Gold: Have No Fear, Inflation Is Here

Fundamentals

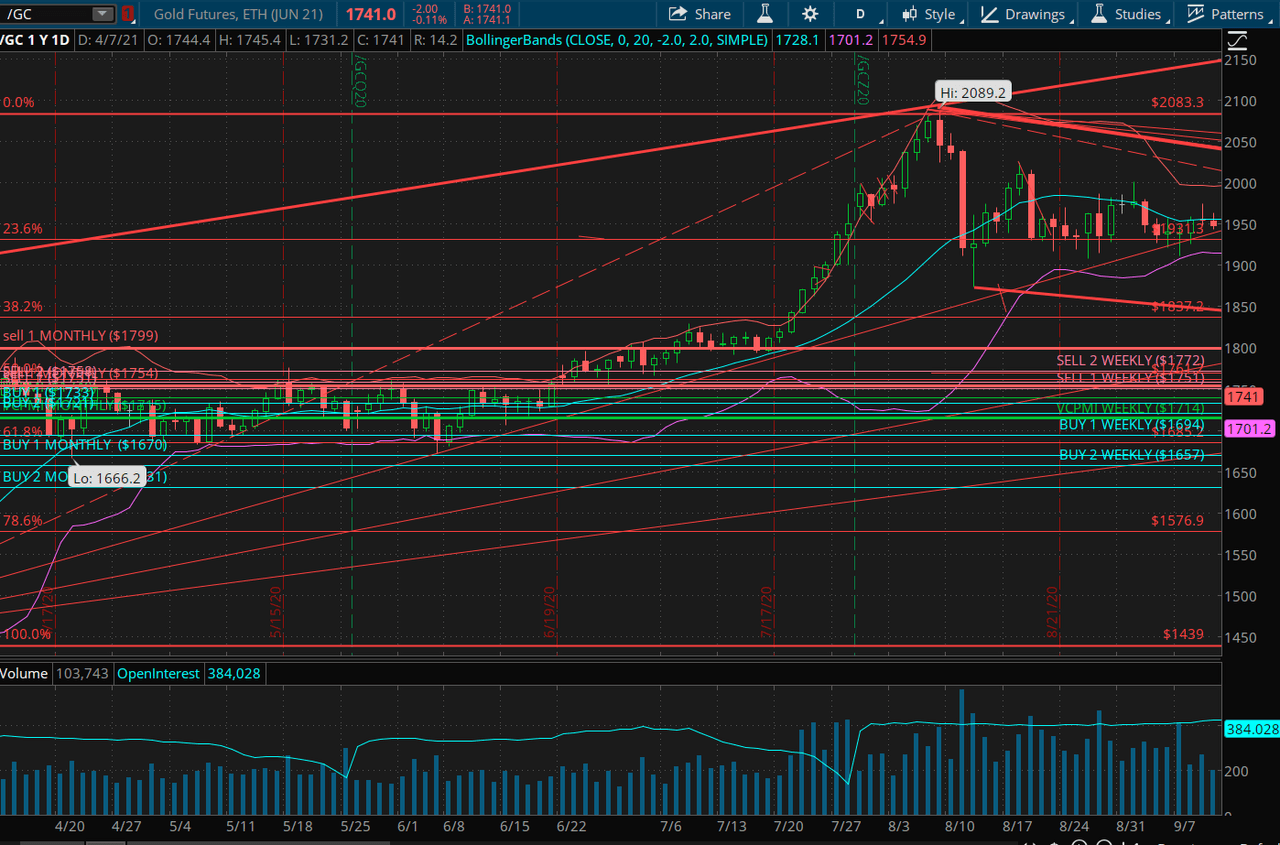

If you listen to fundamentals, you can quickly get lost. Often the fundamentals are the opposite of what the market wants to do. Since the pandemic hit, the economy was crippled and gold hit $2089. Gold seemed to anticipate the damage caused by the pandemic and waited to see how much stimulus would come into the economy. Many analysts thought gold would hit $5000 or go even higher. If gold had hit that level, the global economy would have been in dire trouble. Luckily, it did not. The flood of stimulus that came into the markets, with 10% of GDP mentioned as possible stimulus or $30 trillion, restored confidence in the markets. Supply then came into the gold market and prices fell to a low of $1673 on March 8. That level proved to be a pivot point for our proprietary Variable Changing Price Momentum Indicator (VC PMI) and in terms of a Fibonacci retracement level, and the market reverted from there back up.

