Gold And Silver Adjusting In Price

Fundamentals

Gold and silver appear to be adjusting in price in relation to the monetary policies pursued by most governments around the world. People are beginning to realize the dangers of fiat currencies, particularly against precious metals and Bitcoin. We trade the Grayscale Bitcoin Investment Trust since the asset is regulated more than Bitcoin and somewhat less risky in that sense. It's a virtual asset, it's not a currency. It's increasing in acceptance and major banks are beginning to become interested. China is starting a virtual currency, too. At such highs as today, Bitcoin is risky at these high levels, at least to buy and hold. For day trading, the volatility is excellent for making profits. Bitcoin and the metals show the weakness of the US dollar. The US dollar is entering a devaluation period as the government prints more and more stimulus. Inflation is likely and each dollar is worth less and less.

The Fed and Treasury are in a tough position. They have to keep feeding money into the market and economy to keep them going, but in doing so, they risk high inflation in the future and eroding the asset base of the United States. If we get inflation at any significant level, then the debt that has reached momentous levels around the world could be in grave threat of widespread defaults. The future appears bearish for all currencies, including the US dollar, and bullish for precious metals. In a way, we're seeing what investors believe is real money: Fiat currencies, precious metals, real estate, land, art, or virtual currencies? Real assets are being favored over fiat currencies as trust in the value of fiat currencies declines.

It appears that we're likely to see an explosive economic recovery as the pandemic becomes more and more controlled. If the economy booms, then there will be pressure to raise interest rates. Then there will be fears of raised interest rates and a credit crunch.

Fears about inflation and interest rates for the gold market are becoming old news since the markets have factored in such fears by now. That's usually when the reversion unfolds. Buyers get nervous, fearing the market will go down, and they start to sell, which leads to the market down.

Gold

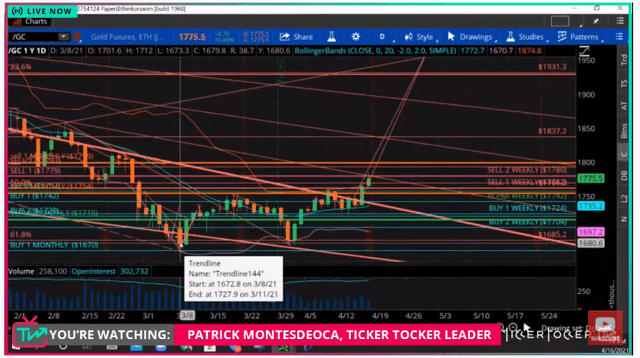

Courtesy: Ticker Tocker

We advised our subscribers to unload and take profits on this recent rally. According to the Variable Changing Price Momentum Indicator (VC PMI), we're reaching an area of supply where sellers are likely to come into the market and a reversion to the mean is likely. We have been long since about $1677, which was a 61.8% Fibonacci retracement. We saw a reversion from those levels up to a high of $1784. We saw a double bottom on March 8 at around $1673. This was the first time the market came down to the Golden Ratio/Fibonacci retracement. It came down four times to test the lower level. Finally, on March 31, gold reverted right into the VC PMI targets, with a high of $1784. This has completed the weekly target of $1780, which we have been tracking this past week. If you are long, lock in some profits and wait for the market to revert back down.

At these current levels, the market may reach higher levels, such as the VC PMI Sell 2 daily of $1793 and the VC PMI Sell 1 monthly of $1799. Or, more likely, it may revert back down. Let the market show you what it's going to do and use the VC PMI as a guide for where the market is likely to go. A close above $1780 would negate the bearishness and activate the target of $1793 to the VC PMI Sell 2 level of $1799. The monthly Sell 1 level was $1754. This area up here is a danger to buy. The odds favor gold reverting back down from here; it may not, but it is most likely. We appear to be in an overbought condition. The Sell 1 level has a 90% probability of the market reverting to the mean, while the Sell 2 level has a 95% probability of a reversion.

Silver

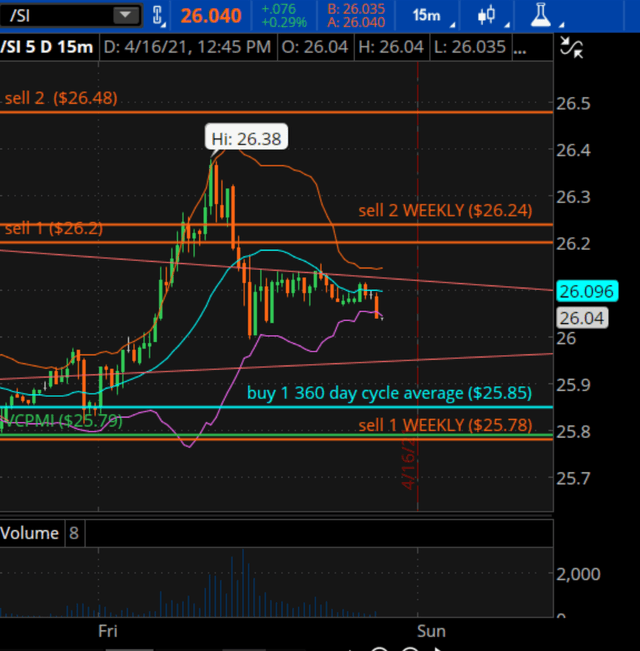

Courtesy; TDAmeritrade

Silver has completed its Sell 1 level targets, too. It almost has reached $26.48, the VC PMI Sell 2 level. When the price reaches these levels, supply is likely to come into the market and selling to occur. Therefore, the market is likely to revert back down to the mean instead of continuing on up. A reversion is 90% certain, while a continuation up is only a 10% chance, according to the VC PMI algorithm. So, the odds favor the market reverting. It is not certain but is it highly likely and we trade the most likely trades at the extremes of the market.

Disclosure: I am/we are long GDX.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on more