Gold: Inflation Is Here To Save The Nation From Deflation

Fundamentals

Precious metals settled higher on dovish central bank comments. Wednesday, February gold was up $10.70, while March silver was up 13.7 cents. Global central bank officials made dovish comments and there was safe-haven demand as the US reported a record number of COVID-19 deaths on Tuesday. A rally in stocks and a strong dollar limited the rise of precious metals. Global economic data was bearish for precious metals, especially for silver, which is an industrial metal. Eurozone industrial production rose 2.5% month to month, stronger than expectations. It was the biggest increase in four months.

Fed comments and Eurozone central banker statements have been bullish for gold. They have been dovish in relation to their 2% inflation goals, which is bullish for precious metals. The real inflation rate is more like 10%, if you count food and energy, according to Shadowstats.com. However, Wednesday’s US economic data was bearish for gold, as it appeared that there's no inflation and that it's under control. Official inflation data does not count food and many other key parts of the economy. The government also doesn’t want you to pay any attention to the debt. The debt bubble is close to collapsing. If interest rates rise, debt defaults are going to be a tsunami through the global economy. If inflation rises above 2% based on Fed data, they will use the yield curve by capping long-term interest rates to seek to control the effects of inflation. The market and the Fed know that we need inflation in the system to get out of this recession and to deal with the mountains of debt.

Gold also has support from the worsening COVID-19 pandemic. The economy is on lockdown, so there's little economic activity. This hurts industrial metals, such as silver. Silver, however, is not just a commodity. It's also a safe haven asset in times of economic chaos, especially when the US dollar is being devalued through inflation. The US is reporting record death levels from COVID-19, while the UK and Japan are facing surges in cases and more stringent and broader lockdowns.

Precious metals have underlying support from the expectations that President-elect Biden will spend trillions of dollars to support the economy. This will further weaken the dollar, increase the risk of inflation, and raise the price of gold and silver. The new administration appears to be far more open in their plans than the Trump administration, which keeps things secret far more. However, every dollar printed makes the dollar worth less, which leads to inflation. Long term the massive stimulus will cause inflation in the US. We already are facing inflation at about 10% and the markets are beginning to see that the real economy is getting overheated. This appears to be what the Fed wants, since they are pumping huge amounts of stimulus into the economy.

Gold, silver and stocks appear to be waiting to hear how big the Biden stimulus package is going to be. This appears to be just the beginning. The stimulus numbers are going to be staggering and they appear to want to see some inflation. Interest rates are at near zero percent, so there's not much the government can do to manipulate the economy. If you count inflation, then we already have negative interest rates. If you include energy and food, I don’t see how you can say that inflation is below 2%. The government is underplaying inflation, since it's already here. They have to say there is no inflation because they don’t have many choices. If interest rates rise, then debt payment defaults are going to happen all over the place. It appears that the Fed is going to allow inflation. Crude oil is heading toward $100 a barrel. We are heading for a major adjustment in prices. Soybeans are at $14.46 and they were at $8.08 in March. Corn has gone from $3 in March to $5.41 today. This is just the beginning of the increase in the cost of food. Inflation is already here, which is bullish for gold and silver.

The moves in commodities are unrivalled by anything else. They are a trader’s dream. Fundamentally, gold benefits from inflation, political unrest, economic slowdowns, rising debt, more printing of money, and almost everything else that is in the news today. It's an exciting time. Gold has been ignored and manipulated by paper day traders. In 1981, the Dow Jones and gold were at about 1:1. Today, stocks are tremendously overdone. Will stocks adjust down to its mean or will gold take off and catch up to the value of stocks with the DJIA at 30,000? Bitcoin is at 40,000 and the spread to gold is going way into the stratosphere. Again, another reason for gold to increase significantly. Bitcoin also faces the danger of regulation and it can be difficult to pull money out of Bitcoin if you make large amounts of profit. Governments have seen the demand for cryptocurrencies, so it seems likely that central banks will begin to issue virtual currencies, just as the Chinese have already done.

Gold

As a long-term trader, when the market is falling, it's a great time to buy for the long term. The market makes new lows when everyone wants to get out. That is when everyone who wants to go long for the long term, gets in. If everyone wants out of the gold market, that is the best time to buy.

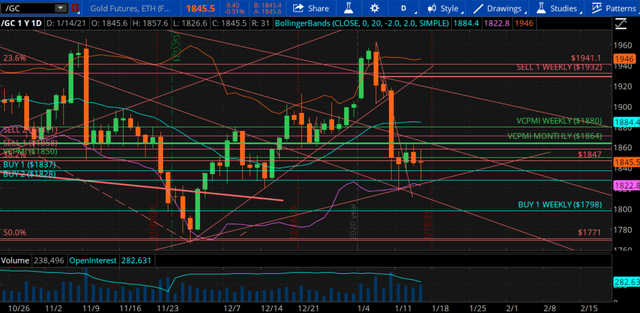

Gold is trading last at $1842. It's in a fast market. It has been volatile. Silver is at $25.54. It is slightly down a few cents. For gold, the Variable Changing Price Momentum Indicator (VC PMI) Buy 1 level is $1837 and the Buy 2 level is $1828. From $1850, a lot of supply came into the market, but the market soon found buyers come in. For day traders, $1827 to $1837 is undervalued. If gold goes through $1850, it may reach the daily Sell 1 level of $1858 and Sell 2 of $1871. Gold appears to be holding the Fibonacci support level at $1828 and a Bollinger Band lower level. It appears that we are looking at an oversold condition. The monthly VC PMI average is $1864 and the weekly average is $1880. The monthly fits nicely in with the daily levels. These levels mark a high probability area for sellers to come into the market. Most of the sudden dips in the market are all Central Bank selling. They sell naked short positions in the futures market to collapse the price as you see when there are big bars down. However, regardless of such attacks, the levels the VC PMI predicts still hold true. This area of $1840 to $1850 is a major area of accumulation. It's a great area to get into the market for the long term. It looks like all the way up to $2015 is open, which is the Sell 2 weekly level for the rest of this week. Just as in the 1970s, inflation is back and commodity prices are reflecting that fact.

Silver

Silver also completed the daily target and we see increasing volatility. It could revert back down to the mean after it met the sell target levels. If we get above $25.65, it will activate the level above. You should not be buying at these high levels, since they are levels that have 90% and 95% probabilities of the market reverting back down to the mean.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on Ticker ...

more