Gold: Getting Ready To Challenge 2020 Highs

Fundamentals

Gold is reverting back down into the blue levels of buyers possibly coming into the market. Gold is in a fast market down, to about $92.00. Trading last at $1859.50. Silver and gold are trading the opposite of what everyone was expecting. In relation to the fundamentals, gold and silver should be going up, not down. Yet, they are reverting and are offering major buying opportunities.

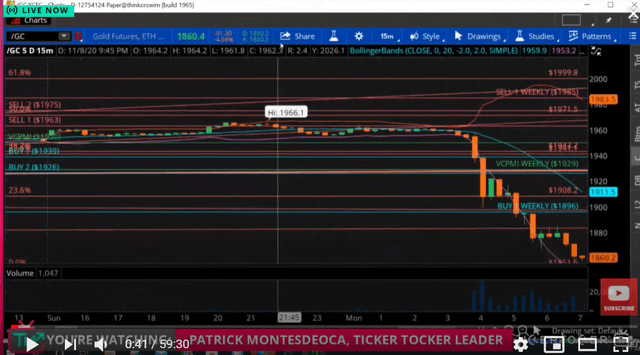

Courtesy: Ticker Tocker

We use the Variable Changing Price Momentum Indicator (VC PMI) to analyze the market, and it recommends to begin to buy the market on the long side. If you have short positions and you have a profit, then we recommend that you take your profits.

When the market comes down into this area, there's a high probability that buyers will come into the market. We are looking at NUGT, which is tremendously undervalued. JNUG is also very undervalued. GDX also is undervalued. All three are great buys at these prices. We are buying NUGT and GDX.

Gold is beginning to enter into an area that the VC PMI identifies as the extreme level below the mean for the week. The weekly average price is $1929. The market trading below that price is bearish, which activates the levels below of $1869 (Buy 1) and $1840 (Buy 2). The low was $1856.70 so far today, so that went through the Buy 1 but not the Buy 2 level.

We have been waiting for a reversion in the market to buy. The market appears to be beginning to create an oversold condition for long-term buyers. It's a tremendous gift. President-elect Biden is going to have to act aggressively in providing stimulus to the market, which will cause gold to rise in value. We are still facing a possible lockdown. Europe is locking down again. It's just a question of time when all of this starts to impact the global economy. Pressure will mount on central banks to provide massive stimulus. Since March, the physical economy has been devastated.

Gold could come down to the Buy 2 level at $1840, which is fine, since that would be a great level at which to add to your long-term gold position. Most people are wondering what happened. The bears come out and say gold is done and we are going down to $600. The chatter creates the volatility that you see. The VC PMI capitalizes on that volatility to make profits. The VC PMI is a contrarian indicator. Gold is down $80 in one day. It's a big deal. The chatter tries to scare traders from buying into the precious metals. Don’t be scared.

We trade gold because it's a commodity, but also a monetary unit. As the government prints more money, then the US dollar and other currencies will decline in value, which means gold will increase in value. The Eurozone is moving toward providing staggering amounts of stimulus. All of the currencies that are being printed is fiat currency; it's not backed by gold, silver or any asset. Such fiat currencies can decline in value rapidly. But governments do not have a choice. They must provide stimulus to support the economy or it will collapse. However, in the mid to long term, such printing of money will destroy the currency’s purchasing power and will lead to inflation. When inflation hits, precious metals will rise in value significantly. Commodities already are rising in price, showing early signs of inflation. The lockdowns have harmed supply chains, which puts pressure on prices, which will rise, especially if we have to go into further lockdowns. A key question is how fast money is going to come back into the economy? We already are seeing the effects of short supplies, which means inflation is probably three or four times greater than the administration is stating. Government inflation stats remove food and energy form the calculation, which are critical parts of the economy.

Selling in gold does appear to be slowing down. The nervous shorts begin to get nervous and they begin to cover their positions by buying. That then slows the decline and may lead to a short-covering rally. The lower the market comes down into the $1846 area, the more optimal the entry point according to the VC PMI.

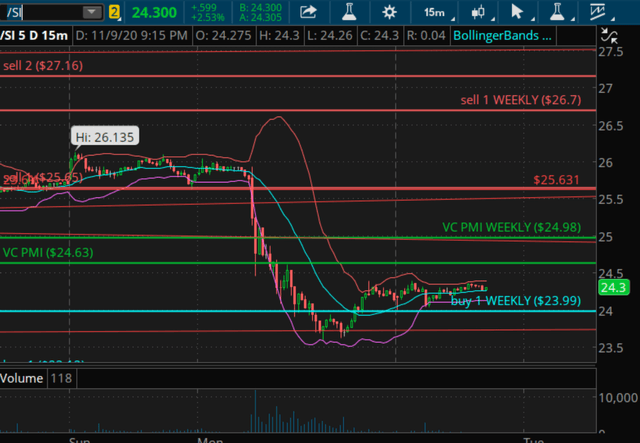

Silver

Silver has activated a buy signal, too, at $24.24. If you trade in the futures contract, buy a silver at the market. Use $23.99 as your protective level. Prepare for a lot of gyration, or you can trade the mini contracts to manage your risk more conservatively. The objective is the 24.98 weekly target.

Continue to be patient and continue to add to your long-term position in precious metals.

Disclosure: I am/we are long GDX.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more