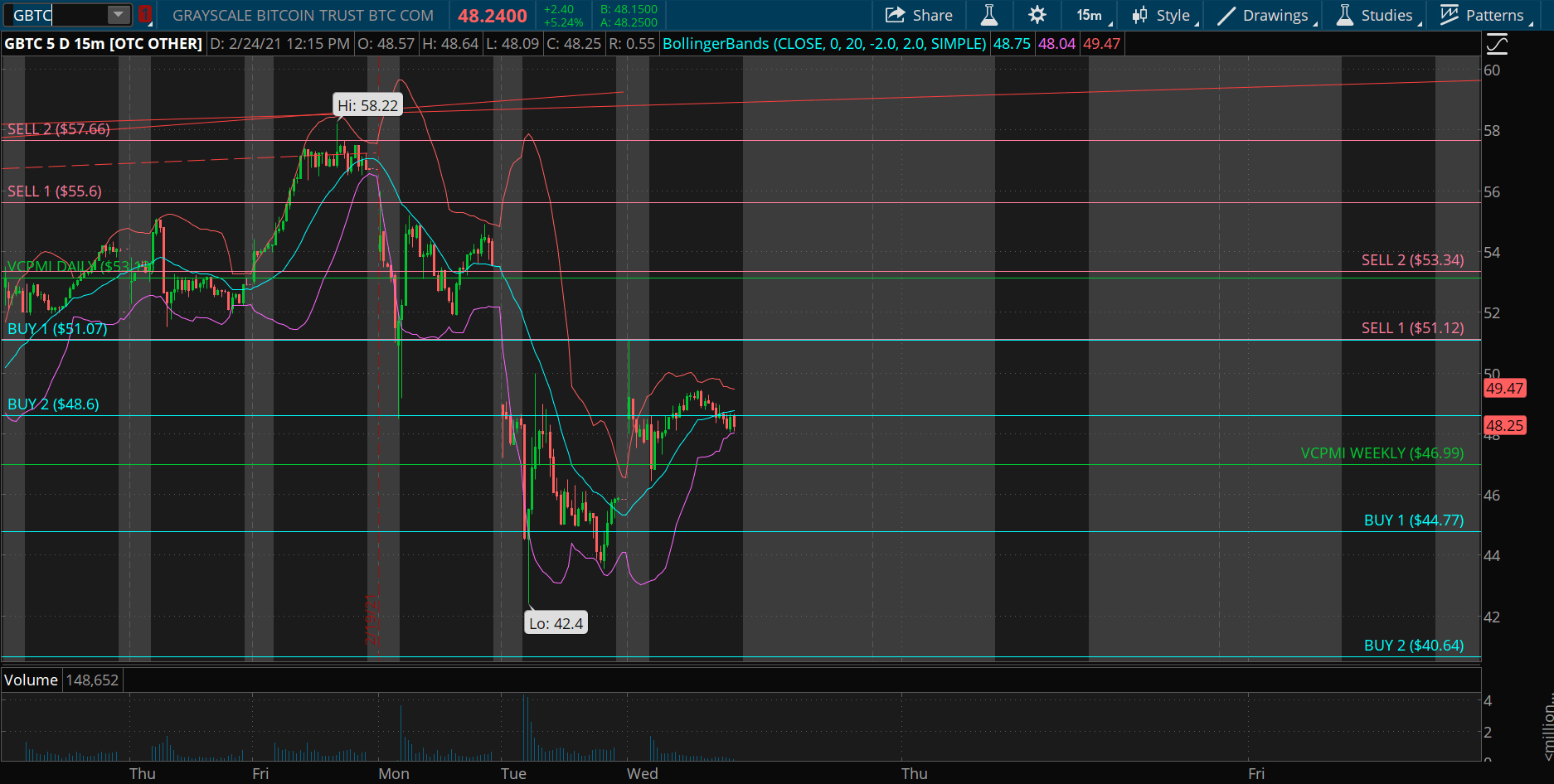

Grayscale Bitcoin Trust

(Click on image to enlarge)

The Grayscale Bitcoin Trust low was 42.40 with a high of 58. We recommended getting back on the long side of Bitcoin. It's highly volatile and probably the most volatile instrument to trade. We use the VC PMI to recognize trigger points, such as the Buy 1 weekly level of 44.77, which was activated yesterday. So we recommended that our traders go long. The market is probably going to test the highs of 58.22.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on Ticker ...

more