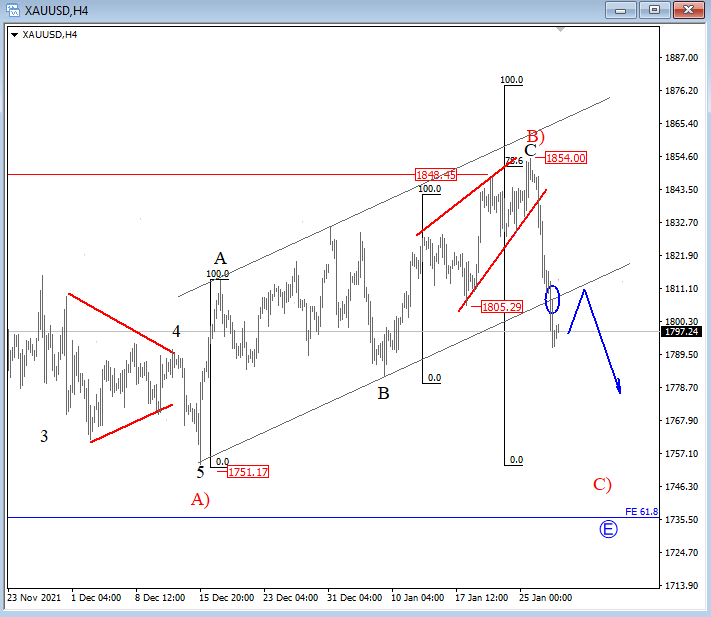

Gold And Silver Look More Downside – Elliott Wave Analysis

USD is still in uptrend with DXY breaking to new highs as speculators move into safe-haven assets due to hawkish FED policy and lower stocks. USD has room for more upside in sessions ahead, but lets be aware of US PCE Inflation later at 13.30GMT.

Gold is making nice and sharp reversal from 1850 area as expected after we noticed a completed ending diagonal in wave C of B). It's very strong decline and current break below the trendline support could easily put much more weakness in play for the final wave C) of E, ideally back to 1750 - 1700 area to complete a big triangle pattern on larger degree.

Photo by Zlaťáky.cz on Unsplash

GOLD 4h Elliott Wave Analysis

(Click on image to enlarge)

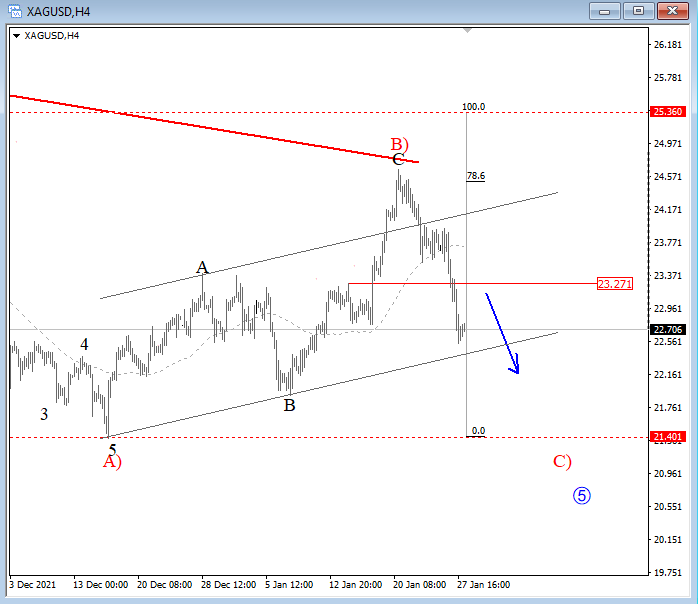

Silver has been recovering since December, but notice that recovery is made by three legs which is a corrective structure. In fact, the price fell back below 23.27 where overlap invalidated any impulsive/bullish interpretations, so we are bearish and are looking for further weakness into wave C) of five; the final leg of a higher degree ending diagonal that can boom near 20/21.

Silver 4h Elliott Wave Analysis

(Click on image to enlarge)

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.