Gold Could Jump To $1,900-$2,100 In Next 30 Days - Here's Why

For the past two years at this juncture, the Precious Metals Sector has risen sharply in a month-long up cycle for Silver and with the high inflation expectations going forward a similar ramp up for the Precious Metals Sector is a real possibility.

Inflation Expectations

According to the New York Fed’s Survey of Consumer Expectations:

- the under-40 crowd expects inflation to hit 3.8% a year from now,

- the 40-60-year-olds expect inflation of 4.7% and

- the over-60 crowd expects inflation to hit 5.7%

- for an average inflation expectations for one year from now of 4.8%.

These inflation expectations tracked by the New York Fed roughly match the inflation expectations tracked by the University of Michigan’s Survey of Consumers, whose latest reading jumped to 4.6%.

The Fed and the government claims, echoed by the major news outlets, that this bout of inflation is just “temporary” or “transitory” are resonating with consumers to some extent as inflation expectations for three years from now have jumped, reaching nearly 3.57% in May and 3.55% in June.

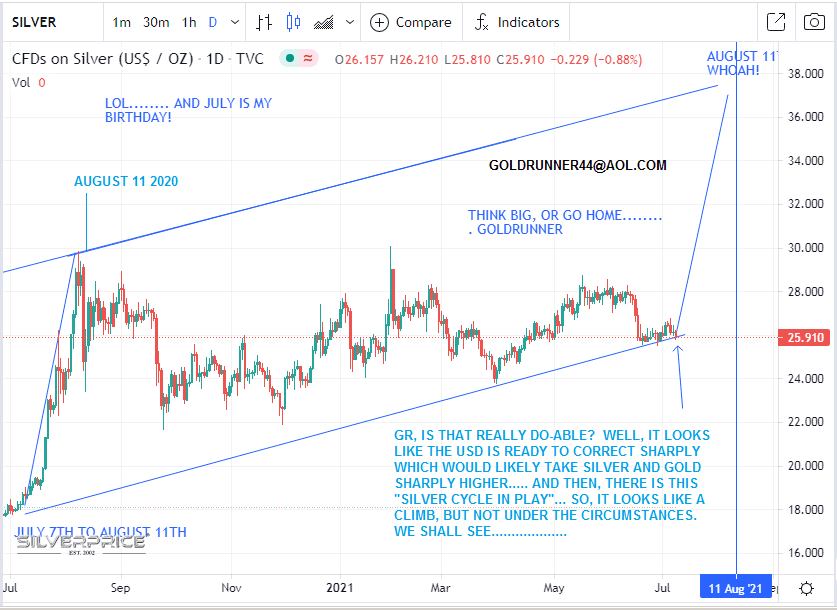

Silver Expectations

With such high inflation expectations, in combination with the 30-day up cycle (July 11th to August 11th) for Silver, Goldrunner's fractal work suggests that Silver might start a run up to $34 per troy ounce and perhaps as high as $37/ozt. over the next 30 days.

(Click on image to enlarge)

