Gold Analysis: Price Clinging To Highs Under $1800, Awaiting FOMC Min

Gold price analysis suggests that the market is silent before a storm and primarily depends upon the US Dollar that awaits FOMC meeting minutes.

Gold maintained its modest intraday gain during the first half of European trading hours but did not move further up afterwards and remained limited in its overnight range. The XAU/USD has been supported by trades just below the $1,790 level and prevailing risk aversion.

In addition to concerns about the rapidly spreading Delta variant, investors remained wary of political tension in Afghanistan. Additionally, a moderate change in the US dollar value also affected dollar-denominated commodities, such as gold.

In response to the recent surge of COVID-19 cases, US economic data shows that consumers have become more cautious. A weaker US retail sales report on Tuesday confirmed this, leading investors to reexamine the likely timing of Fed tightening.

In turn, this did not help the US dollar take advantage of the positive movement of the previous day. However, a moderate rise in US Treasury yields prevented significant dollar loss and kept unsold gold in check, at least for now.

Ahead of Wednesday’s FOMC minutes, investors also didn’t appear to be making aggressive bets.

Traders are looking for clues as to when the Fed will begin reducing its asset purchases. Gold’s direction will be changed dramatically by this short-term change in the dynamics of the US dollar.

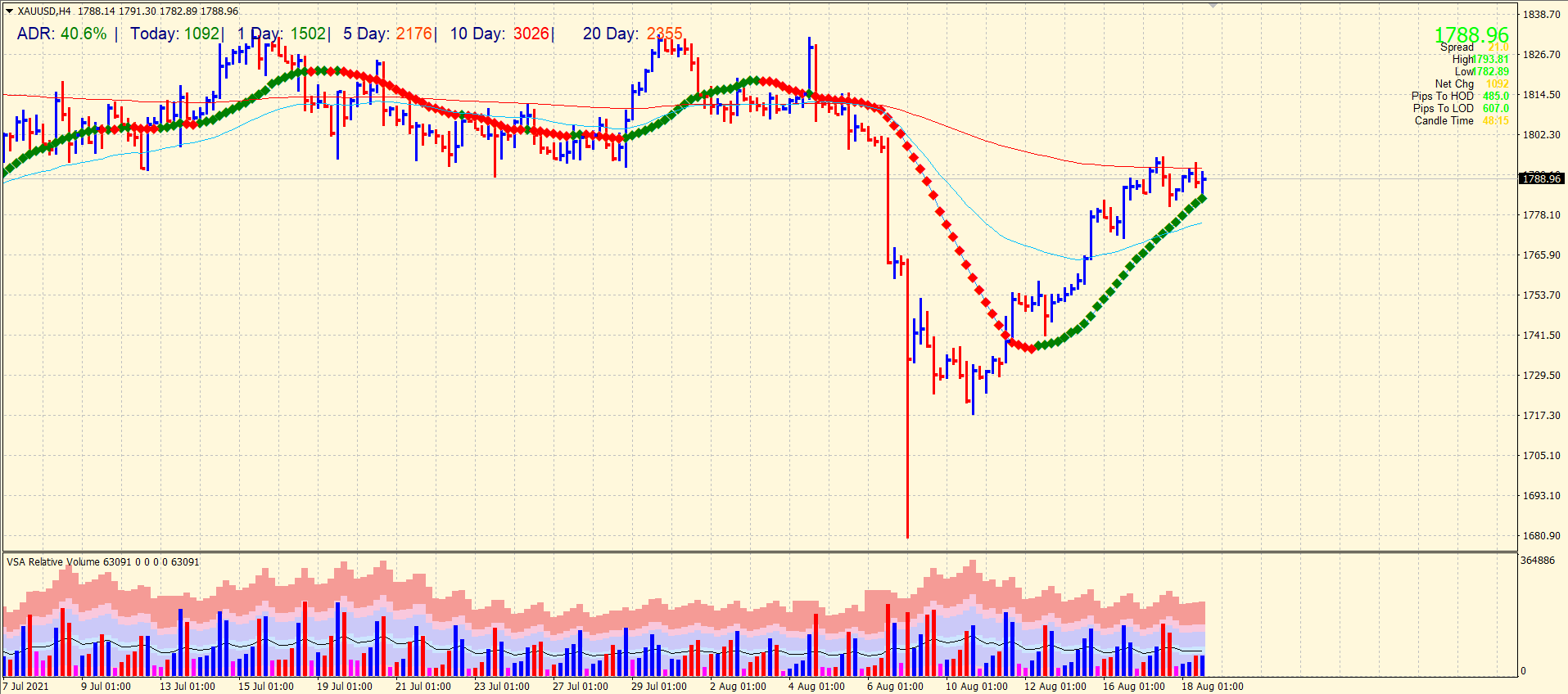

Gold Price Technical Analysis: Dried Volume And Low ADR

Gold price 4-hour chart analysis

The gold price remains well bid above the 20-period SMA on the 4-hour chart. However, the upside remains capped by the 200-period SMA under the $1800 mark. The congestion of 200-period SMA and the psychological level combine to provide a stiff resistance to the gold. The price has covered only 40% average daily range so far. It indicates that the market is awaiting a key moment to jump into positions. Volume data is also very interesting. Last night, the price posted a normal spread-down bar with a very high volume. It means that the tug of war between buyers and sellers ended up with the minor victory of sellers. Since then, the volume is below average.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more