Courtesy: TDAmeritrade

The fundamentals show a shortage of supply of gold and silver, yet gold and silver came down. Talk of a short squeeze also did not cause gold to go up. The VC PMI is a contrarian indicator, so when everyone is focused on the market going down, it recommends buying. When the market is rising, then it recommends selling. It goes against everyone’s expectations. In March of 2020 when gold hit $2089, everyone was talking about $5,000 gold, yet the VC PMI recommended selling. Now the sentiment is gloomy in terms of gold in comparison to Bitcoin and other assets. That's exactly when you want to buy gold. The VC PMI is telling traders to buy for the long term. We have established the low at $1672. The new low was higher, at $1677 and now gold is ready to challenge the supply above the market. The momentum of the market wants to test $1754 or $1758. We have a bullish trend momentum.

Precious metals are challenging what's real money. Is the US dollar, the paper currency, real money? Few people even carry paper money anymore. With trillions in debt, how much value can the US dollar have? All currencies share the same major flaw in terms of lack of real value and astronomical debt. Or is real money gold and silver, which have been considered money for thousands of years? Today we have a dual system: The fiat currencies that are not backed by anything but trust in various governments since 1971 when the dollar went off the gold standard, and precious metals, which have real hard value. We firmly believe that precious metals are an excellent area to build and retain wealth. Going off the gold standard has been catastrophic to the value of the US dollar. Its value has plunged since 1971, even as many individuals have become extremely wealthy in terms of paper money. However, the buying power of the dollar has declined more than 99% since 1971. A millionaire today is far from what a millionaire was in 1971.

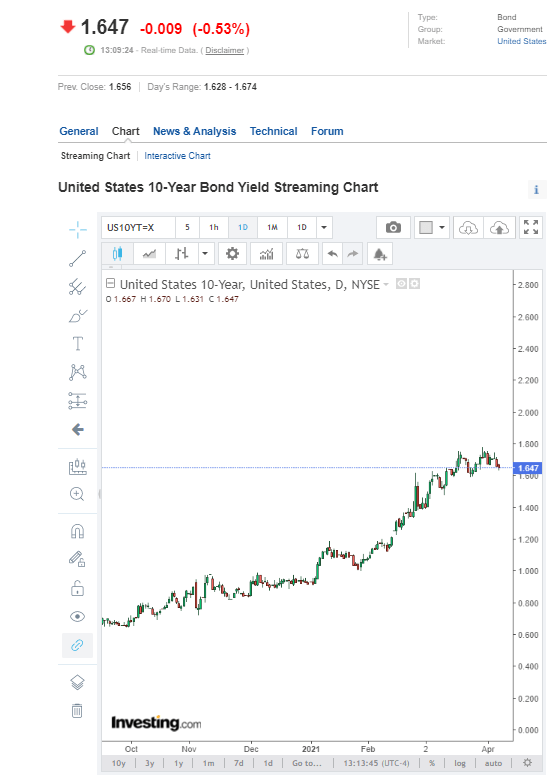

The government keeps spending stimulus money in the trillions of dollars. That spending will further devalue the US dollar and lead to inflation at some point. The dollar will continue to decline in real value. The markets are waking up to the fact that inflation already is here. The grains are rising fast, doubling and more in the past few months. Crude oil has gone from negative to positive. Fear that interest rates will rise and the effect on debt payments is increasing. The 10-year note has almost doubled recently in terms of its yield. In October it was at .64 and now it has more than doubled. The increase is causing havoc in the bond markets, increasing fear in relation to highly leveraged instruments.

Yet, in the face of rising debt, rising interest rates, supply chain shortages, and a severely damaged economy, stocks continue to rise. The E-mini S&P continues to go up. It's in another world. The spread between the Dow Jones and gold is at historic highs. In 1981, the ratio of the Dow Jones to gold was about 1 to 1, gold was at about $850 and the Dow Jones was at about the same price. Since then stocks are above 30,000, while gold has only gone up to $2,000. So there's a great disparity between stocks and gold which will be adjusted. Either gold will go up to $30,000 to reach the 1 to 1 ratio or stocks are going to fall significantly. Or will both adjust somewhere in between - which seems most likely. In any case, you want to be long gold and silver. Every argument points to gold and silver rising in value as more and more investors realize that precious metals are real money.

It's clear that the level of debt, interest rates, the dollar, and what has real value is going to be tested. But wherever there is a crisis, there's an incredible opportunity to trade that crisis. We're in the midst of just such a crisis, which has great opportunities for building wealth. The key is to ignore the fundamentals and to focus on what the market is actually doing.