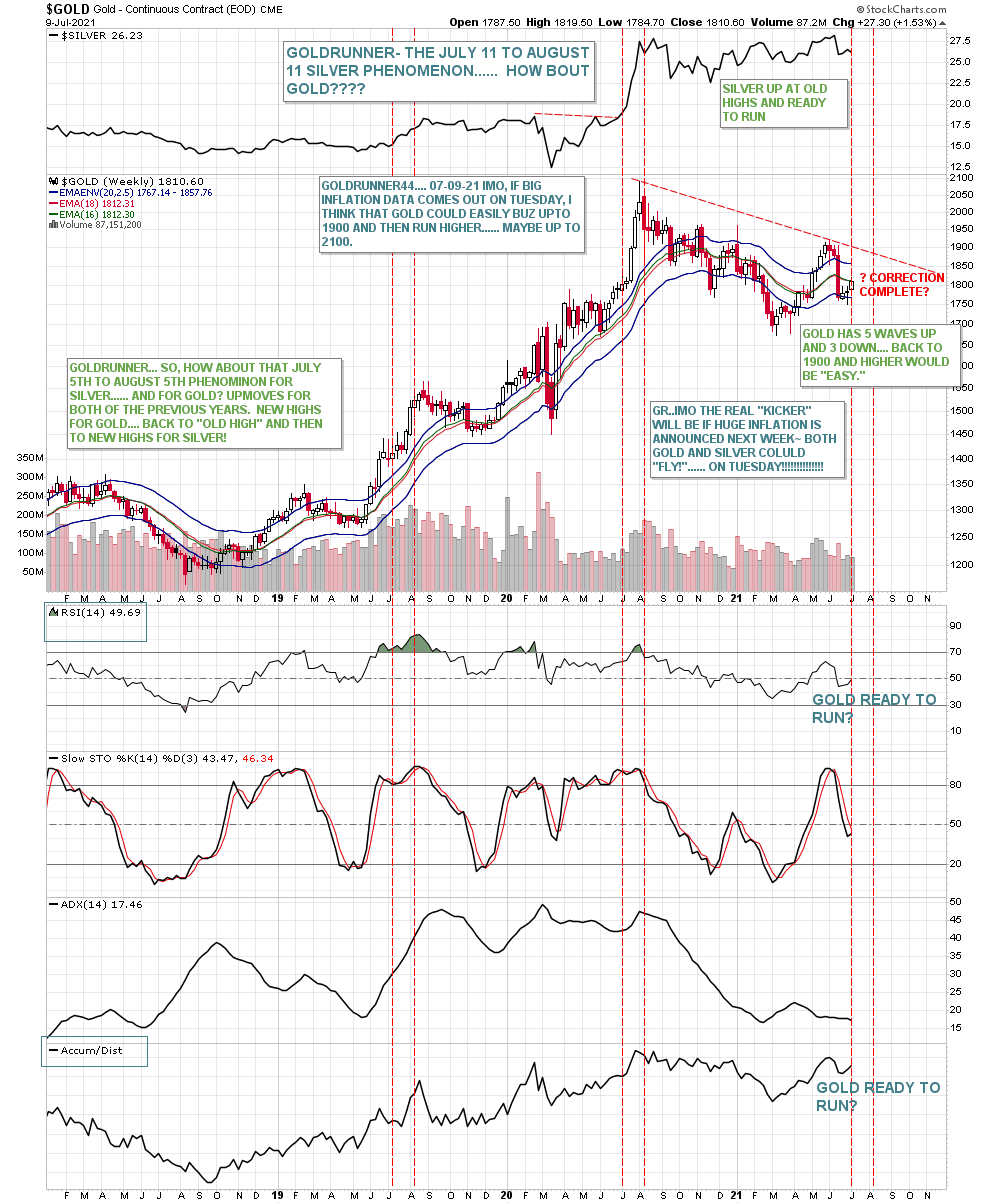

Gold's Expectations

Gold has more overhead resistance but there is little resistance up to the $1,900/ozt. area on Gold's chart so such high inflation expectations could very well see Gold bust up through that red downtrend line pretty easily to perhaps as high as $2,100/ozt.

(Click on image to enlarge)

Gold & Silver Explorers

A major move higher in the price of physical Silver and Gold would also turn on the engines for the little Gold and Silver Explorer class stocks as a whole and cause them to bust to the upside for some time to come and show the kinds of returns that they are capable of without the need for any artificial leverage.

Summary

There are no guarantees in life, but cycles like the one mentioned above and the above charts are simply manifestations of prior price movements that have been illustrated via past price relationships. That being said, this time around things are somewhat different due to the vast number of U.S. Dollars that have been printed and provided to the people. Those Dollars cannot realistically be removed from the system without creating a deflationary collapse so they will just keep on coming and building up PM pricing rises that will fuel Silver and Gold prices higher and higher.

Conclusion

There is only one way to really protect yourself from all of that Dollar Printing and that is to buy Physical Gold, and Silver, and the companies that produce both or that own Gold and Silver in the ground!

Disclosure: The contents of the above article are sourced from a private email from a friend who makes his comments under the pseudonym "Goldrunner" and they are posted here with his ...

more