Gold Forecast: Markets Continue To Look Limp

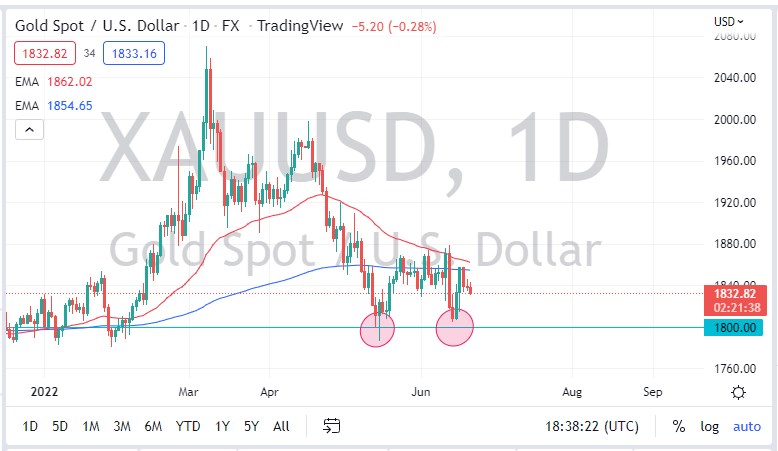

Gold markets initially tried to go higher on Tuesday but fell hard after the initial move during the day. Ultimately, we have broken through the $1840 level, which is short-term support, but having said that it does not register as far as a major level. Ultimately, it’s more likely than not the $1800 level is where the buyers will make some type of stand.

If the market was to go below the $1800 level, that could be a very negative sign for the market, perhaps sending gold down to the $1760 level. On the other hand, the market is likely to continue to see a lot of volatility and choppy behavior. That being said, I think it is going to be difficult to hang on to a position in gold unless you are a longer-term holder. I think gold will eventually have its day, especially with the way that everything has been behaving as of late. Ultimately, as long as the $1800 level holds, it’s likely that we go much higher, perhaps opening up the possibility of the $1880 level being tested again. That was a major short-term resistance level and breaking above there really opens up the doors.

The way the market is behaving on Tuesday does suggest we have a long way to go before we have a bigger move, and think a lot of repositioning is about to happen. With that in mind, gold will continue to be something that you probably need to trade in more of a range-bound attitude. Because of this, you will need to pay close attention to the way you position size because the volatility is going to continue to make this market very difficult. You should also pay attention to the bond market because the interest rates will continue to have a negative correlation to the gold market from what I can tell. After all, we are in a very strange environment, as central banks have to worry about inflation, something that they have not had to worry about for decades.

Traders seem to believe that there are going to be multiple interest rate hikes, and as long as that’s the case it does weigh upon gold in general. As long as we continue to see a lot of problems, the markets will have no idea what to do with themselves (GLD).

c

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more