Gold

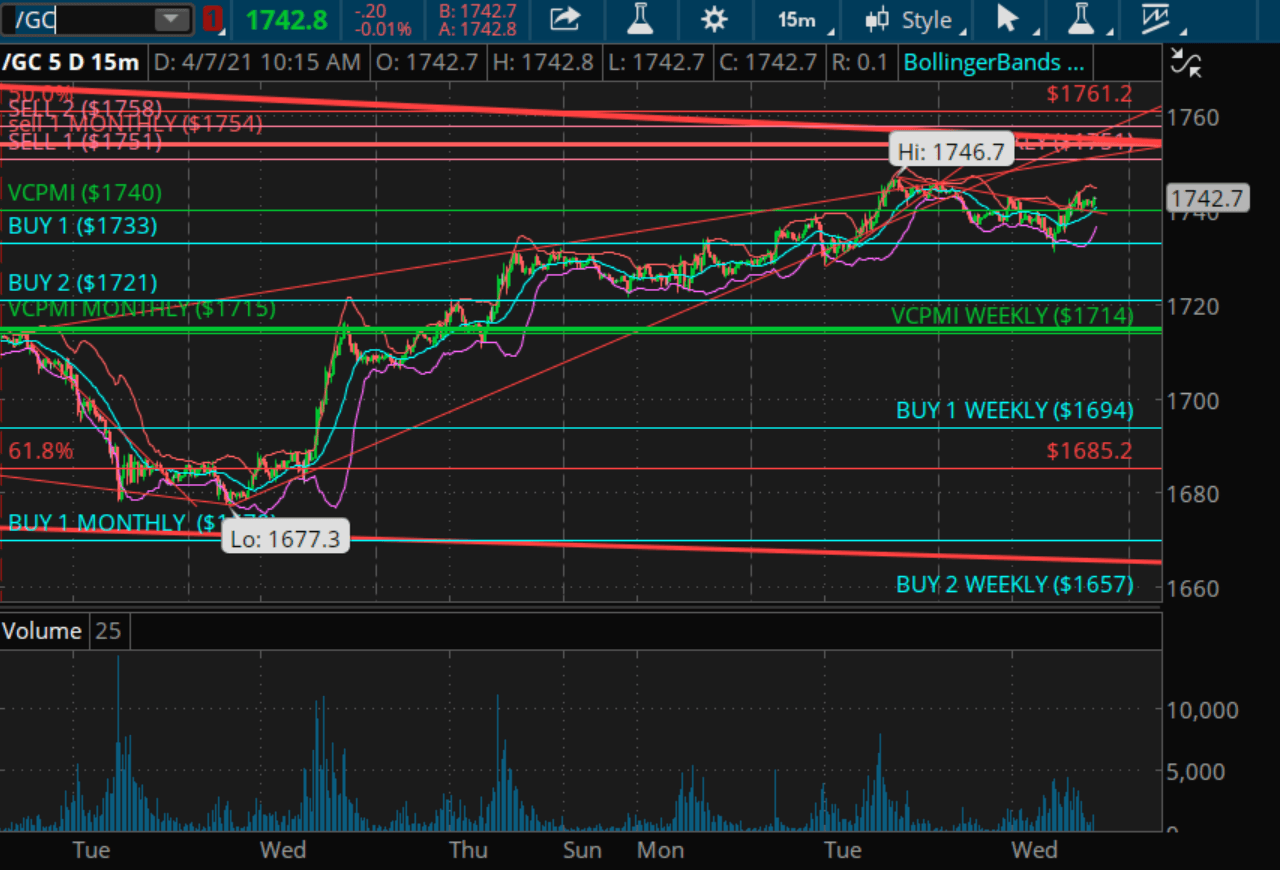

Gold is volatile today, last at $1739.38. We came down to the 32 level, activating a VC PMI Buy 1 trigger at $1732.80. Then the initial target of $1739 was met, and we are still challenging that with the next target of $1751, which is the Sell 1 level and the daily target of $1758. The trade above $1740 turns the daily trend momentum to bullish, negating the previous downtrend.

Last night we hit $1746, where sellers came into the market. The daily target overnight was $1751, but we found sellers and the market came back down to around the daily mean for the rest of the night. The market activated a bearish trend momentum. We do not recommend trading around the mean, since the market has a 50/50 chance of going up or down. Wait for the market to reach an extreme above or below the mean to trade. We want to see the market reach $1751, which has a 90% probability of the market reverting to the mean from that level. That level also is harmonically aligned between the daily, weekly, and monthly, which is a powerful signal. Above $1758 and the monthly target of $1754, we have the $1772 target. At those higher levels, sellers are likely to come into the market. Gold may keep going even higher, but it becomes less and less likely. Below, the level is $1714, which would trigger a buy signal.

Our core position is long and we are looking for $1751 to see the strength of the buyers and whether they are able to absorb the resistance level. For the VC PMI, it's identifying where mathematically sellers are likely to come into the market.

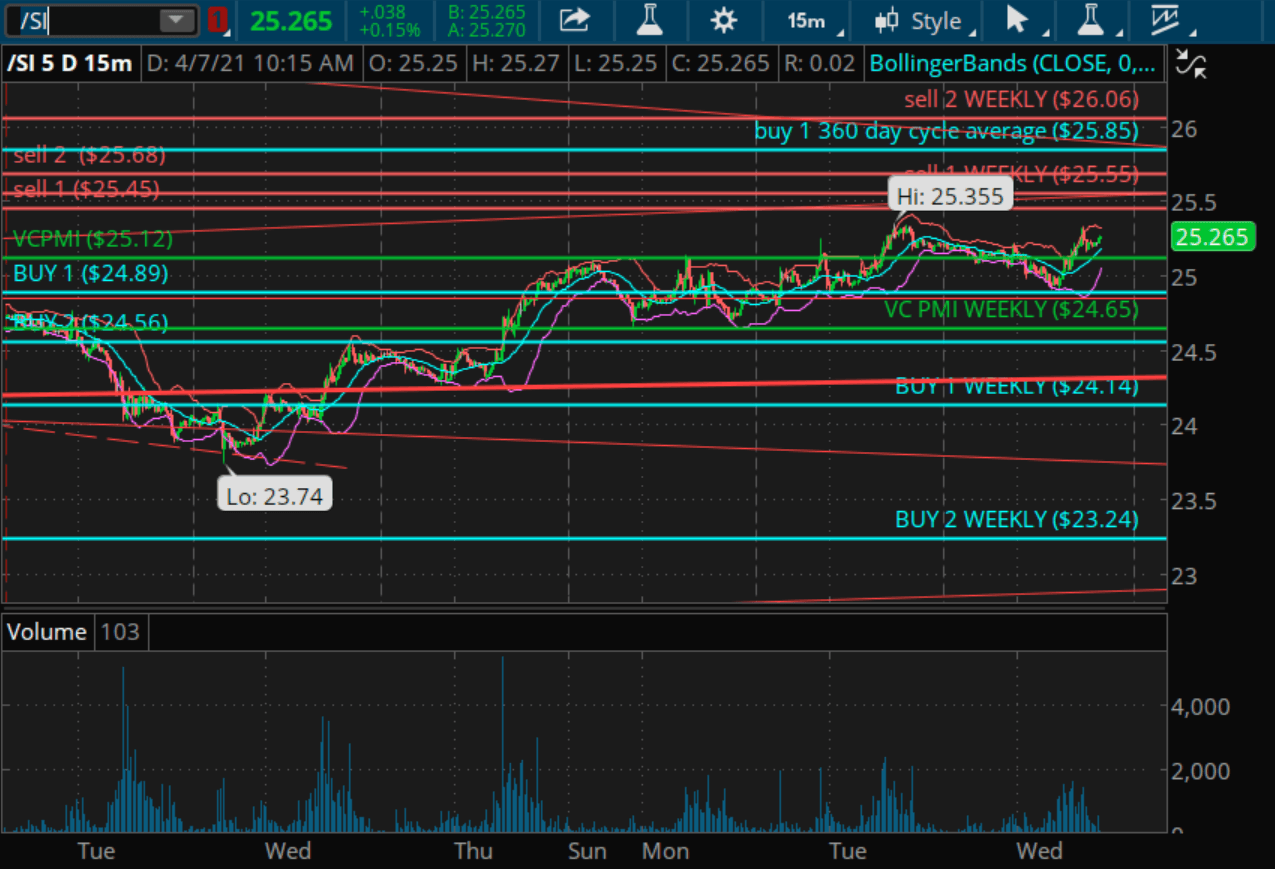

Silver

Silver is showing the same pattern as gold. Silver is above the VC PMI average price of $25.12. Last we traded at $25.14. A close below $25.12 would activate a bearish trend momentum, but the market is choppy right now. The Sell 1 target level is $25.45. Currently, it is in a bullish trend momentum.

The metals look bullish. We are trading above the means.

Disclosure: I am/we are long GDX.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on more